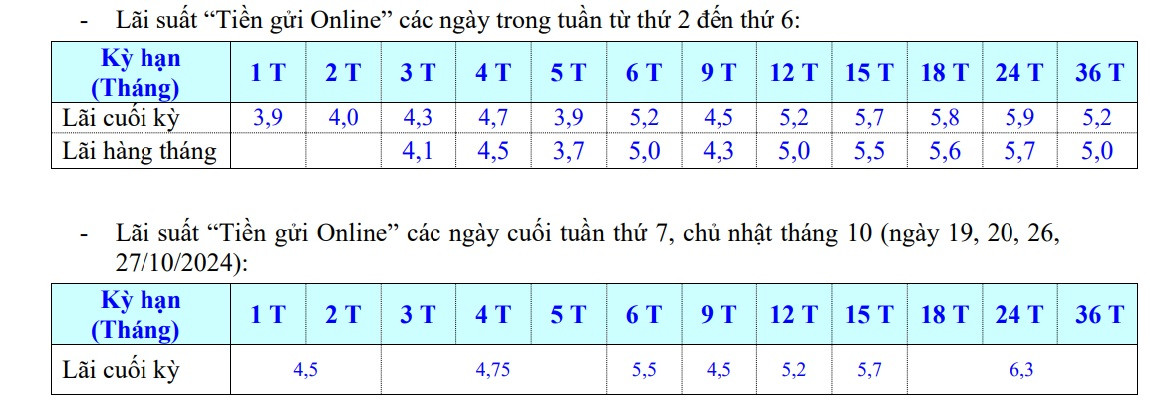

Bank interest rates today, October 22, 2024, increased to the "ceiling peak" when the bank announced the interest rate for deposits with terms under 6 months reaching 4.75%/year, and for terms of 18-36 months up to 6.3%/year. However, this interest rate only applies to online deposits on weekends.

Vietnam Export Import Commercial Joint Stock Bank (Eximbank) is the first bank to announce a special interest rate schedule for weekends. This interest rate schedule exists in parallel with the interest rate schedule for deposits at the counter and online.

Notably, online interest rates on weekends (Saturday and Sunday) are higher than usual, with the highest difference reaching 1.1%/year.

Specifically, the online mobilization interest rate on weekends in October, 1-2 month term is 4.5%/year (0.5-0.6%/year higher than the normal online mobilization interest rate), 3-5 month term is up to 4.75%/year (0.05-0.85%/year higher).

Eximbank is the only bank currently listing the maximum interest rate for deposits with terms of less than 6 months. According to Decision 1124/QD-NHNN dated June 16, 2023, the maximum interest rate applicable to deposits with terms from 1 month to less than 6 months is 4.75%/year.

Eximbank listed the interest rate for 6-month term at 5.5%/year (0.3%/year higher than the normal online deposit interest rate); the 9-month - 12-month - 15-month terms are 4.5% - 5.5% - 5.7%/year respectively (equal to the normal online deposit interest rate).

Notably, the listed 18-36 month term is up to 6.3%/year (0.4-1.1%/year higher than the normal online mobilization interest rate). This is also the highest mobilization interest rate currently.

Previously, Eximbank was one of the few banks to increase deposit interest rates at counters and online on October 7. The adjustment includes an increase of 0.1%/year for 1-2 month term interest rates, and an increase of 0.7%/year for 15-24 month term interest rates.

Eximbank said that the balance of deposits and term savings of individual customers deposited before the effective date of this notice will still enjoy the agreed interest rate and regulations on deposits and withdrawals until maturity.

According to Eximbank's regulations, which are also the general regulations of current banks, the interest rate for early withdrawal of VND applies the lowest non-term interest rate (currently 0.10%/year).

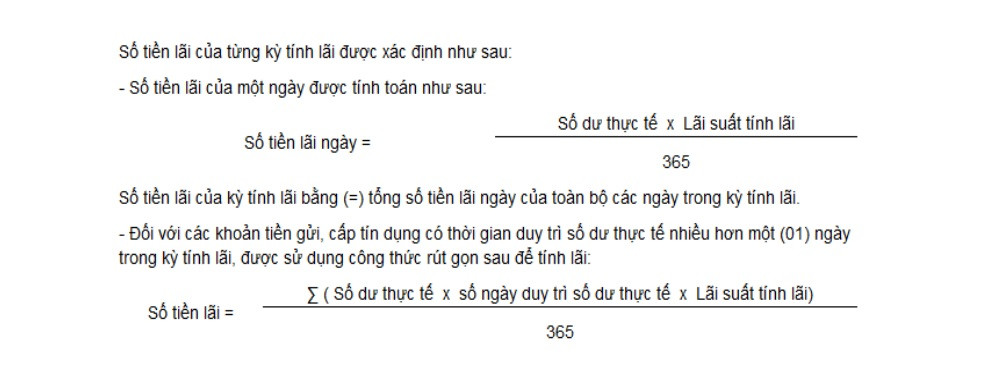

The interest calculation period is determined from the date of receiving the deposit to the end of the day immediately preceding the date of full payment of the deposit (counting the first day, excluding the last day of the interest calculation period) and the time to determine the balance for interest calculation is the end of each day within the interest calculation period.

In which, the actual balance is the balance at the end of the day for calculating interest on the deposit balance. The number of days to maintain the actual balance is the number of days in which the actual balance at the end of each day does not change. The interest rate is calculated at %/year (365 days).

Since the beginning of October, very few banks have increased their deposit interest rates, including: Agribank (1-5 month term), MSB, LPBank, Eximbank, and Bac A Bank. On the contrary, Agribank reduced 0.1%/year deposit interest rates for terms of 6-11 months and Techcombank reduced 0.1%/year interest rates for terms of 1-36 months.

| HIGHEST DEPOSITS INTEREST RATES AT BANKS ON OCTOBER 22, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.2 | 2.7 | 3.2 | 3.2 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.9 | 4.1 | 5.2 | 5.2 | 5.6 | 5.9 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.8 | 4.1 | 5.45 | 5.65 | 5.8 | 6.15 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SEABANK | 2.95 | 3.45 | 3.75 | 3.95 | 4.5 | 5.45 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.6 | 5 | 5 | 5.5 | 5.5 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-22-10-2024-lai-huy-dong-tang-dinh-noc-kich-tran-2334221.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of Steering Committee for key projects and railway projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b9534596258a40a29ebd8edcdbd666ab)

![[Photo] Spreading passion for science and technology in educational environment](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/059521b98e3847368f5ff4120460a500)

![[Photo] Readers' joy when receiving the supplement commemorating the 50th anniversary of the liberation of the South and national reunification of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/283e56713da94988bf608393c0165723)

![[Photo] Young people line up to receive the special supplement commemorating the 50th anniversary of the Liberation of the South of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/9e7e624ae81643eba5f3cdc232cd07a5)

![[Photo] Ho Chi Minh City residents stay up all night waiting to watch the parade rehearsal](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/0c555ae2078749f3825231e5b56b0a75)

Comment (0)