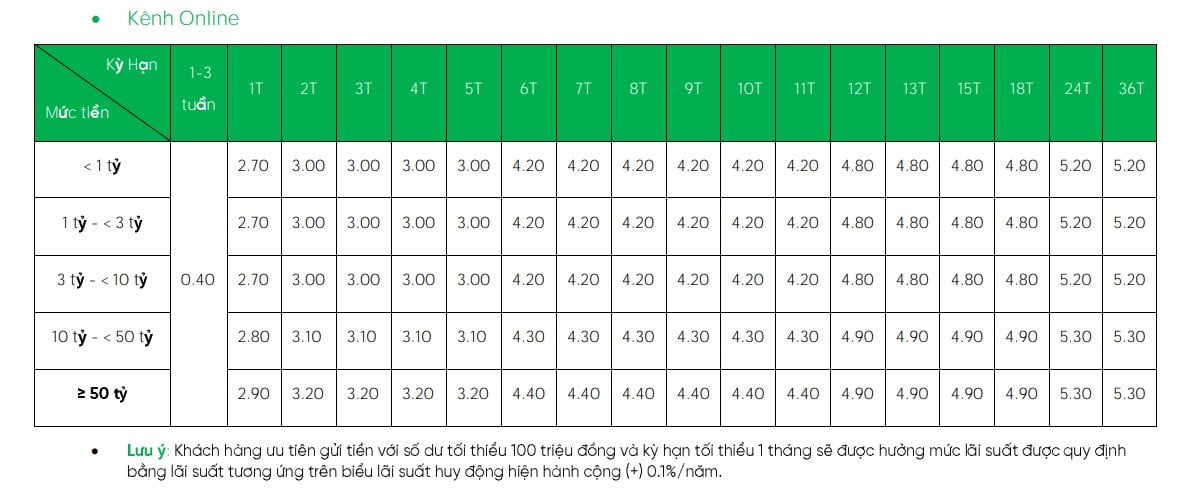

After simultaneously increasing deposit interest rates for all terms on April 10, Vietnam Prosperity Joint Stock Commercial Bank ( VPBank ) continues to increase deposit interest rates for terms from 1-5 months.

According to the mobilization interest rate table just announced by VPBank , mobilization interest rates for 1-5 month terms have increased by 0.3 percentage points.

Currently, the online interest rate for deposit accounts under 10 billion, 1-month term is 2.7%/year, 2-5 month term is 3%/year.

VPBank keeps the deposit interest rates for the remaining terms unchanged. The interest rate for 6-11 month terms is 4.2%/year, 12-18 month terms is 4.8%/year and 24-36 month terms is 5.2%/year.

This bank adds 0.1-0.2%/year interest rate for deposits from 10 to under 50 billion VND and from 50 billion VND or more.

This is the first bank to increase deposit interest rates twice in April, and also the first bank to increase interest rates three times since the beginning of the year. Previously, VPBank increased deposit interest rates at the end of March.

Not only VPBank, after two months of remaining unchanged, the mobilization interest rate at Bac A Commercial Joint Stock Bank ( Bac A Bank ) has just been adjusted. Notably, this bank adjusted the mobilization interest rate to increase at all terms, the increase is from 0.15-0.4 percentage points.

According to the latest interest rate schedule issued by Bac A Bank, applicable to savings accounts under 1 billion VND, interest rates for 1-11 month terms increased by 0.15 percentage points.

Accordingly, the latest 1-2 month term deposit interest rate is listed at 2.95%/year.

The current 3-month bank interest rate is 3.15%/year, the 4- and 5-month terms are up to 3.35% and 3.55%/year respectively.

Meanwhile, the interest rate for 6-8 month term increased to 4.35%/year, and the 9-11 month term also increased to 4.45%/year.

Bac A Bank increased by 0.25 percentage points the interest rate on 12-13 month term deposits, to 4.85%/year.

Interest rates for 15- and 18-month terms increased by 0.15 percentage points, listed at 5.05% and 5.25% per year, respectively.

Notably, Bac A Bank has adjusted the 24-36 month term deposit interest rate to increase by 0.4 percentage points to 5.5%/year. This is also the highest deposit interest rate currently at this bank for savings accounts under 1 billion VND.

Bac A Bank adds 0.2 percentage points to interest rates for all terms for savings accounts worth over 1 billion VND.

This is the first time in the past year that Bac A Bank has increased deposit interest rates.

Also increasing deposit interest rates today is Global Petroleum Commercial Joint Stock Bank ( GPBank ) with a simultaneous increase of 0.2 percentage points for all terms.

According to GPBank's latest online deposit interest rate table, the deposit interest rate for 1-month term is 2.5%/year, 2-month term is 3%/year, 3-month term is 3.02%/year, 4-month term is 3.04%/year and 5-month term is 3.05%/year.

The latest 6-month term interest rate is 4.15%/year, 7-month term is 4.25%/year, 8-month term is 4.3%/year, 9-month term is 4.4%/year and 12-month term has a new interest rate of 4.85%/year.

Interest rates for 13-36 month deposits are listed at 4.95% per year after the increase. This is also the highest interest rate at GPBank at this time.

Except for Bac A Bank, VPBank and GPBank, interest rates at other banks remain unchanged.

Since the beginning of April 2024, a series of banks have increased deposit interest rates including: HDBank , MSB, Eximbank, NCB, VPBank, KienLong Bank, VietinBank, Bac A Bank, GPBank.

VPBank is the first bank to increase interest rates for the second time this month.

In addition, VPBank, Eximbank, SHB, and Saigonbank have increased interest rates since the end of March 2024.

On the contrary, some banks have reduced deposit interest rates since the beginning of April, including: Vietcombank, PGBank, SCB, Techcombank, ABBank, Dong A Bank, Viet A Bank, Eximbank, Nam A Bank.

Of which, SCB has twice adjusted down deposit interest rates.

| HIGHEST INTEREST RATE TABLE ON APRIL 19 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| OCB | 3 | 3.2 | 4.6 | 4.7 | 4.9 | 5.4 |

| HDBANK | 2.95 | 2.95 | 4.6 | 4.4 | 5 | 5.9 |

| NCB | 3.2 | 3.5 | 4.55 | 4.65 | 5 | 5.5 |

| VIETBANK | 3 | 3.4 | 4.5 | 4.7 | 5.2 | 5.8 |

| KIENLONGBANK | 3 | 3 | 4.4 | 4.8 | 5 | 5.5 |

| BAC A BANK | 2.95 | 3.15 | 4.35 | 4.45 | 4.85 | 5.25 |

| NAM A BANK | 2.7 | 3.4 | 4.3 | 4.7 | 5.1 | 5.5 |

| BAOVIETBANK | 3 | 3.25 | 4.3 | 4.4 | 4.7 | 5.5 |

| VIET A BANK | 2.9 | 3.2 | 4.3 | 4.3 | 4.8 | 5.1 |

| PVCOMBANK | 2.85 | 2.85 | 4.3 | 4.3 | 4.8 | 5.1 |

| ABBANK | 2.9 | 3 | 4.3 | 4.1 | 4.1 | 4.1 |

| SHB | 2.8 | 3 | 4.2 | 4.4 | 4.9 | 5.2 |

| VPBANK | 2.7 | 3 | 4.2 | 4.2 | 4.8 | 4.8 |

| GPBANK | 2.5 | 3.02 | 4.15 | 4.4 | 4.85 | 4.95 |

| EXIMBANK | 3 | 3.3 | 4.1 | 4.1 | 4.9 | 5.1 |

| MSB | 3.5 | 3.5 | 4.1 | 4.1 | 4.5 | 4.5 |

| BVBANK | 2.85 | 3.05 | 4.05 | 4.35 | 4.65 | 5.25 |

| LPBANK | 2.6 | 2.7 | 4 | 4.1 | 5 | 5.6 |

| VIB | 2.6 | 2.8 | 4 | 4 | 4.8 | |

| DONG A BANK | 2.8 | 3 | 4 | 4.2 | 4.5 | 4.7 |

| CBBANK | 3.1 | 3.3 | 4 | 3.95 | 4.15 | 4.4 |

| OCEANBANK | 2.6 | 3.1 | 3.9 | 4.1 | 4.9 | 5.2 |

| SAIGONBANK | 2.3 | 2.5 | 3.8 | 4.1 | 5 | 5.6 |

| PGBANK | 2.6 | 3 | 3.8 | 3.8 | 4.3 | 4.8 |

| TPBANK | 2.5 | 2.8 | 3.8 | 4.7 | ||

| SACOMBANK | 2.3 | 2.7 | 3.7 | 3.8 | 4.7 | 4.9 |

| MB | 2.2 | 2.6 | 3.6 | 3.7 | 4.6 | 4.7 |

| TECHCOMBANK | 2.25 | 2.55 | 3.55 | 3.55 | 4.45 | 4.45 |

| ACB | 2.3 | 2.7 | 3.5 | 3.8 | 4.5 | |

| VIETINBANK | 1.9 | 2.2 | 3.2 | 3.2 | 4.7 | 4.7 |

| SEABANK | 2.7 | 2.9 | 3.2 | 3.4 | 3.75 | 4.6 |

| BIDV | 1.8 | 2.1 | 3.1 | 3.1 | 4.7 | 4.7 |

| AGRIBANK | 1.6 | 1.9 | 3 | 3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.7 |

Gold price today April 20, 2024: Middle East conflict cools down, gold price drops

Source

![[Photo] Opening of the 14th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/05/1762310995216_a5-bnd-5742-5255-jpg.webp)

![[Photo] Panorama of the Patriotic Emulation Congress of Nhan Dan Newspaper for the period 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/04/1762252775462_ndo_br_dhthiduayeuncbaond-6125-jpg.webp)

Comment (0)