HABECO has made a profit

Total revenue and other income in 2022 of Hanoi Beer, Alcohol and Beverage Corporation (HABECO) reached VND 6,461.44 billion, an increase of 20.4% compared to 2021, equivalent to VND 1,096.6 billion. This increase in revenue is due to the 14% increase in beer consumption over the same period, and HABECO has increased beer prices since mid-2022.

HABECO's pre-tax profit last year reached VND517.52 billion, equal to 137.32% compared to 2021.

As a result, the business performance of this enterprise in 2022 was profitable, with after-tax profit reaching more than VND 422 billion, equal to 135.9% over the same period. Return on equity (ROE) was 10.35%, Return on total assets (ROA) was 7.24%.

Profit after tax in 2022 increased compared to 2021 mainly due to HABECO increasing beer prices in 2022, causing net revenue from sales and service provision to increase by 20.7% over the same period, while cost of goods sold increased by only 17.7%.

Paper Corporation: A series of affiliated companies in disrepair

In 2022, Vietnam Paper Corporation (Vinapaco) faced many difficulties due to the impact of the world market situation, increasing prices of input materials, old machinery and equipment leading to some technological incidents... However, the corporation took advantage of its strengths to ensure production and business efficiency.

Some major difficulties and problems affecting Vinapaco's production and business results in 2022.

In the industrial sector, the paper production machinery lines at Bai Bang and Song Duong Tissue Paper Company are old and often broken, leading to high maintenance costs. Many technological incidents increase the consumption of raw materials, affecting product quality, planning progress and production and business efficiency.

Major projects that have stopped investment or changed their objectives, such as the Phuong Nam Pulp Mill Project and the Kontum Paper Raw Material Forest Project, are difficulties and problems that Vinapaco must continue to deal with.

The equitization of the corporation was prolonged due to the implementation of the plan to handle the Phuong Nam Pulp Mill Project under the direction of the Government and the Ministry of Industry and Trade. The sale of fixed assets and inventory of the project was hindered because the Vietnam Public Joint Stock Commercial Bank (PVComBank) sued Vinapaco due to the mortgage of the project.

Regarding the financial situation and business results of Vinapaco's member units, the Ministry of Industry and Trade said: The parent company - Vinapaco has 1 subsidiary and 7 associated companies; in which, the subsidiary has many financial problems and financial imbalances; 1 associated company has been losing money for many years, 2 associated companies have stopped operating for many years.

Specifically, at BBP Paper Joint Stock Company, Vinapaco's investment in the company was 52 billion VND. The company stopped operating since October 2015, at which time the company was operating at a loss, with negative equity. Vinapaco was at risk of having to pay the corresponding debt amount that had guaranteed the credit loan for BBP Paper, which was 15 million USD, equivalent to 345 billion VND.

Thanh Hoa Paper Joint Stock Company has stopped operating, Thanh Hoa Provincial People's Committee has reclaimed the entire factory premises. The Paper Corporation has recovered the investment capital here of 26.1 billion/35.6 billion VND of Vinapaco's total investment capital, the remaining amount is 9.45 billion VND.

VINAINCON: A series of subsidiaries and affiliated companies are making losses

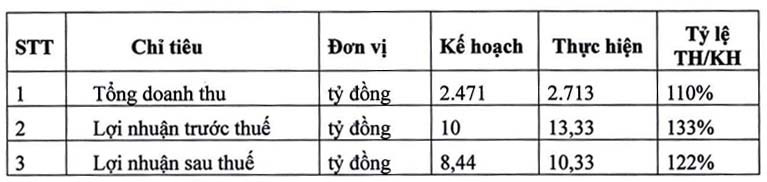

Total revenue and other income of Vietnam Industrial Construction Corporation (VINAINCON) was VND 254.9 billion, reaching 64% of the yearly plan; pre-tax profit was VND 14.7 billion, reaching 101% of the 2022 plan.

In 2022, the dividend income from 2021 profits of companies with capital contributions from the parent company VINAINCON is VND 24,063 billion. Investments in subsidiaries and associates with loss-making business results have been provisioned for financial investments by the parent company, with the balance of long-term provision as of December 31, 2022 being VND 243.3 billion (January 1, 2022 was VND 243.3 billion).

Of which, Quang Son Cement One Member Co., Ltd. 200 billion VND, Ha Bac Chemical Mechanical One Member Co., Ltd. 10 billion VND, Industrial Construction and Production Joint Stock Company 14.08 billion VND, Chemical Construction and Installation Mechanical Joint Stock Company 4.02 billion VND, VINAINCON Centrifugal Concrete Joint Stock Company 5.86 billion VND, Industrial Construction Joint Stock Company 4.56 billion VND...

Some subsidiaries and associates need to pay attention when having accumulated business losses. Chemical Construction and Installation Company Limited: In 2022, the loss was 0.802 billion VND, the accumulated loss up to December 31, 2022 was 77.997 billion VND.

Ha Bac Chemical Mechanical Company Limited lost VND 2,826 billion in 2022, accumulated loss up to December 31, 2022 was VND 49.05 billion. The loss was mainly due to gross profit not being enough to cover management costs and interest.

Machinery and Industrial Equipment Corporation (MIE): Promoting divestment

MIE's total revenue reached VND317.4 billion, of which sales and service revenue was VND297.24 billion, equal to 116.27% of the yearly plan. Pre-tax profit reached VND0.31 billion, equal to 31.13% of the yearly plan.

The parent company's investments mostly ensure the principle of capital preservation. Although the profit ratio of the units is not high, some units still pay dividends annually, such as Hai Duong Grinding Stone Company and Hai Phong Mechanical Engineering Company.

For ineffective business units such as Technoimport Company, Dong Banh Cement Company, Saigon - Hanoi Investment and Trading Joint Stock Company, the corporation continues to divest capital according to regulations. However, due to some problems, MIE has not been able to divest capital in 2022.

VEAM invests in joint venture with big profit

The total profit after tax of Vietnam Engine and Agricultural Machinery Corporation (VEAM) is VND 5,624 billion, reaching 125% of the 2022 plan (exceeding the plan by 25%).

In 2022, VEAM still has many problems from previous years that have not been resolved and handled. The parent company's production activities have not been as effective as planned, but investment efficiency is relatively positive, and financial indicators are at a safe level according to regulations.

VEAM's investment efficiency in joint ventures Honda Vietnam and Toyota Vietnam has increased. However, the efficiency of investments in subsidiaries is still low, especially in companies 100% owned by VEAM (except for DISOCO Company).

Specifically: 5 subsidiaries with 100% capital contribution of VEAM include 4 LLCs and 1 research institute, of which 1 company is profitable, DISOCO Company; 2 companies and 1 research institute are profitable but still have accumulated losses, namely SVEAM Company, TAMAC Company and Institute of Technology; 1 company has incurred losses and accumulated losses, namely Tran Hung Dao Mechanical Company.

8 VEAM subsidiaries have contributed capital of over 50% of charter capital, of which 6 companies will make profits in 2022, including: 1 company will make profits in 2022 but have accumulated losses, which is VETRANCO, 2 companies will have accumulated losses, which are Veam Korea, and Vinh Mechanical Joint Stock Company;

6 VEAM affiliated companies have contributed capital of less than 50% of charter capital, of which: 4 companies are profitable, 2 companies are at a loss in 2022 and have accumulated losses, namely Nakyco Joint Stock Company and Matexim Hai Phong Joint Stock Company.

Two other companies with capital contributions from VEAM, KumBa Joint Stock Company and MeKong Auto Company Limited, do not have Financial Statements for the fiscal year as of December 31, 2022.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)