On the occasion of the bank's 29th anniversary, Mr. Ta Kieu Hung - General Director of NCB shared about the bank's "reverse swimming" journey.

Journey of self-improvement

- Hello sir! More than two years ago, NCB was known as one of the “tiny” banks in the system and was making efforts to restructure. But now the image of NCB has changed a lot?

The past two years have marked many important milestones for NCB after a period of internal stability and building a foundation for a new development path. We are completing the required procedures to increase our charter capital from VND 5,601 billion to more than VND 11,800 billion and are expected to complete the capital increase in the fourth quarter of 2024. According to the roadmap, NCB will continue to increase its capital and it is expected that NCB's charter capital will reach more than VND 29,000 billion by 2028.

NCB also opened a new headquarters in one of the prime locations of Hanoi capital and re-planned the network, upgraded facilities across the system. Through this, we expect to bring new experiences to customers and good working conditions to staff.

The most important milestone is that NCB, together with the world's leading strategic consulting partner, has built the bank's new Strategy and has been vigorously implementing it since the beginning of 2024 with all resources.

Up to now, NCB has been investing heavily in digital transformation to improve customer experience and create increasingly strong trust in the community, recognized by a series of prestigious awards and positive growth figures, especially in total assets, customer growth, capital mobilization and service activities in the context of many market challenges and restructuring.

- So the bank also has new goals besides the restructuring story that has been known to the market for a long time?

Bank restructuring is a journey that requires determination, perseverance and a lot of effort. Last year was also the time when we made new progress in restructuring work. With the support of leading prestigious consulting units in the world and in Vietnam in the field of bank restructuring, NCB has built a Bank Restructuring Plan (PACCL) with a vision to 2030. To date, NCB is the first credit institution in Vietnam to have the State Bank consider and approve the PACCL by the competent authority.

We have started to implement urgently and drastically according to the roadmap since the second quarter and aim to complete PACCL by 2029, making NCB one of the prestigious, healthy and effective banks.

However, the story of focusing on solving the backlog and comprehensively overcoming existing problems does not mean that we stop developing and renewing ourselves. As I have shared, NCB is still vigorously implementing the new strategy in parallel, with the highest determination of the entire system and strong investment from all resources. We choose the right path to become a bank providing financial services and solutions that are loved in the market. We call this period of time the "journey to reach out" to new standards to contribute more to the development of society.

Choose to "stand on the shoulders of giants"

- Could you share more specifically about NCB's new strategy, sir?

NCB has chosen for itself a Banking Development Strategy with a long-term vision of bringing new experiences in the banking sector through innovative thinking, creativity, pioneering the development of products and services on an advanced technology platform, aiming to become a socially responsible bank, contributing to the sustainable development of the community that NCB serves.

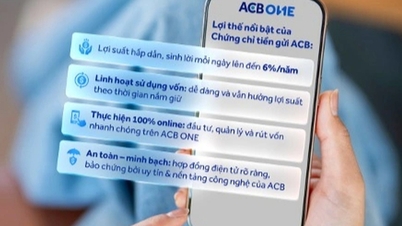

In particular, in the next 5 years, NCB will develop products in the field of asset management through technology to provide to the mass customer group when the demand for systematic and long-term financial investment of this segment is forecasted to grow strongly in the future. However, this is also a market with many challenges because this is a new field and there are many barriers for the mass segment to participate and invest in long-term and professionally.

NCB will strive to bring innovative products with the support of technology to provide customers with financial management solutions similar to the international market with a simple and modern experience.

- In the post-Covid context and economic crisis, the economy in general and the banking industry face many difficulties and obstacles, but NCB chooses to do it twice as hard. Why is that?

Indeed, the Covid-19 pandemic and economic crisis have had severe impacts both directly and indirectly on the banking system and NCB is no exception.

As a small bank, we face many challenges. But even in the most “stormy” moments, we are fortunate to always have the unity and determination of the whole system, which is the determination to turn challenges into opportunities. Opportunities for comprehensive transformation, opportunities for transformation to a new, superior version, opportunities for those who choose to “squeeze through the narrow door” to reach different success.

What the market considers as a disadvantage, we see it as an advantage. Many people call us a “small” bank, I would like to use another phrase to motivate ourselves, which is a “small but powerful” bank. And it is the small scale that helps us to be able to flexibly transform and adapt in addition to defining a correct long-term vision for ourselves.

NCB can apply new solutions, new models and new technologies faster, more efficiently, more compactly and more conveniently. At the same time, we choose to “stand on the shoulders of giants” when accompanied by prestigious partners in the world and the region such as GCP, E&Y, KPMG, CMC Telecom and LUMIQ, Zoho Corporation… to help us gain advantages in knowledge and technology to carry out the “journey to rise”.

In particular, we have been receiving close support and direction from management agencies for the implementation phase of PACCL. That is an important foundation for NCB to confidently follow the financial transparency roadmap.

- So please tell us what stage of the journey NCB is at?

Our ship has started its flywheel and flown into orbit with the consensus of the entire system. Resources in terms of capital, infrastructure and technology solutions, operational capacity and human resources, products and services, etc. have all been strongly deployed by NCB to meet the needs of comprehensive digital transformation and build a new NCB according to the proposed strategy.

Last year, NCB signed a cooperation agreement to deploy a series of solutions such as: Cloud Computing Solution and Data Lake Platform on Google Cloud platform, Customer Relationship Management (CRM) platform, Artificial Intelligence and Machine Learning (AI/ML) platform, Decision Engine project,... with the world's leading technology partners and together with KPMG Tax and Consulting LLC to deploy projects to perfect the internal control system in line with NCB's development strategy in the next 5 years.

We have the participation of many senior personnel who are talented and experienced domestic and foreign experts to help NCB implement the transformation roadmap. We are also currently working hard to prepare for the launch of the new brand identity and Mobile App with a new interface and truly unique features next year.

Quynh Pham (performed)

Source: https://vietnamnet.vn/tong-giam-doc-ngan-hang-ncb-chung-toi-chon-huong-di-phu-hop-2323866.html

![[Photo] The "scars" of Da Nang's mountains and forests after storms and floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/13/1762996564834_sl8-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends a conference to review one year of deploying forces to participate in protecting security and order at the grassroots level.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/12/1762957553775_dsc-2379-jpg.webp)

![Dong Nai OCOP transition: [Article 3] Linking tourism with OCOP product consumption](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/10/1762739199309_1324-2740-7_n-162543_981.jpeg)

Comment (0)