In the context of difficult debt growth, credit institutions in Ha Tinh are trying to stimulate credit demand, but not lowering standards to ensure system safety.

2023 is a challenging year for Agribank Bac Ky Anh Branch (under Agribank Ha Tinh II Branch) when the economy's capital absorption capacity is difficult. Affected by the global economic recession, production and business activities of the business community, cooperatives and people in the area are facing difficulties, the demand for investment loans is decreasing. At the same time, people's income is decreasing, so access to credit for consumption is also "drop by drop".

Agribank credit officer Bac Ky Anh Branch checks the purpose of using the customer's capital.

Mr. Tran Khanh Ninh - Director of Agribank Bac Ky Anh Branch said: "The total outstanding debt of the unit currently reaches 821 billion VND, only reaching 60% of the credit plan for 2023. From now until the end of the year, we continue to strengthen solutions such as: promoting customer communication, actively communicating preferential credit policies for businesses and individuals to access loans... The branch aims to reach over 80% of the assigned credit plan by December 31, 2023.

Despite efforts to bring capital into the economy , Agribank is determined not to lower credit standards. Accordingly, only when customers meet the following conditions: having a scientific and effective production and business plan and project; not having bad debts at other credit institutions; proving the source of debt repayment; committing to using the loan for the right purpose... will they be disbursed. Thanks to that, the credit of Agribank Bac Ky Anh Branch has always ensured safety, up to now the bad debt ratio accounts for only 0.22% of total outstanding debt, overdue debt accounts for only 0.98% of total outstanding debt".

At Vietcombank Ha Tinh Branch, the development of outstanding loans (especially retail loans) has encountered many difficulties in the past. There were times when the branch's retail loans decreased due to the poor capital absorption capacity of the economy. Up to now, the total outstanding loans of the entire branch have reached over 14,000 billion VND, an increase of 20% compared to the beginning of 2023 and mainly increased in the corporate credit segment, while retail credit decreased by 1% compared to the beginning of 2023.

Outstanding loans at Vietcombank Ha Tinh Branch currently reach over 14,000 billion VND.

Ms. Nguyen Thi Hanh - Head of Retail Customer Department, Vietcombank Ha Tinh Branch said: "Vietcombank focuses on reducing lending interest rates, applying digitalization to facilitate customers in the transaction process, simplifying lending procedures... to stimulate credit growth, especially at the end of the year. Currently, despite the surplus capital, Vietcombank is determined to "not develop outstanding debt at all costs", "say no" to lowering credit standards to ensure system safety".

Accordingly, the process of appraising and processing customers' loan applications is strictly complied with by Vietcombank in accordance with current regulations. Specifically: Vietcombank carefully evaluates assets according to market prices and lending rates lower than market prices; determines loan terms in accordance with customers' capital turnover when doing business... Meanwhile, customers borrowing capital must ensure the right purpose; demonstrate cash flow to repay the debt...

With the block of joint stock commercial banks in the area such as: SHB, ACB, Techcombank, MB Bank, Sacombank... credit growth has also been low recently.

Mr. Nguyen Van Chinh - Director of Sacombank Ha Tinh Branch said: “In October and November 2023 alone, the branch's outstanding loans have continuously decreased. Accumulated in 11 months of 2023, the branch has only achieved 25% of the assigned credit plan. From now until the end of the year, Sacombank Ha Tinh Branch will try to increase outstanding loans as much as possible. However, we are determined not to lower credit standards; not to provide capital to customers who do not have the capacity and conditions to ensure credit safety and efficiency in the area, avoiding the situation of high bad debt".

Customers come to make transactions at Sacombank Ha Tinh Branch.

It is known that currently 90% of Sacombank Ha Tinh Branch's customers are individuals, borrowing capital for production, business, services and consumption. According to research, when borrowing capital from Sacombank, customers must meet the following conditions: having a feasible and effective investment plan and project; good customer status; collateral (real estate, vehicles, goods, machinery - equipment, cash...) meeting the legal regulations.

Developing outstanding loans is a key task of credit institutions in the area at the end of the year. According to records, currently, banks are strictly complying with industry regulations and legal regulations, resolutely not trading off to develop credit.

Accordingly, instead of lowering credit standards, credit institutions implement a policy of reducing lending interest rates for old and new loans; promote communication about preferential credit programs under the direction of the Government, the State Bank of Vietnam and Ha Tinh province for customers to grasp and access. Specifically, the VND 120,000 billion credit program for loans for social housing, workers' housing, and renovation of old apartments; the VND 15,000 billion credit program for loans in the forestry and fishery sectors; interest rate support loans under Resolution No. 51/2021/NQ-HDND of Ha Tinh province...

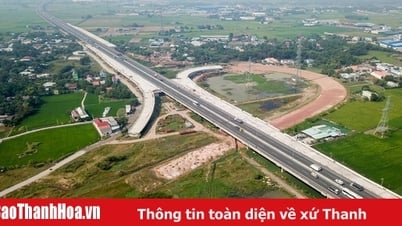

As of early November 2023, the total outstanding debt in the area reached 92,019 billion VND.

In recent times, the State Bank of Vietnam, Ha Tinh Branch, has regularly directed local commercial banks to direct credit to production and business sectors, priority sectors and economic growth drivers in accordance with the Government's policies. Implement solutions to facilitate customers' access to credit capital; simplify lending procedures, publicly and transparently list lending procedures and processes; ensure safe and effective credit activities. As of early November 2023, the total outstanding debt in the area reached VND 92,019 billion, an increase of only 4.12% over the same period in 2022 and an increase of 5.53% over the beginning of 2023. |

Thu Phuong

Source

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)