Gold price skyrocketed compared to early morning

At 11:00 a.m. on February 22, 2024, the domestic SJC gold price fluctuated slightly compared to the early morning of the same day. At Saigon Jewelry Company Limited - SJC, the SJC gold price was listed at 75.8 million VND/tael for buying and 78 million VND/tael for selling. Compared to the early morning of the same day, the SJC gold price decreased slightly by 20,000 VND for selling.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Screenshot at 11:00 on February 22, 2024 |

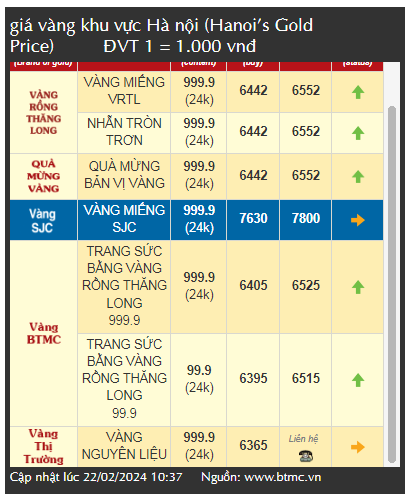

Similarly, at Bao Tin Minh Chau, at 11am, this unit listed the price of SJC gold at 76.3 million VND/tael for buying and 78 million VND/tael for selling. Compared to the early morning of the same day, the price of SJC gold here was adjusted up 400,000 VND for buying and up 50,000 VND for selling.

|

| Gold price listed at Bao Tin Minh Chau. Screenshot at 11:00 on February 22, 2024 |

After the God of Wealth day, the domestic price of SJC gold bars briefly increased to 78.5 million VND/tael in the trading session on February 21, but then decreased immediately afterwards.

If we compare the price of this item in the trading session at noon today with the same time on the God of Wealth day on February 19, the price of gold has increased. At 11:00 a.m. on February 19, the gold price at Saigon Jewelry Company Limited - SJC was listed at 74.5 - 77.5 million VND/tael for buying and selling. Thus, up to now, people who bought SJC gold on the God of Wealth day have lost up to 1.7 million VND/tael.

Mr. Hoang Nam (Bac Tu Liem district, Hanoi) said that the price of gold on God of Fortune Day in 2024 decreased compared to previous years but is still high. However, if investing at this time, investors and consumers will suffer heavy losses. "On God of Fortune Day, I bought some gold both for luck and for storage and investment. If I sell it at this time, I will lose nearly 2 million VND/tael" - Mr. Nam shared and was optimistic, gold is an investment asset that requires a long time, at least 6 months to 1 year. Therefore, Mr. Nam recommends that investors and people should not worry too much if they buy gold for investment on God of Fortune Day because according to forecasts from domestic and foreign economic experts, gold prices will increase in 2024.

According to a representative of Bao Tin Minh Chau, domestic gold trading this morning is still at a high level. According to the brand's records, this morning the number of customers buying and selling is 55% buying and 45% selling.

A representative of Bao Tin Minh Chau gold brand advised that the domestic gold price this morning is still high. Therefore, investors and people should consider before trading and regularly monitor gold prices on official channels to make the most correct decisions.

Will gold prices fall in the future?

This morning's world gold price was trading at 2,027 USD/ounce, equivalent to 61.54 million VND/tael.

Gold prices have not been able to increase further after the USD stabilized. The DXY index (measuring the USD's fluctuations against a basket of six major currencies) was stable at 104.1 points.

|

| Will gold prices fall in the near future? |

Gold tends to cool down due to increased profit-taking pressure after the precious metal rose for four consecutive sessions and stayed above the threshold of 2,000 USD/ounce.

Besides, the peak season for gold consumption is gradually fading away; the Chinese and Vietnamese markets are over the Lunar New Year holiday; and the God of Wealth's Day, an occasion to buy gold for luck, has also passed... therefore, it is predicted that gold prices will continue to cool down.

Investors are now waiting for clearer signals on the US Federal Reserve's monetary policy by dissecting the minutes of the recent policy meeting. The minutes will provide inside details regarding the stance of the members of the Federal Open Market Committee (FOMC) on monetary policy.

Previously, the Fed signaled a three-time interest rate cut in 2024, with a total cut of 75 basis points, bringing the US operating interest rate from a 22-year record high of 5.25-5.5% to 4.5-4.75%/year.

Initially, the market expected the Fed to cut interest rates as early as the March meeting and as late as May. Later, many Fed officials said that it was still early for the US central bank to reverse monetary policy, because inflation remained high.

Investors are now looking for clues about when the Fed will cut interest rates for the first time since March 2022. Many forecasts say the Fed will lower interest rates at its June meeting.

In the long run, the US dollar will fall with the Fed's interest rate cuts. Gold prices will increase rapidly accordingly.

Gold is also supported by the potential for continued unrest in Ukraine and the Middle East. There is no sign that geopolitical tensions in these regions will ease anytime soon.

The precious metal is also supported by physical gold demand in many countries.

On Kitco, expert Stuart O'Reilly from Royal M said that the UK economy is falling into recession. Many investors are looking for safety in the gold investment channel.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

Comment (0)