Bank interest rates today October 31, 2024, ending October with the number of banks adjusting deposit interest rates to the lowest in over a year.

According to statistics, in October, only a few banks increased deposit interest rates including: ABBank, NCB, Agribank , Techcombank, MSB, LPBank, Eximbank, Bac A Bank.

Of which, Bac A Bank is the only bank that increased interest rates twice in one month.

Some banks have reduced deposit interest rates, some have adjusted their interest rates up but also reduced them at the same time, including: Agribank, Techcombank, NCB, VPBank, CB and LPBank .

Although the official deposit interest rates listed by banks are quieter than ever, behind that is the "underground" excitement of the interest rate market as banks apply many different forms to attract deposits.

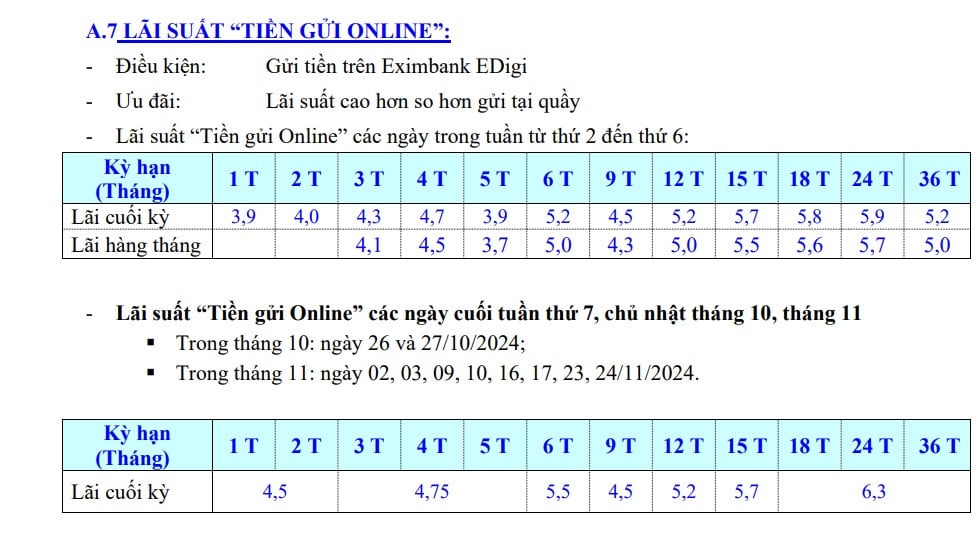

In particular, Eximbank announced a bank interest rate schedule specifically for the weekends of October and November. This interest rate schedule exists in parallel with the interest rate schedule for deposits at the counter and online.

Notably, online interest rates on weekends (Saturday and Sunday) are higher than usual, with the highest difference reaching 1.1%/year.

Specifically, the online mobilization interest rate on weekends in October, 1-2 month term is 4.5%/year (0.5-0.6%/year higher than the normal online mobilization interest rate), 3-5 month term is up to 4.75%/year (0.05-0.85%/year higher).

Eximbank is the only bank that has listed the maximum interest rate for deposits with terms of less than 6 months. According to Decision 1124 of the State Bank, the maximum interest rate applied to deposits with terms from 1 month to less than 6 months is 4.75%/year.

Eximbank listed the interest rate for 6-month term at 5.5%/year (0.3%/year higher than the regular online deposit interest rate); the 9-month - 12-month - 15-month terms are 4.5% - 5.5% - 5.7%/year respectively (equal to the regular online deposit interest rate).

Notably, the listed 18-36 month term is up to 6.3%/year (0.4-1.1%/year higher than the normal online mobilization interest rate). This is also the highest mobilization interest rate currently.

In addition, some banks also call and send emails inviting customers to deposit money with interest rates higher than announced.

Asia Commercial Joint Stock Bank (ACB) recently sent an email to customers with preferential interest rates for 3-month deposits of up to 4.2%/year.

Also in October, SeABank staff called customers to invite them to make online savings deposits with interest rates of 5.25% and 6.15% per year for 6-month and 12-month terms, respectively.

This inviting interest rate is much higher than the interest rate officially listed by the bank, even higher than the 5.95%/year interest rate advertised by SeABank with signs placed in front of branches/transaction offices.

In addition, some banks such as PVCombank, GPBank, PGBank,... although not officially increasing interest rates, also placed signs advertising quite high deposit interest rates in front of transaction points. This interest rate is not officially announced in the interest rate tables posted by the bank.

According to Circular 48 of the State Bank regulating the application of interest rates to deposits in Vietnamese Dong, effective from November 20, the maximum interest rate for deposits in Vietnamese Dong, including promotional expenses in all forms, applies to the end-of-term interest payment method and other interest payment methods converted according to the end-of-term interest payment method.

Credit institutions must publicly post interest rates on deposits in Vietnamese Dong and when receiving deposits, must not conduct promotions in any form (in cash, interest rates and other forms).

| INTEREST RATES FOR ONLINE DEPOSITS AT BANKS ON OCTOBER 31, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.2 | 2.7 | 3.2 | 3.2 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.9 | 5.3 | 5.5 | 5.9 | 6.2 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.95 | 4.25 | 5.4 | 5.5 | 5.8 | 6.15 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.5 | 5.45 | 5.65 | 5.8 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.6 | 3.8 | 5 | 5 | 5.4 | 5.7 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.9 | 4.2 | 5.55 | 5.65 | 5.8 | 5.8 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.55 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 4.8 | 4.8 | 5.3 | 5.3 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-31-10-2024-lo-dien-5-ngan-hang-lai-suat-hon-6-nam-2337312.html

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

Comment (0)