As the end of the year approaches, facing the risk of not completing the annual plan, many businesses choose to request adjustments to the 2024 business plan in the final stages.

Profits plummet, many businesses rush to change annual plans

As the end of the year approaches, facing the risk of not completing the annual plan, many businesses choose to request adjustments to the 2024 business plan in the final stages.

Adjusting plans near the end of the year

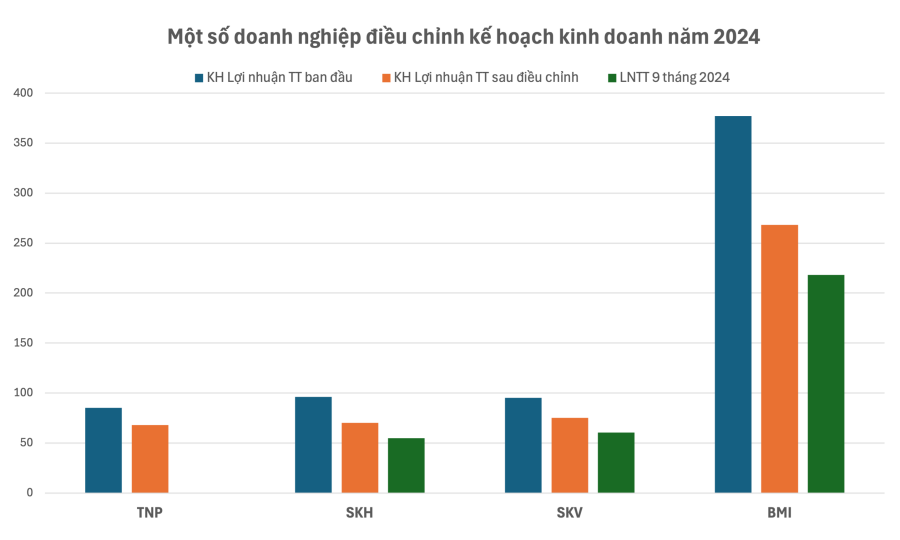

Thi Nai Port Joint Stock Company (TNP) agreed in mid-November 2024 to adjust the business plan targets for the whole year 2024. The adjusted plan targets all decreased sharply compared to the plan approved at the 2024 Annual General Meeting of Shareholders held in April 2024.

Accordingly, after adjustment, the planned cargo throughput through the port decreased from the initial 1,900,000 tons to 1,300,000 tons, equivalent to a decrease of 31.5%. The adjusted total revenue and pre-tax profit plans decreased by 20% and 41.67%, respectively. After adjustment, TNP's target is 68 billion VND in total revenue and 14 billion VND in pre-tax profit.

Information from the TNP Board of Directors meeting said that the world economy is gradually recovering but is unstable, facing many risks and uncertainties. Prices of gasoline, raw materials, transportation costs and world gold prices fluctuate strongly, creating pressure on inflation and global growth. Persistent geopolitical tensions that could escalate to dangerous levels, the Red Sea issue, high debt levels and the instability of economies negatively impact the global trade model.

Faced with the above difficulties, in the first 9 months of 2024, the volume of goods passing through Thi Nai Port decreased significantly compared to the same period last year. At the same time, the Port plans to conduct dredging in the fourth quarter of 2024, which will also reduce the volume of goods in the last months of the year, directly affecting revenue and business performance during the year.

In addition, the decision of the People's Committee of Binh Dinh province to terminate the project of Thi Nai Port Warehouse Service Center and Seafood Processing Area on National Highway 19 (new), Phuoc Loc Commune, Tuy Phuoc, Binh Dinh will cause all costs incurred by Thi Nai Port from 2017 to present (more than 3.57 billion VND) to be accounted for in 2025, directly affecting the annual profit.

The above factors are the reasons why the Board of Directors agreed to adjust down the business plan targets for 2024.

More than 80.9% of the total number of votes of shareholders with voting rights of Sanest Khanh Hoa Beverage Joint Stock Company (SKH) has just approved the adjustment of the company's 2024 production and business plan.

Accordingly, the adjusted net revenue target decreased from VND 1,680 billion to VND 1,170 billion, the pre-tax profit plan decreased from VND 96 billion to VND 70 billion, the reductions were 30% and 27% respectively. SKH's Board of Directors said that the reduction in the annual revenue and profit target was aimed at reducing inventory pressure on the distribution system, implementing production and business strategies to increase revenue and market share, improving product quality, increasing brand recognition at points of sale during the upcoming Lunar New Year season and demonstrating responsibility to shareholders.

In fact, SKH's business results in the first 9 months of 2024 have dropped sharply. Net revenue reached VND 864 billion, down 40% compared to the same period last year. Pre-tax profit was only VND 54.9 billion, down 43%. Compared to the pre-adjustment plan, SKH only achieved 57% of the profit target after 9 months, leaving great pressure for the fourth quarter of 2024 with a high possibility of not completing the plan assigned by the General Meeting of Shareholders. After adjustment, this pressure has been significantly reduced when the rate of achieving the annual profit plan after 9 months has increased to 78%.

Also a company in the Khanh Hoa Salanganes Nest State-owned One Member Limited Liability Company system with SKH, Khanh Hoa Salanganes Nest Beverage Joint Stock Company (SKV) also changed its revenue and profit target for 2024.

SKV has adjusted its revenue plan down by 11% and its after-tax profit plan down by 21%. After the adjustment, SKV's annual plan is VND 1,510 billion in revenue and VND 75 billion in pre-tax profit. Not only that, the 2024 cash dividend payment plan also decreased from 22.4% to 17.7%.

Different from SKH's general reason, SKV said that in 2024, the company's production activities were affected by the economic recession, high inflation leading to a decrease in consumer demand for goods, and the impact of Typhoon Yagi also made business operations difficult.

In addition, the problem of counterfeit goods of Khanh Hoa Salanganes Nest, Sanest, Savinest brands is happening openly, widely and increasingly complicated, causing confusion for consumers, greatly affecting the reputation and brand of the company, revenue and profit have decreased significantly. Based on the results of the first 9 months and forecast for the last 3 months of the year, SKV has just requested to adjust down the production and business plan for the whole year.

SKV's financial report shows that in the first 9 months of 2024, the company achieved VND1,156 billion in net revenue and VND60.5 billion in pre-tax profit, down 23% and 41% respectively compared to the same period last year. Without adjusting the plan, SKV has only achieved 63% of the annual profit plan.

|

| Some businesses ask to adjust their plans near the end of the year. |

As an insurance company - an industry greatly affected by the consequences of super typhoon Yagi, Bao Minh Insurance Corporation (BMI) also plans to adjust its annual plan.

In early November, BMI's Board of Directors agreed to adjust BMI's business plan targets to at least VND268 billion in pre-tax profit, down 29% compared to the previously set target of VND377 billion. At the same time, ROE and dividend payout ratio were both adjusted down from 10% to 7%. These targets will be submitted by BMI to the extraordinary General Meeting of Shareholders to be held on December 27, 2024. This also means that, if approved, BMI's full-year plan will be officially adjusted in the final days of 2024.

In the third quarter of 2024, BMI recorded a sharp decline in profit (-59%). In the first 9 months, BMI achieved VND 218 billion in after-tax profit, down 22% compared to the same period last year.

The average annual plan completion rate remains relatively high.

2024 is considered a difficult year for many businesses. However, besides businesses facing difficulties and needing to adjust their annual plans, the current data still shows a general state of stability in the market.

|

| The completion rate of the 2024 after-tax profit plan in the non-financial group reached 84%, higher than the financial group (73%). Chart: FiinGroup |

A summary report by FiinGroup said that, on a market-wide scale, in the first 9 months of 2024, listed enterprises achieved a profit after tax growth rate of nearly 21% over the same period, higher than the 2024 plan (up 17.9%), and completed 83% of the annual profit after tax plan. This is a relatively high completion rate, thanks to the main contribution from the non-financial group (retail, industrial goods and services, chemicals, personal and household goods, basic resources).

On the contrary, the plan completion rate is quite low in banking and real estate - two industries that account for an overwhelming proportion in the structure of after-tax profits and capitalization of the entire market.

Some other industries such as basic resources (mainly steel), telecommunications, and information technology have post-tax profit growth in the first 9 months of 2024 that far exceeds the 2024 full-year plan. However, the full-year plan completion rate of 76%-79% in the first 9 months of 2024 shows that these industries are still sticking to the plan and have not really created any surprises in terms of profit compared to the plan submitted by the board of directors to the annual general meeting of shareholders earlier this year, FiinGroup assessed.

Source: https://baodautu.vn/loi-nhuan-giam-manh-nhieu-doanh-nghiep-gap-rut-xin-doi-ke-hoach-nam-d230774.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)