Compared to October 10, 2023, the mobilization interest rates at the "big four" banks have had less adjustment than private joint stock commercial banks, but the interest rates at these banks have decreased by a common level of 1.4%/year, some terms have decreased by 0.6-0.8%/year.

Interest rates at Vietcombank are always listed lower than those of the other three banks. Interest rates at Agribank , VietinBank and BIDV do not differ, except for 24-36 month deposit terms.

Currently, the online deposit interest rate for 24-36 months at VietinBank is 5%/year, which is the highest deposit interest rate in the big4 group. The deposit interest rate for this term at BIDV is 4.9%/year, Agribank is 4.8%/year, and Vietcombank is 4.7%/year.

However, Agribank has an advantage over the other three banks in terms of 3-month term deposit interest rates. Currently, this bank lists 2.5%/year for 3-month term online deposits, while VietinBank and BIDV still list 2.3%/year, and Vietcombank only lists 1.9%/year.

| ONLINE DEPOSITS INTEREST RATES FROM BIG4 BANKS IN THE PAST YEAR (%/YEAR) | |||||

| TERM | AGRIBANK | VIETINBANK | BIDV | VIETCOMBANK | |

| 1 MONTH | 10/2024 | 2 | 2 | 2 | 1.6 |

| 10/2023 | 3.4 | 3.4 | 3.2 | 3 | |

| 3 MONTHS | 10/2024 | 2.5 | 2.3 | 2.3 | 1.9 |

| 10/2023 | 3.85 | 3.85 | 3.7 | 3.3 | |

| 6 MONTHS | 10/2024 | 3.3 | 3.3 | 3.3 | 2.9 |

| 10/2023 | 4.7 | 4.7 | 4.6 | 4.3 | |

| 9 MONTHS | 10/2024 | 3.3 | 3.3 | 3.3 | 2.9 |

| 10/2023 | 4.7 | 4.7 | 4.6 | 4.3 | |

| 12 MONTHS | 10/2024 | 4.7 | 4.7 | 4.7 | 4.6 |

| 10/2023 | 5.5 | 5.5 | 5.5 | 5.3 | |

| 18 MONTHS | 10/2024 | 4.7 | 4.7 | 4.7 | 4.6 |

| 10/2023 | 5.5 | 5.5 | 5.5 | 5.3 | |

| 24 MONTHS | 10/2024 | 4.8 | 5 | 4.9 | 4.7 |

| 10/2023 | 5.5 | 5.5 | 5.5 | 5.3 | |

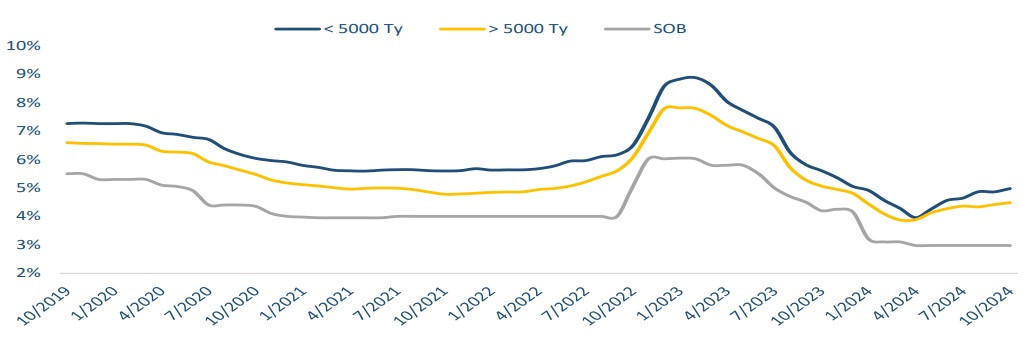

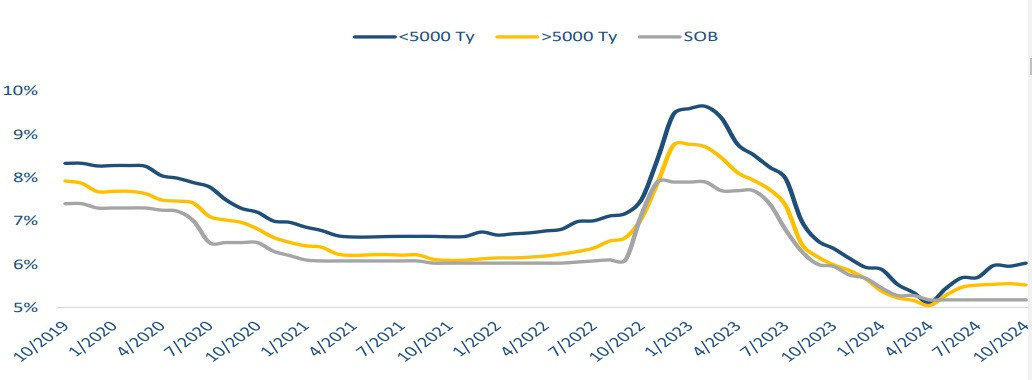

At joint stock commercial banks, today is the fourth consecutive day that the market has not recorded any changes in deposit interest rates. This is a rare occurrence in over a year.

According to statistics, the average 6-month deposit interest rate in October reached 4.45%/year, an increase of 0.07%/year compared to September 2024. The average 12-month deposit interest rate in October reached 5.14%, a slight increase of 0.01%/year compared to September.

The increase in deposit interest rates mainly comes from a number of small banks. Meanwhile, the group of state-owned commercial banks continues to maintain stable deposit interest rates.

Thus, the rate of increase in deposit interest rates in recent months has slowed down significantly compared to the second quarter. Compared to the end of 2023, deposit interest rates are still down 12 basis points.

On average, since the beginning of the year, the mobilization interest rate is at 4.94%/year, still much lower than previous years, including the year of the Covid-19 pandemic (5.85%).

Low deposit interest rates continue to create conditions for banks to maintain low lending interest rates.

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-11-10-2024-lai-suat-ngan-hang-big4-nam-qua-ra-sao-2330858.html

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)