In August 2023 alone, a series of credit institutions in the area adjusted capital mobilization interest rates 2-3 times, reducing mobilization interest rates to below 6%/year.

Deposit interest rates continue to "plummet"

A series of “big guys” in the Ha Tinh banking industry have just adjusted their savings interest rates with a reduction of up to 0.5%/year. The highest capital mobilization interest rate at the state-owned banking group has now dropped to below 6%/year while at the beginning of this year it was listed at 7.5-8%/year.

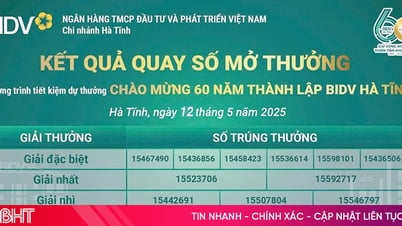

Customers come to transact at BIDV Ha Tinh.

Most recently, on August 23, BIDV Ha Tinh changed the deposit interest rate table with a reduction of 0.3 - 0.5%/year. Accordingly, the 3-month deposit interest rate is currently 3.8%/year (for individuals), 3.5%/year (for organizations); 6 months is 4.7%/year (individuals), 4.4%/year (organizations), 12 months and 36 months is 5.8%/year (individuals), 5.2%/year (organizations)... In particular, the online deposit interest rate at BIDV is "slightly" higher by 0.2%/year compared to direct deposit at the transaction counter.

Similarly, Agribank Ha Tinh II also reduced deposit interest rates from August 23. The current 3-month deposit interest rate is 3.8%/year (for individuals), 3.5%/year (for organizations); 6-month is 4.7%/year (individuals), 4.4%/year (organizations); 12-month is 5.8%/year (individuals), 5.2%/year (organizations); 36-month is 5.5%/year (individuals) and 5%/year (organizations)...

According to Mr. Vo Manh Tuan - Deputy Director of Agribank Ha Tinh II, although the mobilization interest rate has tended to decrease recently, the "attraction" from the branch's bonus savings package and customers' trust in the Agribank brand has resulted in the amount of residential deposits still growing quite well. Accordingly, the total mobilized capital of the branch as of August 24, 2023 reached VND 12,780 billion, an increase of VND 1,092 billion compared to the beginning of the year".

At this time, Vietcombank Ha Tinh also joined the "race" to reduce interest rates this August. Accordingly, the interest rate for 3-month deposits is currently 3.8%/year, 6-month deposits is 4.7%/year, 12-month and 24-month deposits are 5.8%/year...

According to the leader of Vietcombank Ha Tinh, reducing capital mobilization interest rates is a necessary move to create a premise to continue reducing lending interest rates, supporting the economy in the last months of the year. The total mobilized capital of the entire branch has now reached 11,600 billion VND, up 6.6% compared to the beginning of the year.

The highest interest rates of many banks have fallen below 6%/year.

For the joint stock commercial sector, the reduction in deposit interest rates is still taking place. According to records, savings interest rates at some private banks such as Techcombank, ACB... have fallen below 6%/year (ie, a decrease of more than 5%/year compared to the beginning of the year).

At ACB Ha Tinh, in August alone, the deposit interest rate table has been adjusted twice, reducing the highest interest rate from 6.7% to 5.6%/year (for 6-month and 12-month terms), 4.5%/year (for 3-month terms)...

How do people react when interest rates continue to fall?

Experts say that the capital mobilization interest rates of banks have continuously decreased, even some short-term terms have reached the low level of 2 years ago - the time when the COVID-19 pandemic took place.

With inflation expected to continue to decline, it is likely that credit institutions will continue to adjust deposit interest rates in the near future. Therefore, some customers have withdrawn their savings to invest in real estate, stocks, gold, etc. when assessing and predicting positive signs from these markets.

In August alone, ACB Ha Tinh reduced deposit interest rates twice.

According to Mr. Nguyen Van Tuan (Thach Linh Ward, Ha Tinh City), currently, the savings interest rates of "banks" are no longer "attractive" and may continue to decrease, while the real estate market has shown some positive signs of recovery. Therefore, I have just withdrawn my savings to conduct land auctions in planning areas in some communes and wards in the city.

In another development, although interest rates are “plummeting”, to ensure safety, many people continue to choose the savings channel. Ms. Phan Thi Minh Nguyet (Nghen town, Can Loc) said: “Currently, the amount of money we have saved is not much, not enough for large investments. Therefore, I still choose to save for a 12-month period to enjoy the highest interest rate”.

People and businesses expect banks to reduce lending interest rates in proportion to the reduction in deposit interest rates to support the economy.

In the context of input interest rates having cooled down rapidly and strongly, the State Bank of Vietnam has recently requested banks to reduce interest rates on old and new loans by at least 1.5-2% as directed by the Government. However, according to feedback from people and businesses, the reduction in lending interest rates at many banks is not significant and not commensurate with deposit interest rates. For the production and business sectors, interest rates are lower than before, but in the consumption and investment sectors, people are still paying quite high lending interest rates.

Therefore, the banking industry needs more effective solutions to quickly lower lending rates to both stimulate credit demand in the context of gloomy loan growth and contribute to supporting the economy in the face of challenges posed by the global economic recession.

Thu Phuong

Source

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)