Proposal to reduce interest and tax

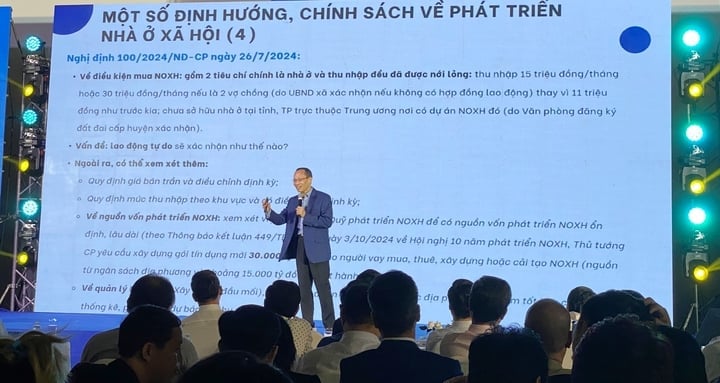

On November 17, at the event “For 1 million Vietnamese families”, a discussion on the topic “Owning social housing from dream to reality” took place. Here, the speakers shared a lot of interesting and hot information about developing social housing for low-income people, workers, and armed forces.

The event "For a million Vietnamese families" was organized by Hoang Quan Group and Dai Bieu Nhan Dan Newspaper in Ho Chi Minh City on November 17. (Photo: Dai Viet)

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, said that the current interest rate of 6.6%/year for social housing buyers is still high. This creates a burden for low-income people. The Ho Chi Minh City Real Estate Association hopes that the Government and the banking sector can have preferential mechanisms so that people can access better preferential interest rate packages.

The association proposed to apply an interest rate of 3 - 4.8%/year to make it easier for people to pay off their debts. Because with the current price of social housing, if they can borrow at a preferential interest rate of 3 - 4.8%, each month, people only have to pay from 5 - 5.5 million VND. This is a payment level suitable for the majority of low-income people.

According to Mr. Chau, currently, there are many people from many localities coming to Ho Chi Minh City to live and work and have a need to rent social housing. However, over the past 3 years, Ho Chi Minh City has only completed 2 social housing projects. One of them is a project of Hoang Quan Group. This shows that social housing projects are too scarce.

According to Mr. Chau, currently, Ho Chi Minh City has about 1.4 million workers and laborers renting houses. Meanwhile, the investors of boarding houses are paying lump-sum tax, personal income tax, and VAT.

Thus, the landlord is being taxed like the owner of a motel or hotel. This is unreasonable when the landlord is providing good accommodation for low-income people. Therefore, it is necessary to exempt personal income tax and VAT for landlords and encourage the development of social housing for rent.

“We propose that investors in social housing rental projects only have to pay corporate income tax at 6% per year instead of the current 10% per year. This will motivate investors to develop social housing, creating a housing supply for low-income people,” said Mr. Chau.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, said that in the past, the implementation of social housing projects faced many difficulties and problems, focusing on five issues: land fund, procedures, mechanisms, interest rates and market output.

Currently, the issues of capital, procedures, and market output have been strongly “untied” by legal regulations in the direction of developing social housing, only the issues of land funds and interest rates are still difficult for businesses. In the coming time, it is necessary to support businesses to access clean land funds to build social housing as well as support preferential interest rates for these businesses.

Developing social housing with many options

Dr. Truong Anh Tuan, Chairman of the Board of Directors of Hoang Quan Group, said that recently, the Party, the National Assembly , the Government, ministries, branches and localities have been making great efforts to join hands to realize the Project of 1 million social housing units for low-income people.

Real estate businesses, especially those specializing in social housing like Hoang Quan, always try to complete ongoing projects despite facing numerous challenges.

According to Mr. Tuan, when building social housing, businesses determine that profits are very low, and many projects are even at a loss after completion. However, the goal of building social housing is not profit, but the cooperation of businesses with the Government and localities to improve the living conditions for people, helping them feel secure in working, doing business, and stabilizing their lives.

“Previously, businesses faced many difficulties in terms of mechanisms and policies. However, the new Land Law, Housing Law, and Real Estate Business Law that have come into effect have gradually removed bottlenecks for social housing developers. These are very humane policies of the National Assembly and the Government to help millions of low-income people buy or rent houses,” said Mr. Tuan.

Dr. Can Van Luc shared information at the event. (Photo: Dai Viet)

Dr. Can Van Luc, member of the National Financial and Monetary Policy Advisory Council, said that in the period from 2021 to 2025, Vietnam needs 1.1 million social housing units. However, in reality, only 400,000 units, equivalent to 36%, have been met.

Thus, the supply still cannot meet the huge demand. It is forecasted that from 2021 to 2030, Vietnam will need 2.4 million social housing units.

Therefore, Mr. Luc recommended that localities must review and strictly implement the planning of land funds and the quality of works for social housing. Ensure that social housing projects are fully planned with related ecosystems including traffic infrastructure, schools, hospitals, markets, supermarkets and should be concentrated in separate areas. In addition, it is necessary to review land funds in industrial parks to develop housing for workers.

In addition, Mr. Luc suggested that localities should review real estate projects and social housing projects that are still stuck in order to promptly resolve them and allow the conversion of functions for some suitable projects. This is also to prevent waste. Research and issue specific support policies for each locality, suitable to the characteristics of the locality to promote the development of social housing and workers' housing.

For businesses, Mr. Luc recommends that businesses need to restructure their operations, control risks of cash flow, interest rates, debt maturities, etc. to have the best capacity to implement projects; they need to proactively learn about and access support programs and packages such as taxes, fees, and credits. Businesses also need to diversify their capital sources and products to bring real estate prices to a more reasonable level.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)