Advertising revenue is still very important...

According to the World Newspapers: Outlook and Trends report by the World Association of Newspapers (WAN-IFRA) in early 2024, news organizations surveyed in this study generally believe that advertising in general is still expected to account for 43% of newspaper revenue in the next 12 months.

In fact, marketing research firm WARC predicts that total global ad spending will surpass $1 trillion for the first time in 2024, at the end of August. Nearly a third (31.5%) of that spending will be in the US. Worldwide, WARC expects the ad market to grow 8.2%.

Newspapers need to combine multiple business models to increase revenue. Illustration photo: GI

However, it is worth noting that more than half of global ad spending this year will go to five major tech companies – Alibaba, Alphabet, Amazon, ByteDance (owner of TikTok and Douyin) and Meta. That means media and news organizations are unlikely to benefit from this growing pie.

Thus, advertising revenue, especially digital advertising, is growing but is being concentrated in the hands of Big Tech companies as the press world has repeatedly identified and warned (this ratio will be even larger in the upcoming AI media era). According to the above report by WAN-IFRA, the digital advertising sources of the press agencies in the survey experienced an 11% decrease in 2023.

…but revenue diversification is the future

And as the media world continues to evolve and change, relying solely on advertising revenue is a recipe for failure for most news and media organizations, no matter how large. Recent studies and surveys around the world have acknowledged that news organizations are forced to continually seek innovative approaches to diversify their revenue streams.

In fact, according to a WAN-IFRA report, news organizations worldwide are predicting that around 20% of their revenue will come from sources other than traditional readership and advertising. Events will remain a top focus for organizations looking to expand and diversify their revenue streams.

The Financial Times even hosts 200 events a year. Similarly, The Guardian is offering a range of events across all disciplines, including discussions with its writers and journalists. “Readers don’t want to be advertised to – they want to be entertained or educated – and ideally both!” argues ShareenPathak, co-founder of media company Toolkits.

That is, while advertising continues to account for the majority of revenue for most newspapers in general, especially in developing or emerging countries like Vietnam, there is a long-standing recognition of the need to gradually reduce dependence on this increasingly unstable source of revenue.

To prove that digital advertising alone is not enough to make large-scale profits, DMGT – the company that owns MailOnline, one of the most visited websites in the world – reported that last year their operating profit was just £52 million!

Meanwhile, in Hong Kong, the once-powerful TV station TVB has been facing a serious decline in viewership and advertising revenue. The South China Morning Post reported: “The company has been losing money for five consecutive years.”

Fortunately, the TVB giant has “woke up” in time to rise again thanks to its creativity in diversifying its revenue sources, including its successful live shopping streaming service, which is very popular in mainland China. They have been planning to hold about 50 live streaming events in 2024. In fact, the first event alone generated 23.5 million yuan (US$3.37 million) in revenue during its 6 hours of broadcasting on Taobao Live.

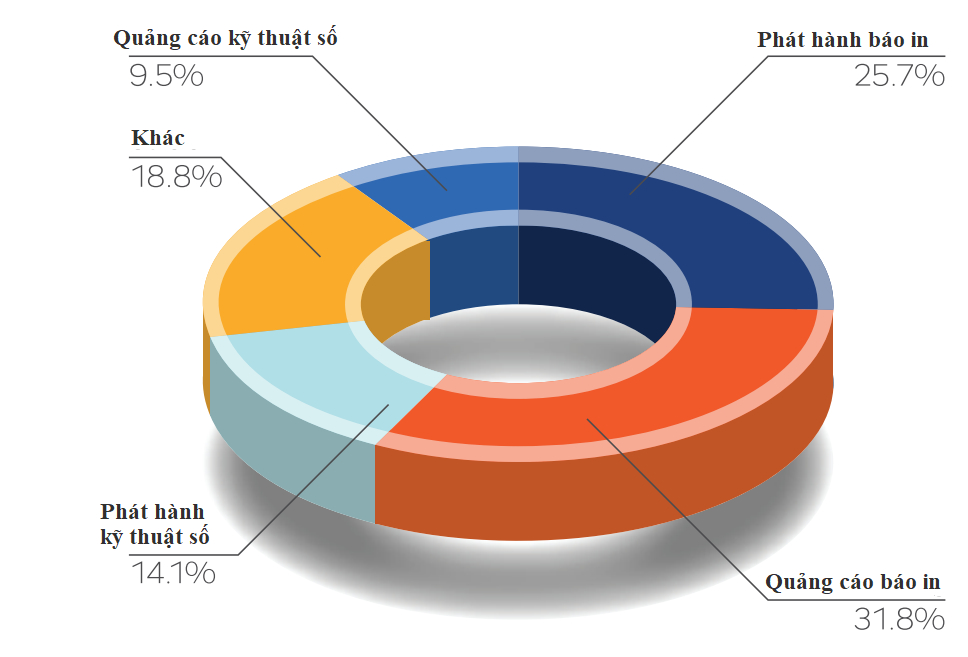

WPT Outlook 2023-2024 Survey results on news agency revenue share in 2023. Graphic image: WAN-IFRA

Trending trends

According to the current trend shown in the WAN-IFRA report, most news organizations around the world believe that revenue growth from readers, product development, events and other revenue sources is the model that news organizations are and will continue to be forced to move towards.

Of course, each organization needs to find its own new main directions. Clarin, Argentina’s largest newspaper, is currently very strong in attracting paying readers to read its newspaper online, with about 700,000 paying subscribers, with digital revenue already surpassing that of many print newspapers. In Germany, the Süddeutsche Zeitung has been very successful in combining paid and free articles on its digital platform.

The Economist has also recently decided to put most of its podcasts behind a paywall. Launching in mid-October, subscriptions to the new service cost £4.90 a month or £49 a year.

That same month, The New York Times and paid online newspaper service PressReader announced a new partnership aimed at expanding The New York Times' global reach to 150 countries.

Partnerships or even mergers are especially needed to help boost revenue for broadcasters. The model of combining TV and online platforms (called CTV) is also booming and promises to continue to be effective. The Washington Post and Time magazine are among the newspapers that have joined this model in the past year.

Thus, despite the difficulties, the press is still finding many new and successful directions to improve and diversify its revenue sources, for a more sustainable and developed future.

Hoang Hai

Source: https://www.congluan.vn/nguon-thu-tuong-lai-cua-bao-chi-se-den-tu-dau-post299887.html

![[Photo] General Secretary To Lam attends the launch of 3 digital platforms serving the implementation of Resolution No. 57-NQ/TW](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/2/d7fb7a42b2c74ffbb1da1124c24d41d3)

Comment (0)