TPBank receives a "shower" of awards thanks to its excellent digitalization strategy

Recently, at the Vietnam Digital Transformation Awards 2024 (VDA 2024) held annually under the chairmanship of the Vietnam Digital Communications Association (VDCA), Tien Phong Commercial Joint Stock Bank (TPBank) was honored to become an Excellent Digital Transformation Enterprise with a series of digital solutions TPBank App, LiveBank 24/7, TPBank Biz, digital transformation applications in internal operations.

Previously, at the 2024 Vietnam Outstanding Banking Awards (VOBA) organized by the International Data Group in Vietnam (IDG Vietnam), TPBank completely convinced the professional council to become the "Outstanding Digital Bank" in 2024. Understanding customer needs is the foundation for TPBank to successfully develop leading and different digital financial products and services in the market.

At this year's Sao Khue Awards Ceremony alone, TPBank was the only bank to win three digitalization-related awards. These included the award in the "Digital Banking" category; the award in the "Innovation" category for the online bid guarantee service on the TPBank Biz platform and the award in the "Digital Access Promotion Solution" category for the Bio Center data warehouse. Along with Backbase, TPBank also won the Best Cross-Channel Digital Experience Solution Award at the Digital CX Awards 2024 organized by The Digital Banker magazine.

A series of prestigious awards and titles are not only a recognition of TPBank's efforts in applying technology and accelerating digitalization from the root, but also a strong affirmation of its excellence in providing effective digital financial products. TPBank continues to lead and shape many new developments and directions in the banking and finance industry, strongly promoting the transformation of the digital economy in Vietnam.

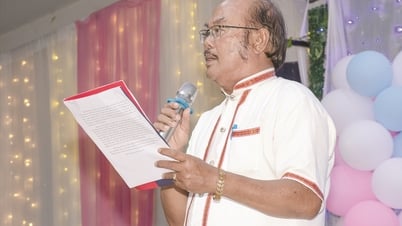

TPBank General Director, Mr. Nguyen Hung, shared: “ Taking customers as the center, constantly innovating and creating in applying information technology to provide superior banking services on a diverse and connected digital ecosystem is the guiding principle in TPBank's digitalization strategy. The bank wishes to accompany and bring customers a personalized, practical and optimal digital financial experience”.

Pioneering technology, leading experience

In the market, TPBank has made a strong impression with many outstanding digital financial products. In particular, LiveBank 24/7 is an automated banking system, integrating modern technology, meeting almost 100% of customers' financial service needs, not only allowing basic transactions but also providing complex services.

TPBank is also a pioneer in breaking the concern that modern digital banking products are often only suitable for young people or people who are tech-savvy when implementing a campaign to bring customers closer to the habit of transacting on digital channels, especially older customers. When arriving at the transaction counter, customers will be introduced by staff at the branch/transaction office and guided on how to perform their own needs at LiveBank 24/7 without having to wait at the counter. By transacting with LiveBank 24/7, customers not only have more options for transaction points closer to home with coverage of nearly 500 transaction points nationwide, but can also proactively transact at any time because LiveBank 24/7 is always open.

In the market, the TPBank App mobile application stands out with smart and creative features such as Opening Nickname Account, Facepay (faceless payment), VoicePay (voice money transfer), MeZone (change TPBank app interface according to preferences) or ChatPay (money transfer like chat), bringing a highly personalized and optimal experience to users.

In addition, the application dedicated to corporate customers - TPBank Biz is also constantly improved by the bank, providing the best solutions for businesses with a 24/7 virtual assistant, helping to confirm payments and make transactions quickly. The BizConnex digital ecosystem with more than 30 partners provides full utilities for customers, from top-up, bill payment to e-wallet services.

In particular, with Bio Center - a biometric authentication system and citizen database "made-in-Vietnam", TPBank supports fast and accurate eKYC, helping customers only need to register biometrics once and use it on all the bank's channels. Pioneering in applying AI and building a biometric database also helps TPBank detect risks early and respond effectively to technological fraud. These efforts not only contribute to the construction of a biometric system in the banking and finance industry but also support the development of a sustainable digital economy.

In the Open-API trend, TPBank has been one step ahead of the industry. Since 2017, TPBank has developed on its digital ecosystem, ready to connect with partners. Since the first API went into service in 2019, hundreds of partners have been connected to nearly 2,000 payment service providers via Open API, TPBank leads the market in terms of the number of connections and service capacity. TPBank's API transactions up to the first quarter of 2024 compared to 2022 increased by over 300%.

In the context of strong digital transformation today, with a clear digitalization strategy, a commitment to dedicated service and tireless efforts to bring pioneering technology solutions, TPBank continues to firmly hold the position of a leading bank in the digital era.

Source: https://www.congluan.vn/loat-cong-nghe-di-dau-bao-chung-cho-vi-the-ngan-hang-so-hang-dau-cua-tpbank-post316076.html

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

Comment (0)