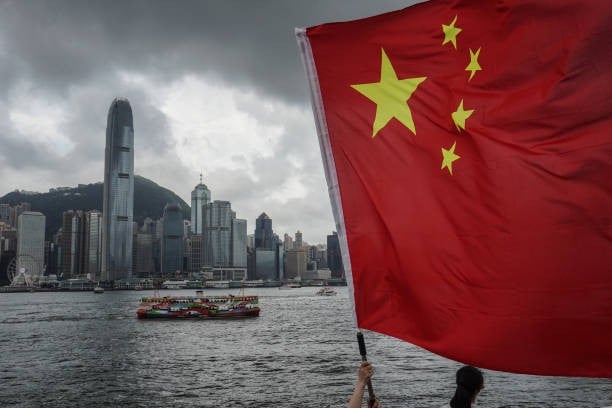

Oil prices today, November 16, oil prices fell more than 2% as investors worried about weak demand from China and the possibility that the US Federal Reserve (Fed) would slow down the pace of interest rate cuts.

|

| Oil prices today, November 16, oil prices fell more than 2% as investors worried about weak demand from China. (Source: Reuters) |

Brent crude fell $1.52, or 2.09 percent, to $71.04 a barrel. WTI crude fell $1.68, or 2.45 percent, to $67.02 a barrel.

For the week, Brent oil prices fell about 4%, WTI oil prices fell about 5%.

China's refineries processed 4.6% less crude oil in October than a year earlier due to plant closures and reduced operating rates at small refineries, according to data from the National Bureau of Statistics.

Also in October, China's factory output growth slowed and demand in the real estate sector was sluggish, adding to investors' concerns about the economic health of the world's largest crude importer.

The “headwinds” from China continue, and any stimulus they introduce could be affected by the Trump administration’s new round of tariffs, said John Kilduff, a partner at Again Capital in New York.

US President-elect Donald Trump has pledged to end China’s most-favored-nation trade status and impose tariffs of up to 60% on Chinese imports, a much higher rate than those imposed during Trump’s first term.

In light of the above tariff hike, economists at Goldman Sachs Research have slightly lowered their 2025 growth forecast for China.

Jan Hatzius, chief economist at Goldman Sachs Research, said they could further downgrade their growth forecasts if the trade war continues to escalate.

Oil prices fell as major forecasters pointed to slowing global oil demand.

On November 15, speaking at the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP29) taking place in Baku, Azerbaijan, Executive Director of the International Energy Agency (IEA) Fatih Birol emphasized that “global oil demand is weakening,” mainly due to China's slowing economic growth and the popularity of electric vehicles worldwide.

The IEA forecasts that in 2025, supply will exceed demand by more than 1 million barrels per day even if the Organization of the Petroleum Exporting Countries and its allies (OPEC+) continues to cut production.

Domestic retail prices of gasoline on November 16 are as follows:

E5 RON 92 gasoline is not more than 19,452 VND/liter. RON 95-III gasoline is not more than VND 20,607/liter. Diesel oil not more than 18,573 VND/liter. Kerosene not more than 18,988 VND/liter. Fuel oil not exceeding 16,009 VND/kg. |

The above domestic retail prices of gasoline and oil were adjusted by the Ministry of Finance - Industry and Trade in the price management session on the afternoon of November 14. Gasoline and oil prices decreased simultaneously with the price of E5 RON 92 gasoline decreasing by 292 VND/liter, RON 95-III gasoline decreasing by 247 VND/liter, diesel oil decreasing by 344 VND/liter, kerosene decreasing by 306 VND/liter, and fuel oil decreasing by 385 VND/kg.

In this operating period, the joint ministries did not set aside or use the Petroleum Price Stabilization Fund for E5 RON 92 gasoline, RON 95 gasoline, diesel oil, kerosene, and fuel oil.

Source: https://baoquocte.vn/gia-xang-dau-hom-nay-1611-lo-ngai-cau-yeu-tu-trung-quoc-gia-dau-lao-doc-hon-2-293934.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)