Officers of the Thai Binh City Inter-District Tax Team - Vu Thu disseminate new tax policies to taxpayers.

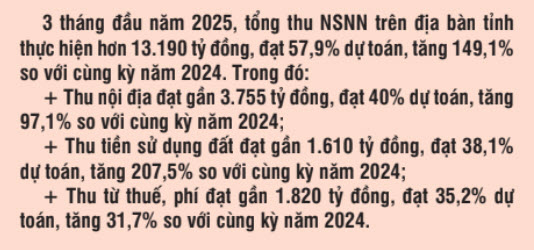

Positive revenue

After merging with the tax departments of Hai Duong and Bac Ninh provinces to establish the Tax Department of Region V, Thai Binh still has 4 tax teams. Although up to 90 tax officials and civil servants applied for early retirement, the work to be resolved increased; however, with the drastic direction of the Provincial State Budget Collection Steering Committee, the active and responsible participation of all levels and sectors, especially the efforts to overcome difficulties of the tax sector, solutions to increase budget revenue have been implemented quickly, fully and effectively. In particular, the tax sector continues to systematically and effectively implement the implementation of electronic invoices generated from cash registers, the "Lucky Invoice" program to encourage consumers to get invoices. By March 18, 100% of retail gasoline stores with pumps in the province had automatically connected to issue electronic invoices for each sale. The tax sector and related units also focus on exploiting potential revenue sources; Implement well the work of revenue management, prevention and control of revenue loss and handling of tax arrears.

Mr. Bui Cong Minh, Deputy Head of the Tax Department of Region V, said: In the first 3 months of 2025, many tax collection targets of Thai Binh had a fairly high growth rate compared to the same period, such as personal income tax and tax from foreign-invested enterprises. The localities with high revenue were Quynh Phu district, reaching 88.6% of the estimate, an increase of 308% over the same period in 2024; Thai Thuy district reached 48.3% of the estimate, an increase of 388% over the same period in 2024. According to Mr. Vu Xuan Hung, Permanent Vice Chairman of the People's Committee of Quynh Phu district: To complete the local budget revenue and expenditure estimate for 2025, Quynh Phu district focused on directing relevant units and localities to drastically implement budget collection measures right from the beginning of the year. Focus on doing a good job of propaganda and mobilization in many forms to enterprises and business households to declare and pay taxes correctly and fully; Units closely coordinate with the Quynh Phu - Hung Ha Inter-district Tax Team to proactively exploit revenue sources, promote land use rights auctions to supplement resources for investment in socio-economic development. Therefore, in the first quarter of 2025, Quynh Phu is the locality with the highest land use fee collection in the province, reaching 104.4% of the estimate, an increase of 437% over the same period in 2024.

Anticipate challenges to enhance solutions

In addition to the encouraging results, the task of collecting the State budget also faces many difficulties. The amount of tax arrears still accounts for a high proportion of the total revenue, and late payment fees of some large debtors still arise every month. The amount of tax and the number of individual business households reaching the tax payment threshold are still low compared to the provinces in Region V; the progress of land use rights auctions in some localities has not ensured the set plan. Mr. Pham Van Hung, Head of the Thai Thuy - Dong Hung Inter-District Tax Team, shared: After the merger, the staff was reduced to 53 people, the area was large, and there were days when up to 130 records were received, so determining land financial obligations was extremely difficult; the tax authority did not have full account information of enterprises, leading to low efficiency in debt enforcement through bank accounts. According to Mr. Pham Ngoc Ke, Chairman of Tien Hai District People's Committee: In the district, there are some land lots where investors have abandoned their deposits and can re-auction the land use rights immediately, but according to the new regulations, after 120 days from the date of approval of the auction results, the competent authority can cancel the recognition of the auction results and re-auction. That is the reason why the district's land use fee collection in the first 3 months of the year has not met expectations.

In 2025, Thai Binh strives for double-digit economic growth and best fulfills the targets set by the Resolution of the 20th Provincial Party Congress, with total state budget revenue striving to reach over VND 22,770 billion, of which total domestic revenue reaches over VND 13,000 billion. Anticipating difficulties to propose and implement practical solutions to ensure the completion of budget collection tasks, Mr. Bui Cong Minh, Deputy Head of the Tax Department of Region V, added: The tax sector recommends that the Provincial People's Committee direct departments, branches, and localities to closely coordinate to speed up the progress of site clearance and land procedures to promptly and successfully organize the auction of projects and land plots; determine specific land prices at projects assigned land so that tax authorities have a basis to issue notices and urge the collection and payment of land use fees to the state budget. The tax sector also focuses on the task of collecting land use fees, maximizing the exploitation of remaining revenue sources, revenues from taxes, fees, and charges; reviewing tax debts, strictly implementing measures to recover tax arrears, enforcing tax debts according to the provisions of law, not allowing new debts to arise; promoting tax management, tightening tax management for business households, effectively managing revenue sources arising from e-commerce transactions, business on digital platforms, online; promoting the application of digital technology in tax declaration and payment...

Despite many challenges, with the initiative and determination in implementing solutions, the Tax Department of Region V - Thai Binh One-Stop Shop expects to achieve positive results in the second quarter of 2025. Good budget collection results contribute to ensuring resources for socio-economic development and create favorable momentum to complete the financial plan for the whole year.

Yong Ji Garment Vietnam Co., Ltd. (Dong La Industrial Park) invested in modern production lines to improve productivity, product quality, increase revenue, and contribute more to the state budget.

Thu Hien

Source: https://baothaibinh.com.vn/tin-tuc/4/222406/khoi-dau-tich-cuc-trong-thu-ngan-sach

![[Photo] Enjoying the experience of enjoying specialty coffee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/cb4f5818052e479392e8b3ad06cb1db0)

![[Photo] Welcoming ceremony for Japanese Prime Minister Ishiba Shigeru and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/1c97f7123f4f47078488e8c412953289)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ee88e7119877496a9a73bb456f3414d3)

![[Photo] Fireworks light up Hanoi sky to celebrate national reunification day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/5b4a75100b3e4b24903967615c3f3eac)

Comment (0)