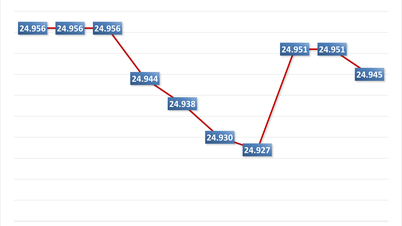

Bank interest rates today, November 18, 2024, continue to add GPBank to the race to increase deposit interest rates, bringing this bank's interest rate above the threshold of 6%/year.

Global Petroleum Commercial Joint Stock Bank ( GPBank ) has just announced a new deposit interest rate schedule, with a uniform increase of 0.2%/year in interest rates for all deposit terms.

According to the online deposit interest rate table that GPBank has just posted, the current 1-month term bank interest rate is 3.4%/year. However, there is a large gap between the 1-month term deposit interest rate and the remaining terms.

Specifically, GPBank's 2-month term interest rate is listed at 3.9%/year. The 3-4-5 month term interest rates are listed at 3.92% - 3.94% - 3.95%/year, respectively.

Online deposit interest rates for 6-month terms were also increased to 5.25%/year, 7-month terms to 5.35%/year, 8-month terms to 5.5%/year, 9-month terms to 5.6%/year and 12-month terms to 5.95%/year.

Notably, online deposit interest rates for terms from 13-36 months at GPBank officially reached 6.05%/year, thereby bringing the bank into the group of banks with deposit interest rates from 6%/year or higher, including: OceanBank, BaoViet Bank, BVBank, HDBank, NCB, ABBank, Bac A Bank, IVB and Saigonbank.

Previously, in the most recent adjustment of deposit interest rates, GPBank increased interest rates by 0.2% for terms from 1-9 months.

Also this morning, Loc Phat Vietnam Commercial Joint Stock Bank ( LPBank ) adjusted to increase by 0.1%/year for deposit interest rates for terms from 12-60 months.

Accordingly, the online deposit interest rate for 12-16 month terms at LPBank is 5.6%/year, the bank interest rate for 18-60 month terms is 5.8%/year.

Interest rates for 1-5 month terms remain unchanged at 3.6-3.8%/year.

According to statistics, 11 banks have increased their deposit interest rates since the beginning of November, including: GPBank, LPBank, Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank and VietBank. Of which, Agribank is the only bank that has increased its interest rates twice since the beginning of the month.

| INTEREST RATES FOR ONLINE DEPOSITS AT BANKS ON NOVEMBER 18, 2024 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 2.9 | 3.6 | 3.6 | 4.8 | 4.8 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 3.9 | 5.5 | 5.6 | 5.9 | 6.2 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.95 | 4.25 | 5.4 | 5.5 | 5.8 | 6.15 |

| BAOVIETBANK | 3.3 | 4 | 5.2 | 5.4 | 5.8 | 6 |

| BVBANK | 3.8 | 4 | 5.2 | 5.5 | 5.8 | 6 |

| CBBANK | 3.8 | 4 | 5.5 | 5.45 | 5.65 | 5.8 |

| DONG A BANK | 3.9 | 4.1 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 3.9 | 4.3 | 5.2 | 4.5 | 5.2 | 5.8 |

| GPBANK | 3.4 | 3.92 | 5.25 | 5.6 | 5.95 | 6.05 |

| HDBANK | 3.85 | 3.95 | 5.1 | 4.7 | 5.5 | 6.1 |

| IVB | 3.8 | 4.1 | 5.1 | 5.1 | 5.8 | 6.1 |

| KIENLONGBANK | 3.7 | 3.7 | 5.2 | 5.3 | 5.6 | 5.7 |

| LPBANK | 3.6 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| MB | 3.5 | 3.9 | 4.5 | 4.5 | 5.1 | 5.1 |

| MSB | 3.9 | 3.9 | 4.8 | 4.8 | 5.6 | 5.6 |

| NAM A BANK | 4.5 | 4.7 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 3.9 | 4.2 | 5.55 | 5.65 | 5.8 | 5.8 |

| OCB | 3.9 | 4.1 | 5.1 | 5.1 | 5.2 | 5.4 |

| OCEANBANK | 4.1 | 4.4 | 5.4 | 5.5 | 5.8 | 6.1 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.35 | 3.65 | 4.55 | 4.55 | 4.85 | 4.85 |

| TPBANK | 3.5 | 3.8 | 4.7 | 5.2 | 5.4 | |

| VIB | 3.5 | 3.8 | 4.8 | 4.8 | 5.3 | |

| VIET A BANK | 3.7 | 4 | 5.2 | 5.4 | 5.7 | 5.9 |

| VIETBANK | 3.9 | 4.1 | 5.2 | 5 | 5.6 | 5.9 |

| VPBANK | 3.6 | 3.8 | 4.8 | 4.8 | 5.3 | 5.3 |

Source: https://vietnamnet.vn/lai-suat-ngan-hang-18-11-2024-them-nha-bang-tang-lai-suat-vuot-6-nam-2342988.html

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)