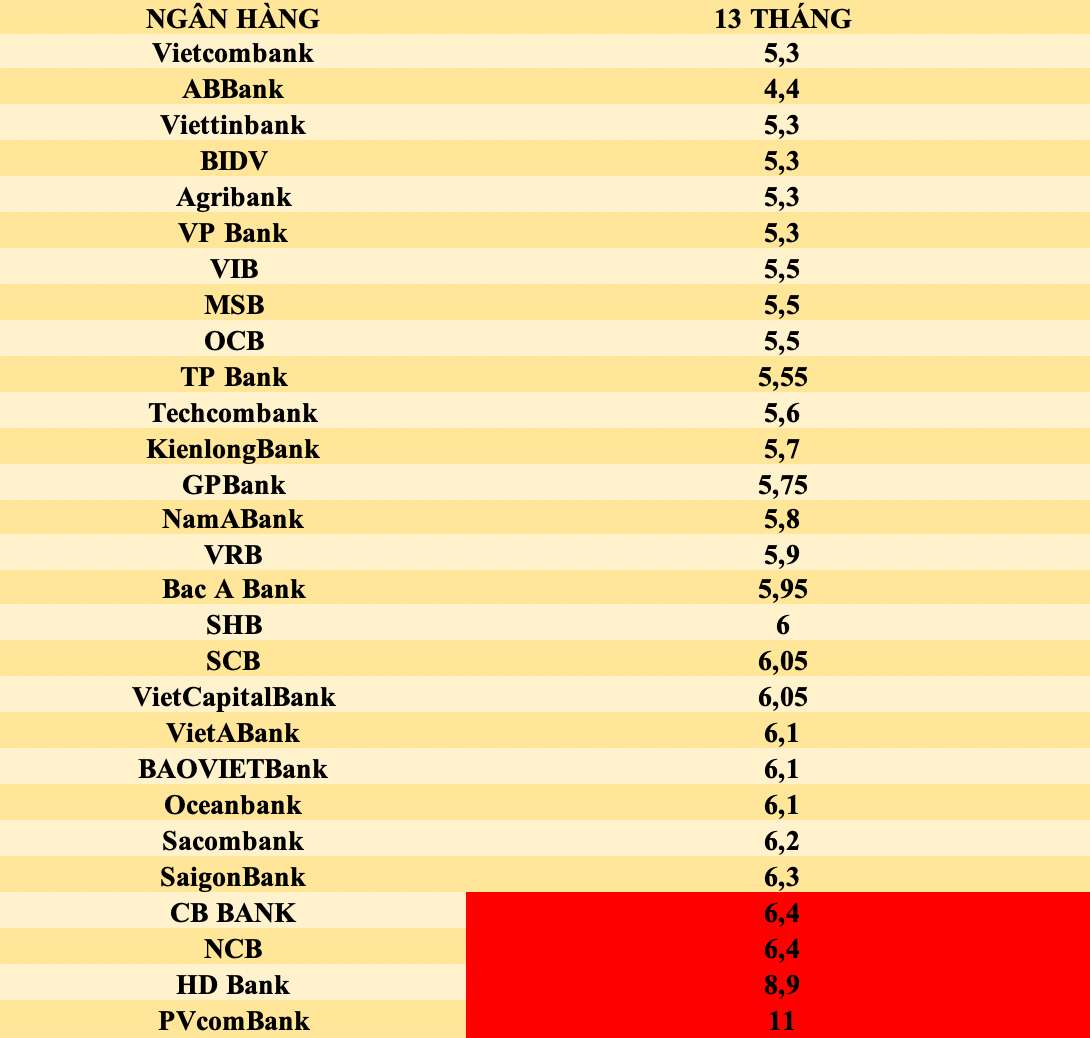

PVcombank is currently offering the highest interest rate of 11% per annum for a 13-month term, applicable to mass savings products, for deposits made at the counter with a minimum balance of 2,000 billion VND.

For online savings accounts, PVcombank offers an interest rate of 6.5% per year.

HDBank is currently offering the highest interest rate for a 13-month term at 8.9% per year, provided a minimum balance of 300 billion VND is maintained. For online deposits, customers receive an interest rate of 6.5% per year. Additionally, HDBank is offering interest rates ranging from 0.50% to 8.9% per year for other terms.

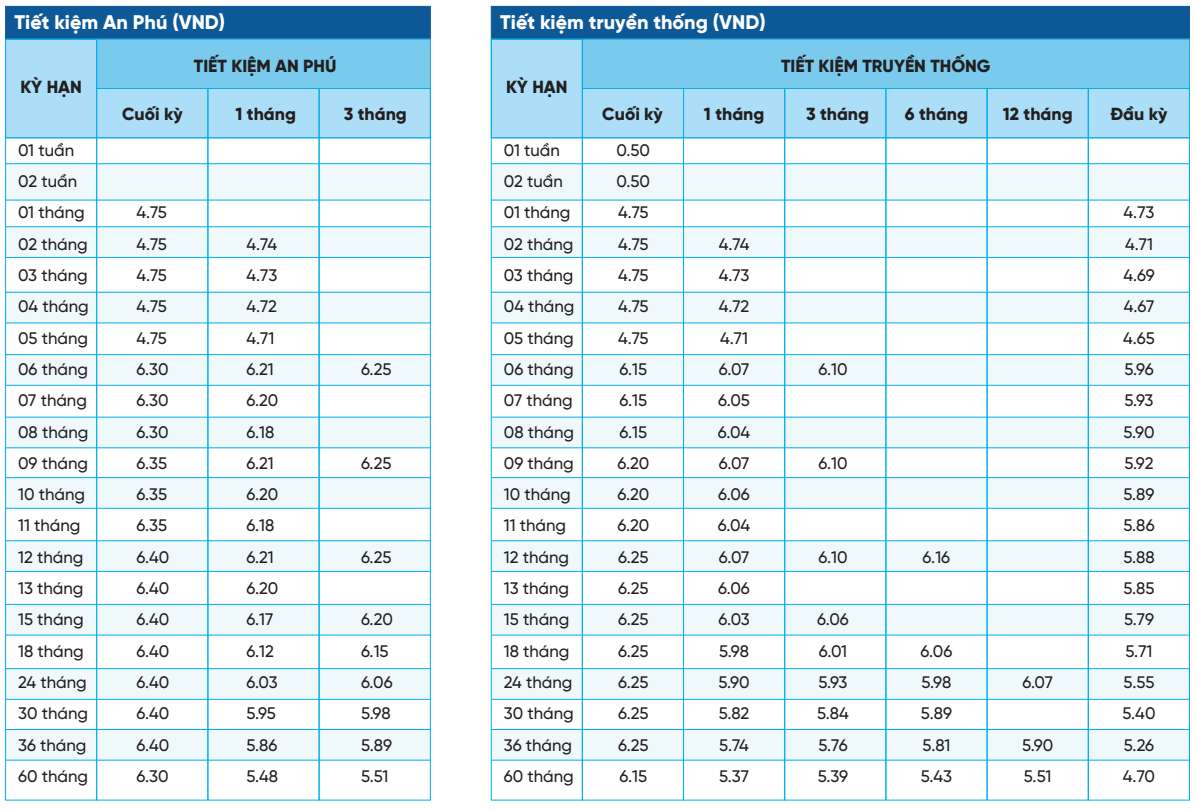

NCB is currently offering the highest interest rate of 6.4% per year for a 13-month term when customers deposit savings at An Phu branch. For the same term, customers who deposit savings through traditional methods will receive an interest rate of 6.25%, with interest paid at the end of the term.

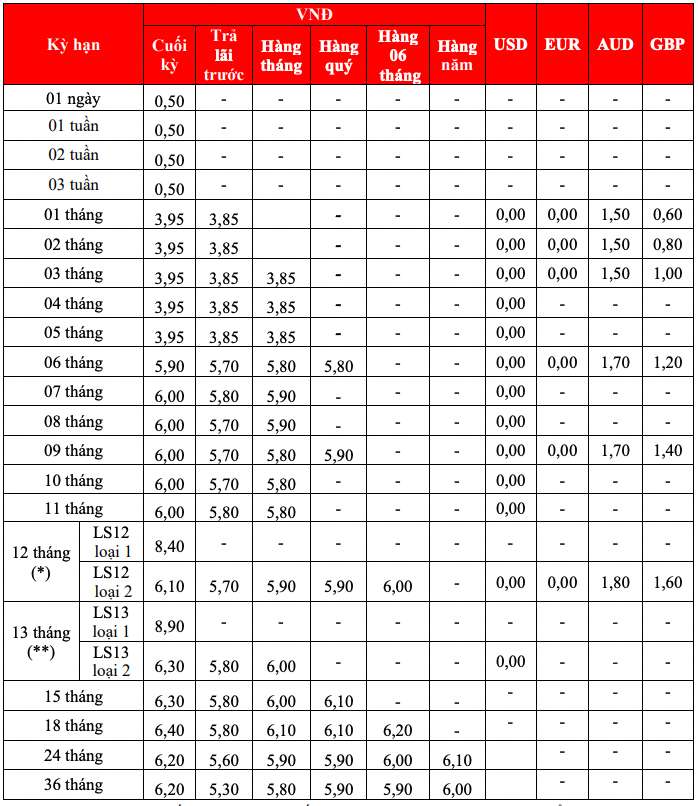

For other terms, NCB is quoting interest rates ranging from 0.5% to 6.4% per year.

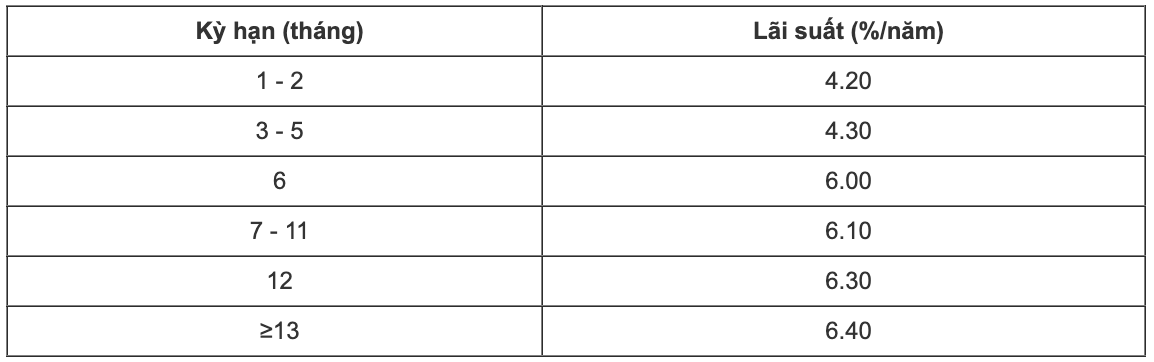

CBBank is currently offering the highest interest rate of 6.4% per year for 13-month deposits made online. For other terms, CBBank is offering interest rates ranging from 4.2% to 6.4% per year.

Below is a comparison table of 13-month term savings interest rates across nearly 30 banks for your reference:

If you deposit 2 billion VND in a savings account, how much interest will you receive after 13 months?

You can refer to the interest calculation method to find out how much interest you will receive after depositing your savings. To calculate interest, you can apply the following formula:

Interest = Deposit amount x Interest rate %/12 x Number of months deposited.

For example, if you deposit 2 billion VND into Bank A for a 13-month term and earn an interest rate of 6.4% per year, the interest received will be as follows:

2 billion VND x 6.4%/12 x 13 = 138.6 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact your nearest bank branch or hotline for specific advice.

Readers can find more articles about interest rates HERE.

Source

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)