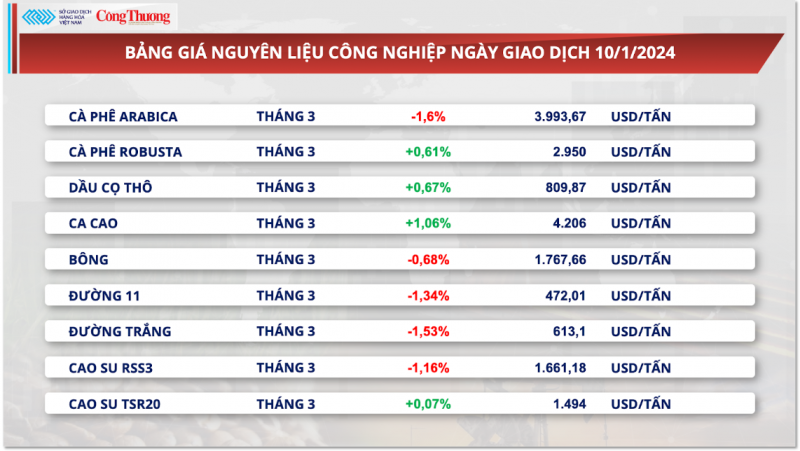

| Not yet "cooled down", coffee export prices have increased for the 5th consecutive session. Due to scarce supply, coffee export prices have mixed developments. |

According to the Vietnam Commodity Exchange (MXV), at the end of the trading session on January 10, Arabica prices fell 1.6%, while Robusta prices continued to increase for the fifth consecutive session. A more positive supply outlook in Brazil has put pressure on prices, along with concerns that Asian farmers are limiting sales.

At the end of yesterday's session, the inventory of qualified Arabica on the ICE-US increased by 3,734 60kg bags, 7.5 times higher than the previous session's decrease. In addition, this unit still has 37,379 bags of Arabica waiting for certification, which is the remaining inventory for further increase in the coming time.

|

| Arabica prices fell 1.6%, while Robusta prices extended their gains to the fifth consecutive session. |

The weather in Brazil is relatively stable with abundant rainfall in the main coffee growing region during the period when coffee trees are focusing on fruit size growth. The favorable weather will dispel concerns about production being affected by heat, thereby maintaining positive expectations for coffee supply in the 2024/25 crop year of the world's largest coffee exporter.

Meanwhile, concerns that Vietnamese farmers in particular and Asian countries in general will limit sales are a common sentiment in the Robusta market.

|

| Vietnam's coffee exports in 2023 will reach about 1.61 million tons, worth 4.18 billion USD. |

In the domestic market, this morning (January 11), the price of green coffee beans in the Central Highlands and the Southern provinces increased by 300 VND/kg. Accordingly, domestic coffee is currently purchased at around 70,000 - 70,800 VND/kg.

According to experts, if the current tension continues, global shipping costs could increase to the same level as during the Covid-19 pandemic, up to more than 20,000 USD.

Supply concerns continued to support the London bull market, as farmers in top Robusta producer Vietnam remained on the sidelines. Vietnam’s General Statistics Office estimated coffee exports in December 2023 at only about 190,000 tonnes, down 3.56% year-on-year. Indonesian coffee remained at a sky-high premium, but was also difficult to buy due to dwindling supplies.

Meanwhile, signs of improved Arabica supply from Brazil have pushed the price of this coffee commodity back down.

According to estimates from the Ministry of Industry and Trade , Vietnam's coffee exports in 2023 will reach about 1.61 million tons, worth 4.18 billion USD, down 9.6% in volume, but up 3.1% in value compared to 2022. Indonesian coffee still maintains a sky-high premium, but it is still difficult to buy goods due to the lack of abundant supply.

Meanwhile, weather forecasts for Brazil’s Conilon Robusta coffee growing states remain dry, and the largest coffee cooperative in Espirito Santo state said the state’s crop could fall by as much as 30 percent this year.

According to the International Coffee Organization (ICO) report, the global coffee price (I-CIP) averaged 175.7 US cents/pound in December 2023 (about 163.9 - 186.04 US cents/pound), up 8.8% over the previous month and up 11.8% over the same period in 2022. This is also the highest price achieved in the past 9 months.

Rising tensions in the Red Sea have forced some shipping lines to reroute their coffee shipments, the ICO said.

As a result, for Southeast Asian and East African coffees en route to Europe, unforeseen impacts include increased shipping costs as some shipping companies have introduced surcharges to compensate for extended transit times.

The ICO forecasts global coffee production in 2023-2024 to increase by 5.8% compared to the previous season to 178 million bags, of which Arabica output increases by 8.8% to 102.2 million bags and Robusta increases by 2.1% to 75.8 million bags. Meanwhile, consumption is expected to increase by 2.2% to 177 million bags, the world coffee market will have a surplus of 1 million bags in 2023-2024.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)