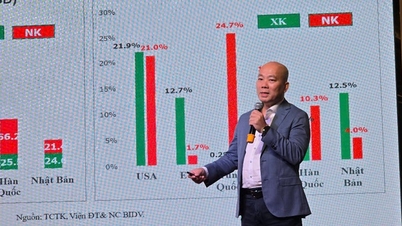

At the 2024 Annual General Meeting of Shareholders of National Citizen Commercial Joint Stock Bank (NCB) on the morning of April 13, the Board of Directors of NCB shared with shareholders about the bank's comprehensive restructuring.

Accordingly, NCB is the first bank to complete the construction and submit to the State Bank a restructuring plan (PACCL) and receive comments from the State Bank.

Currently, NCB's PACCL has been basically completed according to the requirements of the State Bank, in which it fully and comprehensively presents the current status of operations in all aspects, on that basis, it determines the overall and comprehensive goals and solutions to overcome existing problems and improve the bank's operational efficiency, ensuring healthy, safe and sustainable development.

Based on the opinions of the General Meeting of Shareholders on the Progress Report and Results of the Construction of the PACCL, the Board of Directors of NCB will complete and approve the PACCL in accordance with the provisions of the bank's charter and organize its implementation. The Board of Supervisors is responsible for organizing the monitoring of the progress and results of the implementation of the approved PACCL.

Accordingly, implementing the "Project on restructuring the system of credit institutions associated with handling bad debts in the period of 2021-2025" according to Decision 689/QD-TTg of the Prime Minister and guidance of the State Bank of Vietnam, NCB has worked with Ernst & Young Vietnam Co., Ltd. (E&Y) to conduct an independent, objective and comprehensive assessment and identification of the current situation of the bank, proactively identifying goals and proposing comprehensive solutions to restructure the bank.

NCB also cooperated with KPMG to assess the current status of the internal control system and develop a roadmap to improve the internal control system in line with the development orientation in the following years.

The General Meeting of Shareholders approved the 2024 business plan. The bank aims to achieve VND 105,892 billion in total assets, an increase of 10% compared to 2023; outstanding customer loans are expected to reach VND 64,344 billion and customer deposits to reach VND 86,050 billion, up more than 16% and 8% respectively compared to the end of 2023.

NCB is also determined to increase its customer base by 15% by the end of 2024, reaching 1.15 million customers. The cumulative number of customers using digital banking applications by the end of 2024 is expected to reach 595,051 customers, an increase of 34%; the cumulative number of credit cards will reach 31,991 cards, an increase of 28% compared to 2023. Thereby, the bank expects CASA to reach VND 6,075 billion, an increase of 24% compared to the 2023 results.

The General Meeting of Shareholders also approved the proposal to continue implementing the plan to increase charter capital. In 2024, NCB will continue to implement the plan to issue individual shares to increase charter capital by an additional VND 6,200 billion.

It is expected that after the issuance is completed, NCB's charter capital will increase from VND5,602 billion to VND11,802 billion. All proceeds from the private offering of shares to investors will be used to supplement working capital (VND5,300 billion); technology and digital transformation (VND500 billion); building brand identity (VND200 billion) and renovating and upgrading facilities (VND200 billion).

Regarding the progress of implementation, the bank said it has prepared a proposal and received approval from the State Bank. NCB is implementing procedures for capital increase according to regulations, including preparing documents to submit to the State Securities Commission for approval of private offering of shares.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)