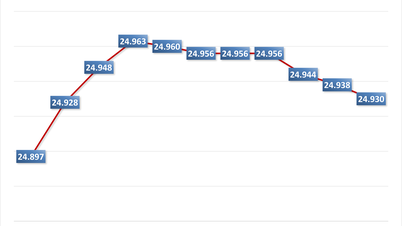

Dong A Commercial Joint Stock Bank ( Dong A Bank ) has just become the next bank to reduce deposit interest rates in March, with a reduction of 0.2 percentage points across all terms.

According to the deposit interest rate table just announced by Dong A Bank, the interest rate for deposits with terms of 1-5 months is 3.3%/year; the interest rate for deposits with terms of 6-8 months is 4.3%/year; the interest rate for deposits with terms of 9-11 months is 4.5%/year and the interest rate for deposits with terms of 12 months is 4.8%/year.

Dong A Bank still maintains interest rates for some terms above 5%/year, despite having just lowered interest rates. The highest bank interest rate belongs to the 13-month term, up to 5.1%/year. The 18-36 month terms have a new interest rate of 5%/year.

However, Dong A Bank still maintains the "special interest rate" of 7.5%/year, applied to term deposits of 13 months or more with deposit amounts from 200 billion VND.

Currently, some commercial banks still maintain “special interest rates” that are significantly higher than normal deposit interest rates. However, to enjoy this interest rate, customers must deposit a very large amount of money.

At ACB, the "special interest rate" applied to 13-month term deposits is 5.6% for deposit accounts of VND200 billion or more (while the normal interest rate for this term is 4.5%/year).

At PVCombank, the interest rate for deposits at the counter for a term of 12-13 months for regular customers is 4.5%-4.7%/year. However, the “special interest rate” is up to 10%/year (the highest currently), applied to deposit accounts of VND2,000 billion or more.

At MSB, the announced interest rate for 12-13 month deposits at the counter is only 4%/year. However, for customers depositing VND500 billion or more, the applicable interest rate will be 8.5%/year.

At HDBank, the special interest rates applied to 12- and 13-month deposits at the counter are 7.7% and 8.1% per year, respectively. This interest rate policy is only for deposit accounts of VND500 billion or more, while the normal interest rate for the same term is only 4.7-4.9% per year.

Dong A Bank is the only bank to reduce deposit interest rates on the first day of the week (March 11). Thus, since the beginning of March, 9 commercial banks have reduced deposit interest rates, including: PGBank, BVBank, BaoViet Bank, GPBank, ACB, Agribank, VPBank, PVCombank, Dong A Bank.

Of which, BaoViet Bank and GPBank have reduced deposit interest rates twice since the beginning of the month.

| HIGHEST DEPOSITS INTEREST RATE TABLE ON MARCH 11 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| DONG A BANK | 3.3 | 3.3 | 5.3 | 4.5 | 4.8 | 5 |

| ABBANK | 3 | 3.2 | 4.7 | 4.3 | 4.3 | 4.4 |

| NCB | 3.4 | 3.6 | 4.65 | 4.75 | 5.1 | 5.6 |

| VIETBANK | 3.1 | 3.5 | 4.6 | 4.8 | 5.3 | 5.8 |

| HDBANK | 2.95 | 2.95 | 4.6 | 4.4 | 4.8 | 5.7 |

| OCB | 3 | 3.2 | 4.6 | 4.7 | 4.9 | 5.4 |

| NAM A BANK | 2.9 | 3.4 | 4.5 | 4.8 | 5.3 | 5.7 |

| VIET A BANK | 3.1 | 3.4 | 4.5 | 4.5 | 5 | 5.3 |

| CBBANK | 3.6 | 3.8 | 4.5 | 4.45 | 4.65 | 4.9 |

| BVBANK | 3.3 | 3.4 | 4.4 | 4.6 | 4.8 | 5.5 |

| OCEANBANK | 3.1 | 3.3 | 4.4 | 4.6 | 5.1 | 5.5 |

| KIENLONGBANK | 3.2 | 3.2 | 4.4 | 4.6 | 4.8 | 5.3 |

| BAOVIETBANK | 3 | 3.25 | 4.3 | 4.4 | 4.7 | 5.5 |

| PVCOMBANK | 2.85 | 2.85 | 4.3 | 4.3 | 4.8 | 5.1 |

| BAC A BANK | 2.8 | 3 | 4.2 | 4.3 | 4.6 | 5.1 |

| SHB | 2.6 | 3 | 4.2 | 4.4 | 4.8 | 5.1 |

| PGBANK | 2.9 | 3.3 | 4.1 | 4.2 | 4.7 | 5.1 |

| VIB | 2.7 | 3 | 4.1 | 4.1 | 4.9 | |

| LPBANK | 2.6 | 2.7 | 4 | 4.1 | 5 | 5.6 |

| TPBANK | 2.8 | 3 | 4 | 4.8 | 5 | |

| VPBANK | 2.3 | 2.5 | 4 | 4 | 4.3 | 4.3 |

| GPBANK | 2.3 | 2.82 | 3.95 | 4.2 | 4.65 | 4.75 |

| SACOMBANK | 2.6 | 2.9 | 3.9 | 4.2 | 5 | 5.6 |

| SAIGONBANK | 2.5 | 2.7 | 3.9 | 4.1 | 5 | 5.4 |

| EXIMBANK | 2.8 | 3.1 | 3.9 | 3.9 | 4.9 | 5.1 |

| MSB | 3.5 | 3.5 | 3.9 | 3.9 | 4.3 | 4.3 |

| MB | 2.4 | 2.7 | 3.7 | 3.9 | 4.7 | 4.9 |

| SEABANK | 2.9 | 3.1 | 3.7 | 3.9 | 4.25 | 4.8 |

| ACB | 2.5 | 2.8 | 3.7 | 3.9 | 4.8 | |

| TECHCOMBANK | 2.55 | 2.95 | 3.65 | 3.7 | 4.55 | 4.55 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.8 | 4.8 |

| VIETINBANK | 1.9 | 2.2 | 3.2 | 3.2 | 4.8 | 4.8 |

| SCB | 1.75 | 2.05 | 3.05 | 3.05 | 4.05 | 4.05 |

| AGRIBANK | 1.7 | 2 | 3 | 3 | 4.8 | 4.8 |

| VIETCOMBANK | 1.7 | 2 | 3 | 3 | 4.7 | 4.7 |

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in April 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/48eb0c5318914cc49ff858e81c924e65)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Tomas Heidar, Chief Justice of the International Tribunal for the Law of the Sea (ITLOS)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/58ba7a6773444e17bd987187397e4a1b)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

Comment (0)