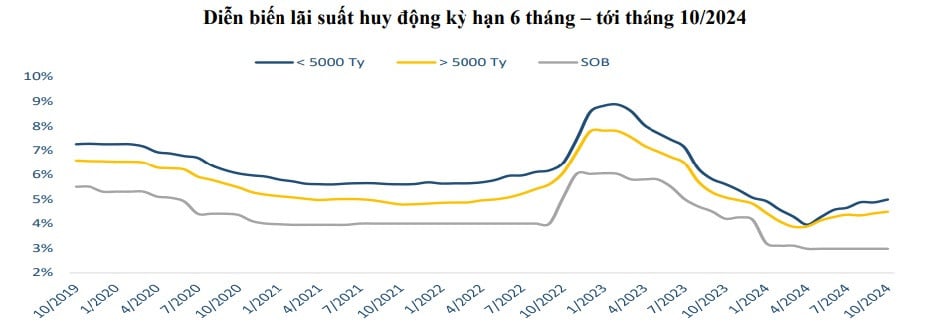

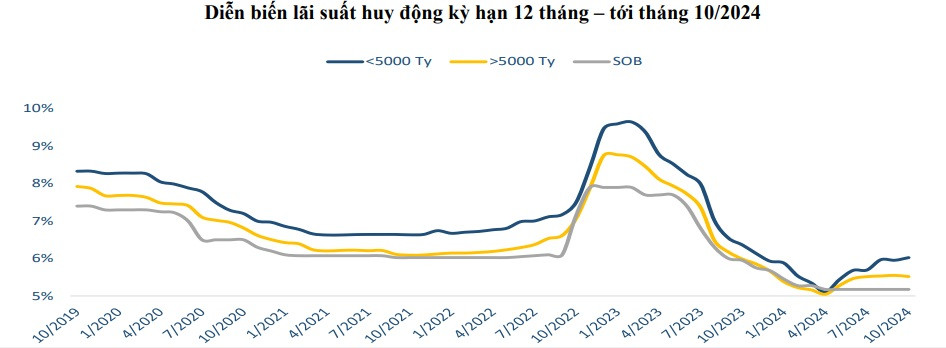

Bank interest rates today October 18, 2024, the deposit interest rate table of banks is recording 6 banks with long-term interest rates from 6% or higher.

This is the second consecutive day that the deposit interest rate market has not changed since Agribank increased 0.2%/year deposit interest rate for 1-5 month term and reduced 0.1%/year deposit interest rate for 6-11 month term.

Before Agribank, only LPBank, Bac A Bank and Eximbank increased deposit interest rates since the beginning of October. On the contrary, bank interest rates at Techcombank decreased by 0.1%/year for savings interest rates for terms of 12 months or more.

The sharp drop in interbank interest rates is an indication that deposit and lending interest rates will not be able to increase in the near future.

According to the State Bank of Vietnam's report, as of October 10, interbank interest rates for overnight, 1-week, and 2-week terms decreased by 0.46%; 0.42%; 0.3% to 3.3%; 3.38%; 3.47%, respectively, the lowest levels in 1 month.

During the week from October 7 to 11, 2024, the SBV withdrew a net VND10,791 billion in the open market, as the previously issued OMOs had expired. During the week, the SBV did not issue any more OMOs. Currently, the total amount of OMOs in circulation has decreased from the peak of VND70,658 billion at the end of September to VND452 billion.

At the press conference to inform about the results of monetary policy management in the third quarter of 2024, which took place on the afternoon of October 17, Deputy Governor of the State Bank of Vietnam Dao Minh Tu said: "We leave open the story of operating interest rates in the coming time, will continue to maintain as they are now or can reduce interest rates to support the economy. Under the conditions of ensuring inflation, supporting growth and exchange rate relations, we will study and consider operating interest rates in the coming time."

A representative of the State Bank of Vietnam said that as of September 30, 2024, credit growth in the entire economy increased by 9% compared to the beginning of the year, 16% higher than the same period in the first 9 months of 2023; meanwhile, capital mobilization in the first 9 months increased by 5.28%.

The Deputy Governor said that the total amount of loans in the first 9 months of the year reached 14.7 million billion VND, while the total amount of mobilized capital was lower, reaching 14.5 million billion VND.

Mr. Dao Minh Tu gave the above figure and affirmed that credit institutions lent out as much as they mobilized, even using money from the bank's equity. There is no way that banks only mobilized without pushing capital into the economy, leading to a surplus of 14-15 million billion VND as rumored in the market in recent days.

| HIGHEST DEPOSITS INTEREST RATES AT BANKS ON OCTOBER 18, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.2 | 2.7 | 3.2 | 3.2 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.7 | 5 | 5.2 | 5.6 | 5.7 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.8 | 4.1 | 5.25 | 5.35 | 5.7 | 5.85 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.2 | 3.72 | 5.05 | 5.4 | 5.75 | 5.85 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.9 | 4.1 | 5.2 | 5.2 | 5.6 | 5.9 |

| MB | 3.3 | 3.7 | 4.4 | 4.4 | 5.1 | 5 |

| MSB | 3.7 | 3.7 | 4.6 | 4.6 | 5.4 | 5.4 |

| NAM A BANK | 3.8 | 4.1 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.8 | 4.1 | 5.45 | 5.65 | 5.8 | 6.15 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| CBBANK | 3.8 | 4 | 5.55 | 5.5 | 5.7 | 5.85 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.25 | 3.45 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.2 | 3.6 | 4.6 | 4.6 | 5.1 | |

| VIET A BANK | 3.4 | 3.7 | 4.8 | 4.8 | 5.4 | 5.7 |

| VIETBANK | 3.8 | 4 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.5 |

.

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-18-10-2024-7-ngan-hang-tra-lai-suat-6-tro-len-2332969.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)