|

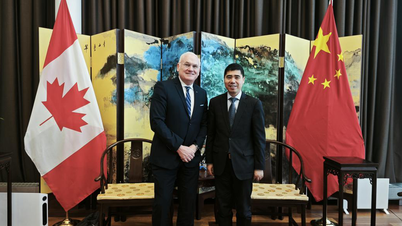

| The US cannot win a trade war with China… and should not try. Illustration photo. (Source: Reuters) |

Why are Chinese goods cheap?

Is China's glut of cheap goods due to an undervalued yuan?

The allegation of China’s manufacturing excess capacity has sparked heated discussions among policymakers. During a visit to China in April, U.S. Treasury Secretary Janet L. Yellen argued that “as global markets are flooded with artificially cheap Chinese products, the viability of American and other foreign companies is called into question,” and that the situation was still the same a decade ago.

It can be seen that the Sino-US trade war has strengthened rather than weakened China's export competitiveness.

In 2023, China will account for about 14% of total global exports, up 1.3 percentage points from 2017 (before the trade conflict between the two countries began). More notably, China's trade surplus will be about $823 billion in 2023, nearly double that of 2017.

More than a decade ago, China’s trade surplus was largely due to an undervalued renminbi (CNY). The situation is somewhat similar today.

According to research by expert Qiyuan Xu, in 2023, the CNY was undervalued by 16% against the USD, contributing to China's high exports and trade surplus. The reason given was that the inflation rate in the US over the past two years was 10 percentage points higher than China's. Therefore, according to purchasing power parity calculations, the CNY should have appreciated by 10% against the USD, but in fact it depreciated by 11%.

From this perspective, the CNY is 21% undervalued against the USD.

Of course, short-term exchange rates are more affected by interest rate differentials than inflation rates. Therefore, Mr. Qiyuan Xu used econometric methods, combining factors such as interest rate differentials and economic growth, to estimate what the CNY exchange rate would be.

Comparative studies by this expert show that the undervaluation of CNY is much larger than that of major ASEAN currencies in the past two years. Compared to the most recent interest rate hike by the US Federal Reserve (Fed) in the period 2015-2018, the undervaluation of CNY in recent years has increased significantly.

Curiously, there is no evidence that the Chinese government is aiming to manipulate the exchange rate. Even the US agrees that China has not manipulated its currency in recent years.

In this respect, the situation today is very different from a decade ago, as China has made significant progress in reforming its exchange rate system during the intervention period. The question here is why is the CNY still undervalued?

Looking at the balance of payments in 2020 and 2021, cumulative net inflows from direct investment and stock investment exceeded $400 billion, while cumulative net inflows from the capital and financial accounts exceeded $500 billion in 2022 and 2023. China’s huge current account surplus has not led to a CNY appreciation – as one might expect – due to the relatively high capital outflows.

This makes changes in exchange rates ineffective in adjusting the trade balance.

Such capital outflows cannot be attributed solely to changes in the interest rate differential between China and the US. In fact, capital outflows are largely the result of non-economic factors, including some of China's own policies, such as tightening control over certain industries.

Recognizing this, the Chinese government included non-economic policies in its self-assessment framework late last year. More importantly, the recent escalation of tensions between the two countries has prompted the US to adopt a series of policies to discourage investment in China.

This includes restricting venture capital flows into China and warnings about the risks of investors looking to the world's No. 2 economy.

The US Congress is also considering legislation to further restrict US investment in China.

Together, these factors have exacerbated capital outflows, amplified the degree of CNY undervaluation, and further weakened the impact of exchange rate adjustment on the trade balance.

The more you hit... the harder it is to win.

Expert Qiyuan Xu concluded that as long as US-China relations continue to be difficult, the more "hits" the US makes against China, the CNY exchange rate is likely to remain significantly undervalued, and Treasury Secretary Yellen's complaints will become more difficult to resolve than ever.

Of course, the political factors that distort the exchange rate also slow the development of China’s service sector and thus hinder its efforts at structural adjustment. But the US will not see victory in a trade war with China… and should not try, because the consequences could go far beyond what the US fears.

For example, Chinese Foreign Ministry spokesman Lin Jian recently accused the US of using the Ukraine conflict as an excuse to impose sanctions on many Chinese companies because of their ties to Russia.

Western sanctions and export controls are intended to contain America’s rivals, leveraging the power of the dollar to force them into submission. This has inadvertently created a global “shadow economy” that ties together the West’s main rivals, with America’s main rival, China, at its center, according to a commentary in the Wall Street Journal .

Unprecedented financial and trade restrictions on Russia, Iran, Venezuela, North Korea, China and others have squeezed those economies by limiting their access to Western goods and markets.

But Beijing has increasingly been successful in thwarting the U.S.-led effort by strengthening trade ties with other sanctioned countries, according to Western officials and customs data. The bloc of countries sanctioned by the U.S. and its Western allies now has the economic scale to defend itself against Washington’s economic and financial warfare, trading everything from drones and missiles to gold and oil.

Former senior US defense official Dana Stroul and now a senior fellow at the Washington DC Institute for Near East Policy, commented: “China is a major strategic competitor of the US and has the potential to reshape the current global order.”

“For the benefit of both sides, China needs to develop a consistent mechanism to assess the impact of non-economic measures and the US must ease its restrictive policies on Beijing,” Qiyuan Xu, deputy director of the Institute of World Economics and Politics, suggested.

Source

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)