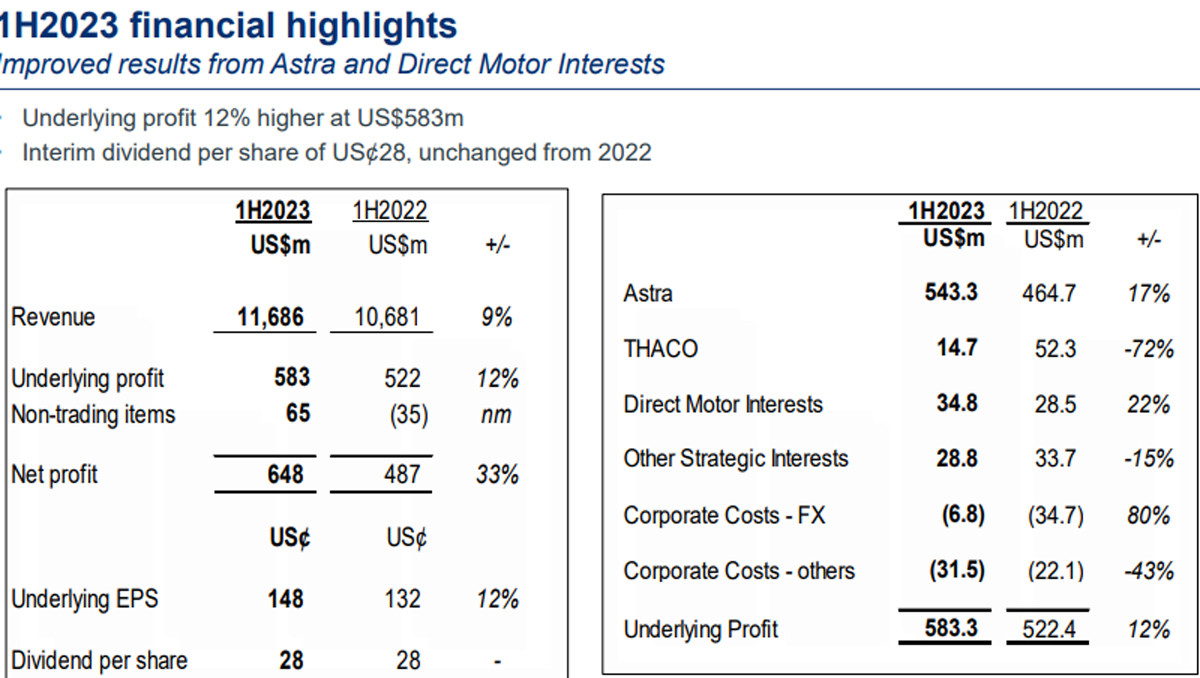

According to Jardine Cycle & Carriage's (JCC) semi-annual report, the group recorded a profit of 583 million USD in the first half of 2023, up 12% year-on-year.

JCC is an investment company of Jardine Matheson Group (Jardines) in Southeast Asia. This is a group that is no stranger to Vietnamese investors, with investments in leading Vietnamese enterprises such as Vinamilk, REE, Thaco .

At the same time, JCC is a distributor of many car brands across Southeast Asian countries. JCC currently owns more than 50% of Astra - the largest independent automotive group in Southeast Asia from Indonesia.

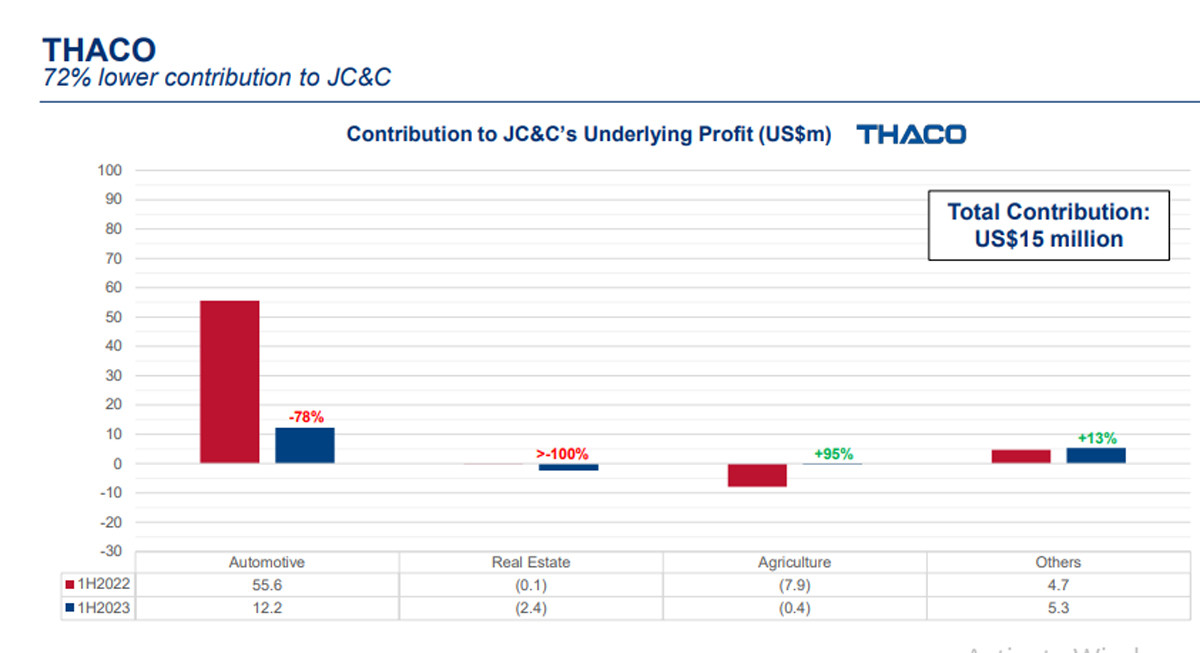

In JCC's profit structure, the contribution from Thaco of billionaire Tran Ba Duong reached 14.7 million USD, down 72% over the same period.

Thaco is known as Truong Hai Group Joint Stock Company (Truong Hai Group), formerly Truong Hai Auto Joint Stock Company (Thaco), established on April 29, 1997, in Dong Nai . The founder is Mr. Tran Ba Duong, currently Chairman of the Board of Directors. Currently, JCC holds 26.6% of Thaco shares.

Thaco's profit decline is due to a weakening economy and tightening consumption, along with increasing pressure from competitors.

In 2019, Jardine Cycle & Carriage Limited purchased Thaco's privately issued shares at a valuation of more than 9.2 billion USD.

However, the valuation of Mr. Tran Ba Duong's Thaco has recently decreased. According to the financial report of VietinBank Securities (CTS), CTS has sold more than 4.7 million unlisted shares with a total sale value of VND141 billion (equivalent to VND30,000/share).

According to the report, the sharp decline in the value of CTS's unlisted stock investment came from shares of Truong Hai Auto Corporation (Thaco). This shows that CTS has sold a part of this company's shares.

With a price of VND 30,000/share, Thaco is valued at VND 91,500 billion (equivalent to about USD 3.8 billion), much lower than the price Thaco issued privately to strategic shareholder JC&C in 2019.

In late June 2023, billionaire Tran Ba Duong's Thaco said it would sell 10% of its shares in Thaco Auto Company Limited, a subsidiary specializing in automobile manufacturing and trading, in 2023. According to a source, Thaco Auto could be valued at 5 billion USD.

Established in December 2020, Thaco Auto is a member of Thaco Group and also the main unit. Thaco Auto specializes in manufacturing, assembling, distributing and retailing vehicles of the brands KIA, Mazda, Peugeot, BMW... with a system of nearly 400 retail showrooms nationwide and a production complex with 7 factories (KIA, Thaco Royal, Mazda, Luxury Car factory, motorcycle factory, bus factory, truck and specialized truck factory) located in Chu Lai Industrial Park (Quang Nam).

Currently, Thaco is a multi-industry industrial corporation including: Thaco Auto (automobiles), Thaco Agri (agriculture and forestry); Thaco Industries (mechanics and supporting industries), Thadico (construction investment), Thilogi (Logistics) and Thiso (trade and services).

Truong Hai Group is known as a private enterprise of Mr. Tran Ba Duong and Ms. Vien Dieu Hoa's family. This enterprise is no longer a public company and does not have to disclose information.

Over the past decade, Thaco has expanded into many fields, including agriculture, real estate, retail, logistics, etc. In 2022, Thaco recorded a profit of VND 7,400 billion but its debt was high, more than VND 104,000 billion (USD 4.4 billion).

According to Forbes, the family assets of Thaco Chairman Tran Ba Duong are currently at 1.5 billion USD.

Mr. Tran Ba Duong had great success with Thaco and made a breakthrough thanks to his investment in Thu Thiem. However, this billionaire had a difficult time rescuing HAGL Agrico. HAGL Agrico (HNG) is an agricultural enterprise with a large land area but modest revenue and profit.

The high prices of fertilizers and agricultural materials and the skyrocketing transportation costs over the past year have caused difficulties for agricultural enterprises like HNG. Mr. Tran Ba Duong’s Thaco has poured billions of dollars into HAGL Agrico, but the recovery of this enterprise has been quite slow.

In addition to its investment in Thaco, Jardine Cycle & Carriage (JCC) is holding millions of dollars in assets of Vinamilk and REE.

Income from Vinamilk dividends remained stable at $9 million. Profit from REE increased 34.4% to $11 million due to increased REE profits and JCC increasing its ownership in the Vietnamese company.

Source

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)