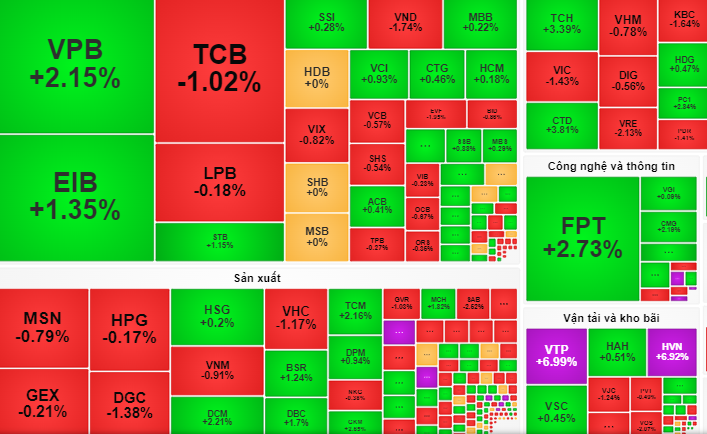

At the end of the session on June 19, the VN-Index increased by only 0.29 points (+0.02%), closing at 1,279 points.

Although the market opened in the green, it quickly returned to a cautious and tentative state. At times, the VN-Index fell to near the 1,270-point mark. The market was only supported and gradually recovered in the afternoon session of June 19.

At the end of the session, the VN-Index increased by only 0.29 points (+0.02%), closing at 1,279 points. Liquidity on the HoSE floor reached 1 billion shares, equivalent to a value of VND25,741 billion.

Among the 30 large stocks (VN30), 14 increased in price, such as FPT (+2.7%), VPB (+2.2%), MWG (+1.8%), PLX (+1.2%), STB (+1.1%)... On the contrary, 14 decreased in price, such as SAB (-2.5%), VRE (-2.1%), VIC (-1.4%), VJC (-1.2%), TCB (-1%)...

This session, foreign investors continued to net sell on HoSE with a value of VND1,511 billion. In particular, they sold heavily in FPT (-VND221.7 billion), VNM (-VND170.4 billion), VPB (-VND129 billion), VHM (-VND97.5 billion). Therefore, many domestic investors are concerned that the "dumping" move of foreign investors may continue in the next session.

According to VDSC, liquidity on June 19 increased compared to the previous session, showing that cash flow is trying to support the market when the supply of stocks increases. It is expected that the VN-Index will continue to fluctuate to probe the supply and demand of stocks in the 1,275 - 1,285 point range in the next trading session.

"However, the recent cautious signals may still pose risks in the short term. Therefore, investors should avoid falling into an overbought state" - VDSC recommends.

VCBS Securities Company also recommends that investors consider buying small amounts of stocks that are moving sideways in the technology, electricity, and seafood industries.

Source: https://nld.com.vn/chung-khoan-ngay-mai-20-6-khoi-ngoai-co-the-con-xa-hang-196240619181657204.htm

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)