Subsidiary companies follow their parents on the stock exchange: A new wave in the stock market

After many years of the stock market only welcoming a small number of "newcomers", the wave of listing subsidiaries/member companies by many large listed enterprises is expected to bring more options to investors.

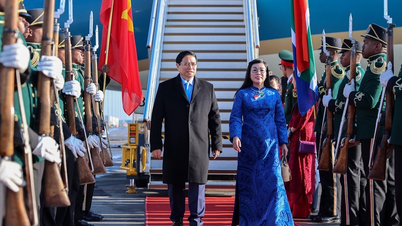

|

| Vingroup Corporation is carrying out procedures to list Vinpearl on the stock exchange. |

Newbie on the stock exchange: New but not strange

It is expected that June 13 will be the last trading session of 110 million shares of Moc Chau Milk Joint Stock Company (MCM) on the UPCoM floor. The 65-year-old long-standing milk brand has officially received approval to list its shares from the Ho Chi Minh City Stock Exchange after 8 months from the date of application submission and more than a year from the time of approval by shareholders.

“The plan to transfer the listing will begin after being approved by the General Meeting of Shareholders. The company will try its best to complete the transfer procedure within one year,” Ms. Mai Kieu Lien - General Director and Member of the Board of Directors of Vinamilk , who is also the Chairwoman of the Board of Directors of Moc Chau Milk, strongly affirmed at last year's Annual General Meeting.

With the appearance of Moc Chau Milk, the HoSE will have a second dairy enterprise, besides Vinamilk - which is also the largest shareholder of this enterprise. In early 2020, Vinamilk officially held the largest number of shares in Moc Chau Milk after the merger of GTNFoods into Vietnam Livestock Corporation - Vilico. At the end of 2020, Moc Chau Milk registered to trade on the UPCoM floor. The information about switching to trading on the listed floor is not only a boost to help MCM shares set a new price record. More notably, stock liquidity recorded a leap from tens of thousands of units per session to hundreds of thousands of units in recent sessions.

Vinamilk is not the only company preparing to list its member companies on the stock exchange. Gelex Electricity Joint Stock Company - a subsidiary 80% owned by Gelex Group (GEX) has officially submitted its application to list GEE shares on HoSE at the end of April 2024.

The plan to list Masan Consumer (MCH) shares on HoSE was also presented and approved by 100% of shareholders at the recent Annual General Meeting. Nearly 93.6% of Masan Consumer's charter capital is owned by MasanConsumerHoldings Company Limited - a subsidiary of Masan Group.

“In 2024, Masan decided to start the journey of IPO Masan Consumer (MCH)”, Mr. Nguyen Dang Quang - Chairman of the Board of Directors of MaSan Group Corporation (MSN) stated at the meeting, emphasizing one of the important tasks of this group this year. The effect of changing the floor and the new expectations of the board of directors quickly reflected in MCH stock transactions right after the Congress, both in price and trading volume per session.

Not listed on HoSE, but expected in the second quarter of this year, BCG Energy - a subsidiary in the renewable energy sector of Bamboo Capital Joint Stock Company will trade on UPCoM. On May 20, the State Securities Commission issued an official dispatch approving the public registration dossier of this enterprise - one of the steps to implement the roadmap for listing of this member unit.

Although not yet “documented” in documents, the IPO plan of Gia Lai Livestock subsidiary has been announced by Mr. Doan Nguyen Duc - Chairman of the Board of Directors of Hoang Anh Gia Lai. According to Mr. Duc, Gia Lai Livestock compared to currently listed companies such as Dabaco, BAF… is not inferior in value and assets.

Vinpearl, the “giant” in resort tourism and entertainment, has not yet registered to trade shares on the UPCoM floor, promising to be a prominent name on the Vietnamese stock exchange. At the 2024 annual general meeting of shareholders, Vingroup’s leaders said they are carrying out procedures to list Vinpearl on the stock exchange. The successful listing is expected to be at the end of this year.

Seize the opportunity from market upgrade

Becoming a public company with a charter capital of VND 7,500 billion and the number of shares held by retail investors accounting for 49.3% of the charter capital, information transparency is what BCG Energy aims for. According to Mr. Nguyen Giang Nam, Deputy General Director in charge of Project Finance BCG Energy, corporate governance is one of the top criteria at the company. The determination to list shares on the stock exchange is also aimed at implementing this issue. With stricter requirements on information transparency in financial reports, management reports, etc., investors have a more accurate view of the value of the enterprise.

As for Masan, the decision to transfer the floor for a member unit is considered the "family heirloom diamond" of the Group, as Chairman of the Board of Directors Nguyen Dang Quang calls it, directly aiming at the goal of raising capital. Masan Consumer has had many rounds of issuing ESOP shares to employees but has never raised capital through issuing shares to existing shareholders.

Mr. Danny Le, General Director of Masan Group Corporation, said that the average growth rate of 15% per year over the past 6-7 years of Masan Consumer is the basis when considering the implementation of the above potential IPO plan. In addition to helping raise capital, this CEO expects the offering of Masan Consumer shares will help increase the valuation of shares that are trading below their intrinsic value on the UPCoM exchange.

In fact, in just the past month, MCH stock price has increased by more than 30% since the Congress. The capitalization of this manufacturing enterprise has also increased to over 5 billion USD. At the same time, liquidity in each session has reached several hundred thousand units of stock.

In addition to the internal story of the enterprise, the stock market has also witnessed excitement in both the primary and secondary markets recently. In addition to the excitement of the market reflected in the total trading value of each session, the successful IPO of DNSE Securities, which helped raise VND900 billion at the beginning of the year, is also a good signal for the market.

Furthermore, as “commodities” on the stock market, the emergence of “newcomers”, especially large-scale enterprises, is the core for sustainable market development. At the first Conference on Deploying the Task of Developing the Stock Market in 2024 chaired by the Head of the Government, in the group of tasks/solutions for issuers, the Prime Minister encouraged all types of enterprises to conduct IPOs associated with listing and registering for trading on the stock market.

Recently, the State Securities Commission has also been rebuilding coordination regulations to help shorten the time for the stages after enterprises complete IPO, listing/registering for trading; and to bring them to a single reporting point to simplify the information disclosure process of enterprises.

This is also one of the efforts of the management agencies towards the goal of upgrading the market. Because the expected capital flow into the stock market from the upgrade story can only be taken advantage of if investors find opportunities to "put money". It cannot be a story of one or two days if we want investors to have a correct view of the value of the enterprise, or further, to promote the role of the stock market as a medium and long-term capital channel.

Source: https://baodautu.vn/cong-ty-con-theo-me-len-san-lan-song-moi-tren-thi-truong-co-phieu-d216337.html

![[Photo] General Secretary To Lam receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763723946294_ndo_br_1-8401-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763715853195_ndo_br_bnd-6440-jpg.webp&w=3840&q=75)

![[Photo] Visit Hung Yen to admire the "wooden masterpiece" pagoda in the heart of the Northern Delta](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763716446000_a1-bnd-8471-1769-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong receives Speaker of the Korean National Assembly Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763720046458_ndo_br_1-jpg.webp&w=3840&q=75)

Comment (0)