SGGPO

Implementing the Prime Minister's direction, the State Bank of Vietnam requires credit institutions to reduce lending interest rates for existing outstanding loans and new loans, striving to reduce interest rates by at least 1.5-2%/year to support businesses and people to recover and develop production and business.

|

| SBV continues to request to reduce lending interest rates by another 1.5 - 2% |

The State Bank of Vietnam (SBV) has just issued Document No. 6385/NHNN-CSTT to credit institutions (CIs) and foreign bank branches, requesting continued implementation of solutions to reduce interest rates.

Specifically, implementing the Prime Minister's direction, the State Bank of Vietnam requires credit institutions to reduce lending interest rates for existing outstanding loans and new loans, striving to reduce interest rates by at least 1.5-2%/year to support businesses and people to recover and develop production and business.

The SBV also requires credit institutions to report their commitment to reduce lending interest rates in 2023 for existing outstanding loans and new loans before August 25, 2023. Credit institutions must report the results of implementing their commitment to reduce lending interest rates in 2023 for existing outstanding loans and new loans to the SBV before January 8, 2024.

Previously, in Resolution No. 105/NQ-CP of the regular Government meeting in June 2023, the Prime Minister also requested the State Bank to continue to reduce interest rates, especially reducing lending rates (striving to reduce at least about 1.5-2%) to study and apply to both new and outstanding loans.

Since the beginning of 2023, the State Bank of Vietnam has continuously adjusted the operating interest rates four times with a total reduction of 0.5-2%/year; at the same time, it has directed credit institutions to thoroughly cut costs to reduce lending interest rates to support businesses, people and the economy to recover production and business. Therefore, in recent times, the mobilization interest rate level has gradually decreased, expected to have a positive impact on lending interest rates.

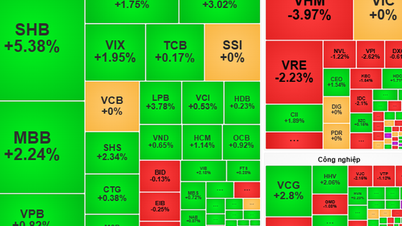

However, in the first 6 months of 2023, credit growth in the entire banking sector increased by only 4.7%, nearly half of the 9.35% increase in the same period in 2022. Information released from the regular meeting in July 2023 said that credit growth at the end of July 2023 was recorded at 4.3% compared to the end of 2023, a slight decrease compared to the 4.7% announced by the State Bank at the end of June 2023. This shows that the economy's capital demand is decreasing sharply. Currently, the State Bank has also granted all room (credit limit) to banks up to 14% for the whole year of 2023. The State Bank's credit growth target for the whole year is about 13-15%, and in favorable cases, it can increase higher.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)