If fertilizers are subject to a 5% value added tax, three "houses" will benefit together.

In the long term, applying value-added tax on fertilizers will benefit the State, manufacturers and farmers.

Fertilizers are “responsible” for 40-60% of the world’s food production. In Vietnam, fertilizers are an important part of agricultural production.

Statistics from the Plant Protection Department ( Ministry of Agriculture and Rural Development ) show that the demand for fertilizers in Vietnam is about 10.5 - 11 million tons of all kinds. In the period 2018 - 2023, Vietnam imported from 1 - 1.6 billion USD of fertilizers each year, in the first 6 months of 2024 alone, this figure reached 838 million USD.

The upcoming 8th Session of the 15th National Assembly , taking place on October 21, 2024, whether the National Assembly will include fertilizers in the 5% value-added tax category, or keep them as non-taxable as they are now, will have a major impact on the agricultural sector, as well as the players in the sector.

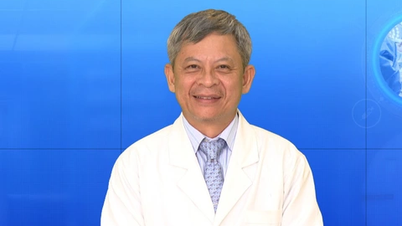

"Since 2015, when Tax Law 71 took effect, the Association has persistently petitioned to request the transfer of fertilizers from non-taxable items to those subject to 5% value added tax," Dr. Phung Ha, Chairman of the Vietnam Fertilizer Association, shared at the "Consultation seminar on the impact of applying 5% value added tax on the fertilizer industry", held on the afternoon of October 17.

Mr. Ha analyzed that Tax Law No. 71/2014/QH13 stipulates that fertilizers, specialized machinery and equipment for agricultural production... are items not subject to value added tax.

Fertilizer manufacturing enterprises are not allowed to deduct or refund value added tax on purchased goods and services, including value added tax on purchased or imported goods to create fixed assets for fertilizer production. This not only reduces business profits, but also prevents businesses from investing in new generation fertilizer technology, towards green and sustainable production.

More importantly, when applying Law 71, imported fertilizers are not subject to value added tax. This benefits foreign manufacturers when exporting fertilizers to Vietnam and severely affects domestic manufacturing enterprises.

Therefore, Mr. Ha proposed to change fertilizer products from non-VAT subject to VAT to VAT subject with a tax rate of 5%.

“Regardless of any policy in general and tax in particular that is related to the interests of many parties, it is difficult to bring benefits to all parties at the same time. What is important is to base it on long-term benefits, overall benefits and the ability of management agencies to harmonize the interests of related parties,” Dr. Phung Ha emphasized.

|

| Many opinions currently support the option of applying a 5% value added tax on fertilizers. |

Farmers benefit in the long term

On June 17, 2024, the National Assembly heard a report on amending the Law on Value Added Tax presented by the Minister of Finance, authorized by the Government. According to the report, the Government proposed to subject fertilizers to value added tax at a rate of 5%.

This is one of the issues that attracts great attention from the community, fertilizer production and trading enterprises, as well as farmers nationwide.

There are currently two opposing opinions. One side believes that amending the value added tax on fertilizers is absolutely necessary. The other side says that the amendment will only benefit businesses, while farmers will suffer.

However, according to Dr. Nguyen Tri Ngoc, Vice President and General Secretary of the Vietnam General Association of Agriculture and Rural Development, in the short term, fertilizer prices will increase and farmers will suffer a little loss because they have to pay more to buy fertilizer. But in the long term, farmers will benefit from the 5% value added tax policy on fertilizer products.

Mr. Ngoc pointed out three practical reasons why farmers benefit from this policy.

Firstly, fertilizer production enterprises are entitled to input tax deductions, so investment costs are reduced and production costs will decrease.

Second, businesses are motivated to invest in research, technological innovation, and production of new generation, high-tech fertilizers, increasing productivity and improving product quality, thereby increasing the efficiency of sustainable crop cultivation.

Third, the State collects a tax from fertilizer products, so it has more conditions to increase spending on scientific research activities... This will make farmers increase production efficiency per unit area, increasing the competitiveness of domestic agricultural products.

“Fertilizers subject to value-added tax will harmonize the interests of all three 'houses': the State, production enterprises and farmers,” a representative of the Vietnam Association of Agriculture and Rural Development affirmed.

Source: https://baodautu.vn/neu-phan-bon-duoc-ap-thue-gia-tri-gia-tang-5-ba-nha-se-cung-co-loi-d227758.html

![[Photo] Unique art of painting Tuong masks](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763094089301_ndo_br_1-jpg.webp)

![[Photo] Unique architecture of the deepest metro station in France](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763107592365_ga-sau-nhat-nuoc-phap-duy-1-6403-jpg.webp)

![[Photo] Special class in Tra Linh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763078485441_ndo_br_lop-hoc-7-jpg.webp)

Comment (0)