(Dan Tri) - The draft Decree detailing and guiding the implementation of a number of articles of the 2024 Law on Social Insurance stipulates the level of allowance calculation for people of retirement age but have not yet contributed for 15 years.

According to the draft Decree detailing and guiding the implementation of a number of articles of the Law on Social Insurance 2024 on compulsory social insurance, beneficiaries are Vietnamese citizens of retirement age who have paid social insurance but do not meet the pension period requirements (minimum 15 years) and do not meet the conditions for social pension benefits (70-75 years old).

To enjoy this regime, the beneficiary does not receive a one-time social insurance payment and does not reserve the social insurance payment period but requests to receive monthly benefits.

The duration and level of monthly benefits are determined based on the duration of payment and the average salary used as the basis for their social insurance payment.

The duration and level of monthly benefits are determined based on the employee's social insurance contribution period and basis. The lowest monthly benefit level is equal to the social pension benefit level.

During the period of receiving this monthly allowance, workers are also entitled to free social insurance and funeral expenses upon death as a pension.

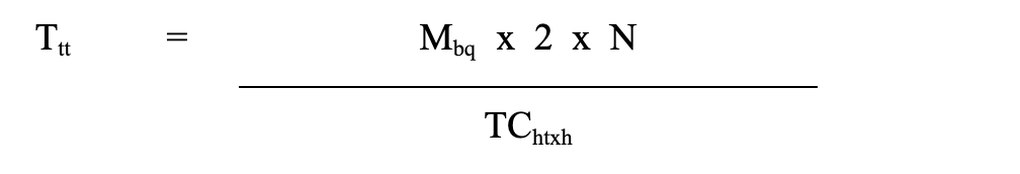

The monthly benefit period is determined based on the employee's social insurance contribution period and basis and is calculated according to the following formula:

In which, Ttt is the monthly benefit period (calculated by month).

Mbq: The average salary level used as the basis for compulsory social insurance contributions is calculated according to the provisions of Article 72 of the Law on Social Insurance and Article 15 of this Decree for compulsory social insurance participants; The average income level used as the basis for voluntary social insurance contributions is calculated according to the provisions of Article 104 of the Law on Social Insurance for voluntary social insurance participants; The average income and salary used as the basis for social insurance contributions are calculated according to the provisions for people who have both voluntary social insurance and compulsory social insurance contributions.

N is the number of years of social insurance payment. In case the social insurance payment period has odd months from 1 month to 6 months, it is counted as half a year, from 7 months to 11 months is counted as one year.

TChtxh: The monthly social pension allowance is calculated at the time of settlement of the monthly allowance regime.

Regarding the monthly allowance level, this level at the time of settlement is calculated equal to the monthly social pension allowance level prescribed in Clause 1, Article 22 of the Law on Social Insurance.

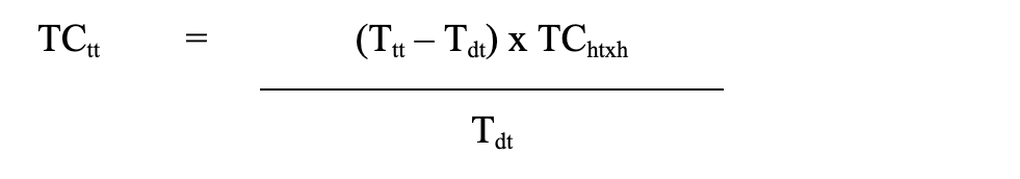

In case the monthly allowance period calculated according to the formula stated in Clause 1, Article 22 of this draft Decree exceeds the period until reaching the age of receiving social pension allowance, the employee shall be calculated to receive a monthly allowance at a level higher than the social pension allowance at the time of settlement according to the following formula:

In which, TCtt: Monthly allowance level increased compared to monthly social pension allowance level.

Ttt: Monthly benefit period is calculated according to the formula specified in Clause 1 of this Article (calculated by month).

Tdt: Time from the month the employee submits a written request until reaching the age of receiving social retirement benefits (calculated by month).

TChtxh: The monthly social pension allowance is calculated at the time of settlement of the monthly allowance regime.

When calculating the monthly allowance, if the value is odd, it is rounded to the nearest unit (rounded up).

The monthly allowance level is adjusted when the Government adjusts pensions according to the provisions of Article 67 of the Law on Social Insurance.

The employee's request for monthly allowance must follow the form issued by the social insurance agency.

Source: https://dantri.com.vn/an-sinh/nguoi-tu-60-tuoi-chua-du-15-nam-dong-bao-hiem-xa-hoi-nhan-tro-cap-ra-sao-20250207163902785.htm

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Walking on the royal poinciana flower road in the West](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/18/f9335355d0744d1593f7e36bc4c7f4b7)

Comment (0)