| USD weakens, coffee export prices recover Robusta coffee prices hit new peak as USD falls sharply |

Supply shortage concerns were the main factor supporting Robusta prices to surge last week. Specifically, the risk of heat waves appearing in Vietnam's key coffee growing areas has raised concerns about the prospect of a less positive new crop supply in the world's largest Robusta exporter.

Furthermore, Robusta inventories on the ICE-EU exchange continue to hover at historically low levels, keeping market sentiment in constant fear of supply shortages. As of March 7, Robusta inventories on the exchange reached 24,030 tonnes, down 160 tonnes from the previous week.

|

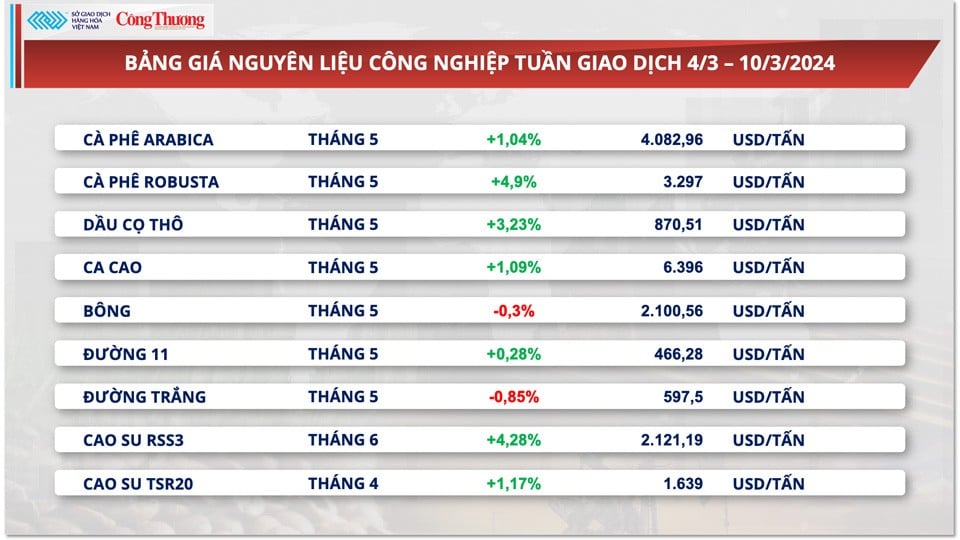

| Robusta stockpiles at the exchange hit 24,030 tonnes, Arabica prices rose 1.04% and had hit a one-month high |

Following Robusta, Arabica prices rose 1.04% and hit a one-month high. The weakness of the US dollar continued to support prices despite the improvement in supply. Specifically, the Dollar Index fell 1.11% last week, corresponding to the money flow shifting to other assets such as coffee.

Meanwhile, certified Arabica stocks on ICE-US increased by 64,205 bags compared to the previous week, bringing the total certified bags to 410,877 bags.

At the same time, large export figures from the main supplying country also contributed to stabilizing the supply in the market. According to the Brazilian Government, the country's coffee exports in February increased by 88.33% compared to the previous month, reaching 220,000 tons.

The price of green coffee beans in the Central Highlands market increased by 5,000 - 5,200 VND/kg. Coffee prices have increased continuously since the beginning of the year with an increase of about 50% and compared to the same period last year, coffee prices have doubled.

The news that the Chairman of the US Federal Reserve (Fed) announced that he would delay cutting interest rates until the second half of the year, causing the DXY index to fall sharply, has supported the prices of many commodities to set new highs.

However, the market remains cautious as Brazil prepares to enter its new crop harvest this year, promising to increase hedging on futures exchanges and the Real is currently at a favorable level for farmers to sell their coffee for export.

According to experts, the world's demand for Vietnam's Robusta coffee is very large, which is the reason why domestic coffee prices have increased compared to many years in history. Coffee farmers earn higher profits.

Along with that, another reason for the increase in coffee prices is that some green coffee products are roasted and ground to make them soluble in water, so domestic demand increases.

Last week, the US dollar fell in value after the Fed chairman's announcement to delay interest rate cuts until the second half of this year, causing speculative capital to flow massively into derivatives markets.

|

| Vietnam's coffee output in 2023/2024 crop year may decrease by 10% to 1.656 million tons |

Funds and speculators returned to coffee futures markets to increase buying, despite unsupportive fundamentals with reports of increased exports from many producing regions around the world.

Commenting on the market this week, expert Nguyen Quang Binh said that the market of the two coffee floors is tending to decrease in terms of current business position and increasing inventory. According to the expert, if the upward momentum like last week can be maintained, there must be a very strong driving force from monetary policy meetings, weather events or natural disasters...

On the contrary, coffee prices this week tend to decrease slightly. However, according to other comments, even though coffee prices on both exchanges go down, domestic coffee prices can still increase because supply is running out.

Tight coffee inventories remain supportive of coffee prices. Improved rain prospects in Brazil have eased drought concerns and prompted funds and speculators to liquidate net positions on both coffee futures exchanges. Moderate rains are expected in Brazil’s coffee-growing regions over the next five days, forecaster Maxar Technologies said.

Coffee prices fell further after the Brazilian real fell to a one-week low, encouraging export sales from Brazilian coffee producers.

On March 7, the May Robusta coffee contract hit a high and the nearest Robusta coffee futures contract hit a record high due to tight Robusta coffee supplies from Vietnam - the world's largest producer of Robusta coffee beans.

Vietnam's Ministry of Agriculture forecast on November 3, 2023 that Vietnam's coffee output in the 2023/2024 crop year could fall by 10% to 1.656 million tons, the smallest crop in four years, due to drought. Meanwhile, the Vietnam Coffee Association forecast on December 5, 2023 that Vietnam's coffee output in the 2023/2024 crop year will fall to 1.6 - 1.7 million tons, down from 1.78 million tons a year earlier.

Source

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)