The highest listed interest rate of banks is currently 6.15%/year at NCB Bank with a term of 18-60 months.

Some other banks are listing interest rates of 6% or higher. Dong A Bank listed interest rates of 6%/year for 13-month term, and 6.1%/year for 18-36-month term. HDBank listed up to 6%, 6.1%/year for 15- and 18-month term deposits. Ocean Bank listed interest rates of up to 6%/year for 18-36-month term deposits.

The deposit interest rate of 6.1%/year is also listed bySHB Bank for online deposits with terms of 36-60 months. This is also the savings interest rate listed by Saigonbank for terms of 36 months. Saigonbank also listed an interest rate of 6%/year for deposits with terms of 13-24 months.

BVBank continues to maintain 6%/year for 18-24 month term deposits. This interest rate is also listed by BaoViet Bank for 18-36 month term deposits.

However, the increase in deposit interest rates has generally slowed down since the beginning of September.

In October, only 3 banks have increased their deposit interest rates since the beginning of the month, namely LPBank, Bac A Bank and Eximbank. One bank has reduced its interest rate, which is Techcombank.

In addition, some banks, although not publicly posting high interest rates, still offer depositors interest rates higher than listed.

This group of banks can be mentioned as: Bac A Bank is inviting deposits, the highest interest rate is up to 6.05%/year. While the highest mobilization interest rate according to the official listing of Bac A Bank is only 5.85%/year, applied to deposits with terms from 18-36 months.

Similarly, GPBank offers deposit interest rates of up to 6.25%/year, the highest at this time. Meanwhile, the highest online mobilization interest rate is only 5.85%/year, applied to deposits with terms of 13-36 months.

This situation also occurred at Global Petroleum Commercial Joint Stock Bank (GPBank) and Vietnam Public Joint Stock Commercial Bank (PVCombank) in September.

GPBank's current highest listed interest rate is 5.75%/year, but the sign says it's up to 6.25%/year.

PGBank offers deposit interest rates of up to 6%/year, while the highest announced rate is 5.9%/year, applied to 24-36 month term deposits. The difference between actual mobilization interest rates and PGBank's announced interest rates is not much.

At PVCombank, the bank offers depositors an interest rate of 6% per year. The highest interest rate announced is only 5.8% per year, applied to deposits with terms of 18-36 months. A PVCombank employee said that depending on the amount of money and the priority customer class, each branch has its own preferential policy, so the actual interest rate can be up to 6% per year.

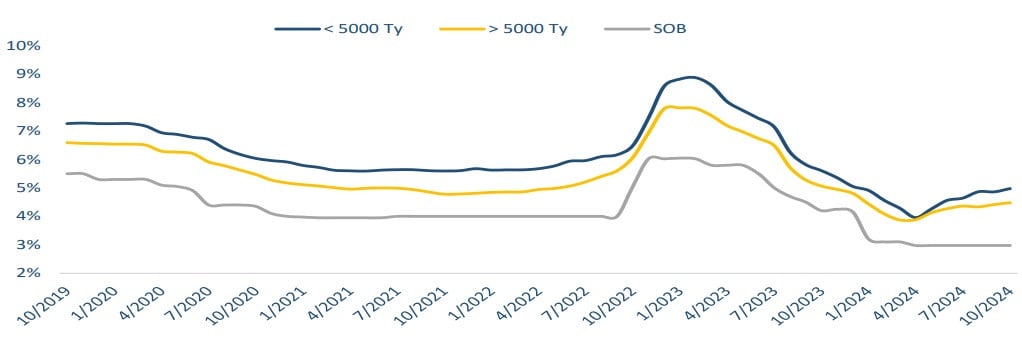

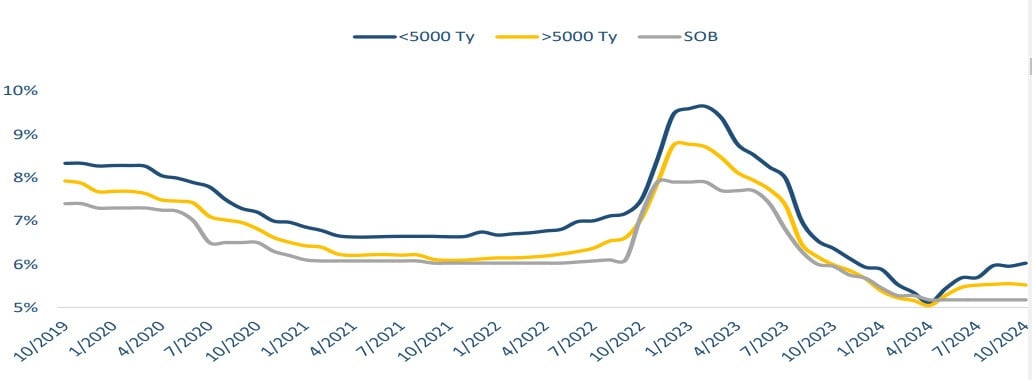

According to statistics, the average 6-month deposit interest rate in October reached 4.45%/year, an increase of 0.07%/year compared to September 2024. The average 12-month deposit interest rate in October reached 5.14%, a slight increase of 0.01%/year compared to September.

The increase in deposit interest rates mainly comes from a number of small banks. Meanwhile, the group of state-owned commercial banks continues to maintain deposit interest rates at a stable level.

Thus, the rate of increase in deposit interest rates in recent months has slowed down significantly compared to the second quarter. Compared to the end of 2023, deposit interest rates are still down 12 basis points.

On average, since the beginning of the year, the mobilization interest rate is at 4.94%/year, still much lower than previous years, including the year of the Covid-19 pandemic (5.85%).

According to Bao Viet Securities (BVSC), low deposit interest rates continue to create conditions for commercial banks to maintain low lending interest rates. As of September 17, lending interest rates had decreased by 86 basis points compared to the end of 2023. This factor will continue to promote credit growth in the coming time.

According to the General Statistics Office, as of September 27, the economy's credit growth reached 8.53% (same period last year reached 6.24%). Previously, as of August 26, the State Bank said credit growth reached 6.63%. Thus, within 1 month, credit increased by 1.9%, which is a relatively positive growth rate. By the end of 2024, credit growth could reach 14-15%.

| HIGHEST DEPOSITS INTEREST RATES AT BANKS ON OCTOBER 9, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2 | 2.5 | 3.3 | 3.3 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.9 | 4.1 | 5.2 | 5.2 | 5.6 | 5.9 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.7 | 3.7 | 4.6 | 4.6 | 5.4 | 5.4 |

| NAM A BANK | 3.8 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.8 | 4.1 | 5.45 | 5.65 | 5.8 | 6.15 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.75 | 3.95 | 4.5 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.5 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-9-10-2024-da-tang-chung-lai-gui-tien-dau-lai-nhat-2330154.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

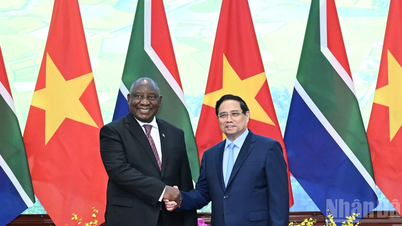

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

Comment (0)