After many days of remaining unchanged, today's bank interest rates, October 21, 2024, unexpectedly witnessed MSB increase a series of deposit interest rates for all deposit terms, including special interest rates.

Maritime Commercial Joint Stock Bank (MSB) has just unexpectedly increased interest rates by 0.2%/year for deposit types and terms.

Accordingly, the interest rate for deposits from 1 month to 36 months at MSB has increased by 0.2%/year from today. According to the latest online interest rate schedule for depositors receiving interest at the end of the term, the bank interest rate for a term of 1-5 months has increased to 3.9%/year; the bank interest rate for a term of 6-11 months is 4.8%/year, and the bank interest rate for a term of 12-36 months is 5.6%/year.

Thus, the highest current interest rate for customers depositing money online and receiving interest at the end of the term is 5.6%/year.

Meanwhile, the difference between online deposit interest rates and counter deposit interest rates is quite clear. According to the latest counter deposit interest rate table, the interest rate for 1-5 month term is 3.4%/year; 6-11 month term is 4.5%/year, and 13-36 month term is 5.3%/year.

Notably, in this adjustment of savings interest rates, MSB also increased by 0.2%/year for term deposits with the “special interest rate” product. Accordingly, the “special interest rate” for 6-month term deposits is 5.3%/year; and for 12-month, 15-month, and 24-month terms is 5.9%/year.

The condition for customers to enjoy the above “special interest rate” is that the maximum deposit amount is 5 billion VND and only applies to customers who do not have a savings book, deposit contract, or deposit certificate at MSB at the time of opening the book. In addition, each customer at a time is only allowed to have one savings book opened under the “special interest rate” product.

This is the first time in more than 5 months that MSB has adjusted its deposit interest rates. The last time this bank adjusted was on June 6, 2024 after simultaneously increasing interest rates for terms of 1-36 months.

However, in addition to the above-mentioned “special interest rate” for ordinary customers, MSB still maintains the “special interest rate” for super VIP customers with an interest rate of up to 7%/year. This interest rate remains unchanged from before, the condition to receive this interest rate is that customers deposit from 500 billion VND or more and must deposit for a term of 12-13 months.

Apart from MSB, deposit interest rates at other banks have remained unchanged. Since the beginning of October, only a few banks have increased deposit interest rates, including: Agribank (1-5 month term), MSB, LPBank, Eximbank, and Bac A Bank. On the contrary, Agribank reduced deposit interest rates by 0.1%/year for terms of 6-11 months and Techcombank reduced interest rates by 0.1%/year for terms of 1-36 months.

| HIGHEST DEPOSITS INTEREST RATES AT BANKS ON OCTOBER 21, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.2 | 2.7 | 3.2 | 3.2 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.9 | 4.1 | 5.2 | 5.2 | 5.6 | 5.9 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 3.8 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.8 | 4.1 | 5.45 | 5.65 | 5.8 | 6.15 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.5 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-21-10-2024-mot-ngan-hang-tang-lai-suat-dong-loat-2333866.html

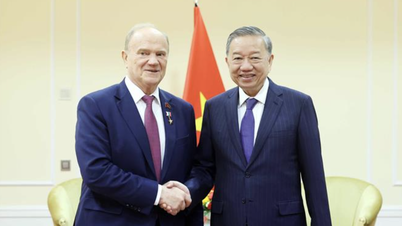

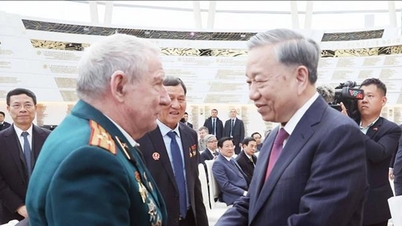

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)