Currently, home loan interest rates at banks are moving in two directions: remaining the same or decreasing slightly by about 0.2 percentage points. In addition, disadvantaged people in society will soon have a new preferential credit package.

With Agribank, loans with a minimum term of 3 years will have a fixed interest rate of 6.5%/year for the first 12 months. With a 5-year loan, the interest rate is fixed at 7%/year for the first 24 months.

At BIDV, the interest rate is about 5%/year for the first 6 months or 5.5%/year for 12 months, for loans with a minimum term of 36 months. If applying for a 60-month loan package, the interest rate will be 6%/year for the first 24 months.

|

| Many banks have reduced home loan interest rates by about 0.2 percentage points. Photo: Investment Newspaper |

With Vietcombank, short-term loans will have interest rates from 5.7% in the first 12 months; 6.5% in 2 years; or 8.5% in 3 years.

At VietinBank, this bank is offering a preferential loan interest rate of about 6%/year for the first 12 months. For medium and long-term loans, the fixed interest rate for the first 18 months will be 6.2%/year or 6.7%/year for the first 24 months.

In the group of joint stock commercial banks, BVBank recorded the same interest rate as last month, fixed at 6.9% for the first 6 months; 8.49% for 18 months.

TPBank has a slightly reduced interest rate, down to 6.6% fixed for the first 12 months with a minimum loan of 48 months. In addition, this bank also has a loan package with a minimum of 72 months with a fixed interest rate of 7.6% for the first 24 months.

MSB can currently be considered one of the commercial banks with the lowest interest rates, fixed at around 4.5% for the first 6 months. This figure for fixed loans in the first 12 months is 6.2%.

Sacombank has the same interest rate as in September 2024, when the preferential loan rate is still around 6.5%/year in the first 6 months; 7% in the first 12 months; or 7.5% in 24 months.

Similarly, MBBank still has preferential home loan interest rates of 7.5% for the first 6 months; 7.9% for 12 months; 9% for 24 months.

HDBank has preferential interest rates for the first 6 months at 5%; for the first 12 months at 6.5%; for 24 months at about 8%.

Woori Bank recorded a fixed interest rate of 5.3% for the first 12 months; 6% for the first 24 months; and 6.4% for 36 months.

Borrowers should note that all of the above figures are preferential interest rates and are only applicable for a certain period of time. When the term expires, the interest rate will return to the floating rate, fluctuating between 8.2 - 11.7%/year.

In addition, in early October 2024, Prime Minister Pham Minh Chinh assigned the Ministry of Construction to preside over and coordinate with the Ministry of Planning and Investment, the Ministry of Finance, and the State Bank of Vietnam to research, develop, and implement a preferential credit package of about VND 30,000 billion for the Bank for Social Policies to lend to purchase, hire-purchase, construct, renovate, and repair houses, and implement social policies.

Accordingly, the Vietnam Bank for Social Policies will prioritize this capital source for ethnic minorities, mountainous areas, extremely difficult areas, border areas, islands, remote areas. This policy is expected to be completed in October 2024.

Source: https://baodautu.vn/batdongsan/mot-so-ngan-hang-giam-lai-vay-mua-nha-trong-thang-102024-d227419.html

![[Photo] President Luong Cuong attends the National Ceremony to honor Uncle Ho's Good Children](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/9defa1e6e3e743f59a79f667b0b6b3db)

![[Photo] In May, lotus flowers bloom in President Ho Chi Minh's hometown](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/aed19c8fa5ef410ea0099d9ecf34d2ad)

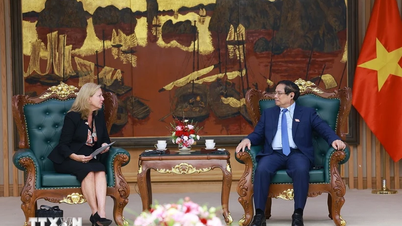

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

Comment (0)