List of banks with leading deposit interest rates

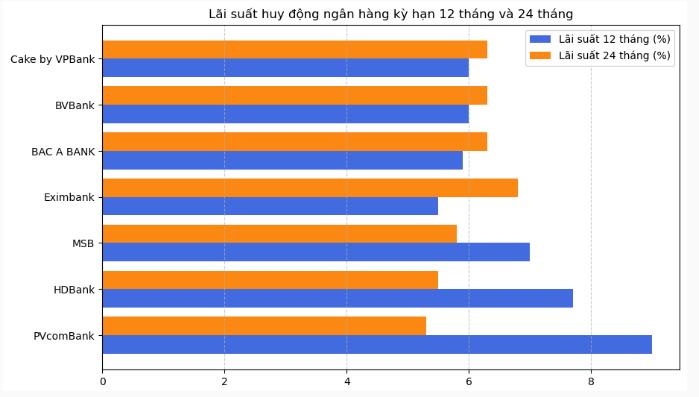

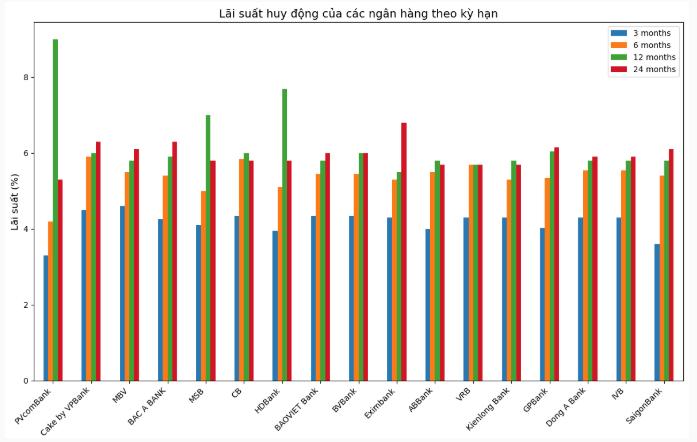

Right after Tet, a series of banks have adjusted interest rates with a strong increase, especially in medium and long terms. In particular, PVcomBank is currently leading the market with an interest rate of 9%/year for a 12-month term. However, this interest rate is not for all customers but only applies to deposits of 2 billion VND or more, deposited at the counter and may be accompanied by certain preferential conditions.

Not only PVcomBank, many other banks are also offering attractive interest rates to attract customers to deposit money after Tet. Specifically, HDBank is currently listing an interest rate of 7.7%/year for a 12-month term, while MSB is applying a rate of 7%/year. For longer terms, Eximbank is currently leading with an interest rate of 6.8%/year for a 24-month term, followed by BAC A BANK, BVBank, Cake by VPBank all applying a rate of 6.3%/year.

While private banks and small-scale banks are increasing deposit interest rates to attract deposits from customers, state-owned commercial banks such as Vietcombank, BIDV, Agribank, and VietinBank still maintain lower interest rates thanks to the advantage of abundant liquidity and stable capital sources.

A notable point in this adjustment is the participation of some foreign banks in the interest rate race. Woori Bank, one of the foreign banks actively operating in Vietnam, has even applied a special interest rate of up to 11%/year for special accumulated savings, although it comes with conditions such as a maximum deposit amount of VND 2 million/month and requires customers to use digital banking services. Meanwhile, banks such as Standard Chartered, HSBC, and Shinhan Bank still maintain more stable interest rates, focusing on corporate customers instead of competing directly with domestic banks.

According to some economic and financial experts, this difference not only reflects the trend of increasing interest rates after Tet but also shows the difference in capital mobilization strategies between banking groups. The reason is that large banks have a solid financial foundation and are under less pressure to raise interest rates to retain customers, while private and small-scale banks are forced to raise interest rates to compete and expand market share. This contrast is creating a clearly differentiated interest rate market, providing opportunities for depositors to seek higher profits, but at the same time requiring them to carefully consider between attractive interest rates and safety factors when choosing a bank.

In addition, the sharp increase in deposit interest rates after Tet is not only the result of competition between banks but also stems from the increasing demand for capital mobilization to meet the borrowing needs of businesses. Because after the long holiday, many businesses need capital to expand production and business, boost imports and reinvestment, increasing the demand for loans at commercial banks. This creates pressure for banks to increase deposit interest rates to ensure capital sources meet credit needs.

In addition, the sharp increase in the USD exchange rate is also a factor affecting interest rates. The USD's continued increase has forced banks to adjust foreign exchange rates, while increasing the cost of borrowing in USD. Some banks have also been forced to raise VND deposit interest rates to retain domestic customers and prevent cash flow from shifting to other investment channels such as foreign currency or gold.

According to the forecast of Associate Professor Dr. Dinh Trong Thinh (Academy of Finance), deposit interest rates may continue to increase in the short term before gradually stabilizing in the second half of the year. Expert Thinh emphasized that customers should consider depositing money in the medium and long term to take advantage of the highest interest rates before the market adjusts.

Lending rates also increased

Not only are deposit interest rates increasing, lending interest rates are also showing signs of upward adjustment, creating considerable pressure on both businesses and individuals in need of loans. Currently, the average lending interest rate has increased by 0.3 - 0.7% compared to before Tet, reflecting the trend of tightening credit and increasing capital costs.

The main reason for the increase in lending interest rates is the high increase in deposit interest rates, forcing banks to adjust their output interest rates to maintain their profit margins. In addition, the continued strong fluctuations in the USD exchange rate also affect the cost of borrowing in foreign currencies, forcing many banks to adjust lending interest rates to reduce liquidity risks. At the same time, the State Bank's credit control policy to ensure macroeconomic stability also has an indirect impact, making it difficult for lending interest rates to remain as low as last year.

Some banks have started to increase lending interest rates right after Tet, including Techcombank, which has adjusted the increase by 0.2%/year for medium-term loans; meanwhile, MB Bank and VPBank have increased consumer loan interest rates by 0.5% - 0.7%, currently fluctuating from 8% - 10%/year. Large banks such as BIDV and VietinBank have maintained relatively stable interest rates but have made small adjustments for individual customers borrowing to buy houses.

According to economic and financial expert Dr. Nguyen Minh Phong, the trend of increasing lending interest rates is inevitable in the context of many economic fluctuations. However, the expert also emphasized that the State Bank will have regulatory measures to avoid too much impact on production and business activities. Dr. Nguyen Minh Phong recommends that businesses and individuals with capital needs should be cautious in their financial plans to avoid being affected by interest rate fluctuations.

Accordingly, borrowers need to carefully consider preferential loan packages from banks, especially those with fixed interest rates for the first 6-12 months to reduce short-term financial pressure. In addition, comparing interest rates between banks before deciding to borrow is also necessary, because each bank has different policies and conditions.

It is forecasted that in the coming time, deposit interest rates may continue to increase slightly before stabilizing, while lending interest rates may be under pressure but will be controlled by the monetary policy of the State Bank. Credit policy adjustments may take place in the middle of the year to stabilize the financial market and support business development.

Source: https://doanhnghiepvn.vn/kinh-te/lai-suat-ngan-hang-tang-manh-sau-tet-cao-nhat-len-den-9/20250205092715241

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)