Increasing unemployment benefits and supplementing family allowances will help workers overcome challenges when unemployed, according to the International Labor Organization (ILO) in Vietnam.

In the newly published report One-time Social Insurance (SI) withdrawal in Vietnam: Trends, challenges and recommendations, ILO assessed that one-time social insurance withdrawal seems large and attractive to workers but has many shortcomings. No one knows how long they will live after retirement, it could be 5 or 30 years, and they also do not know how much they will have to spend every month until the end of their life. Without a savings plan, workers will face difficulties when they get old.

Many people use their one-time insurance withdrawals to invest in businesses, buy new homes, send their children to study abroad, or travel abroad. But most of them spend it all very quickly, even for those with careful financial planning.

ILO cited research in Malaysia in the 2000s, most workers who withdrew their insurance in one lump sum to retire early spent it all within 3 years. In the end, they still had to rely on the government 's social assistance for the poor. At that time, the whole society had to bear the cost, including the taxpayers.

Another problem is that most workers withdraw their social insurance contributions at one time when they are of working age, causing Vietnam to face a double challenge of having to both expand the safety net and keep them in the system.

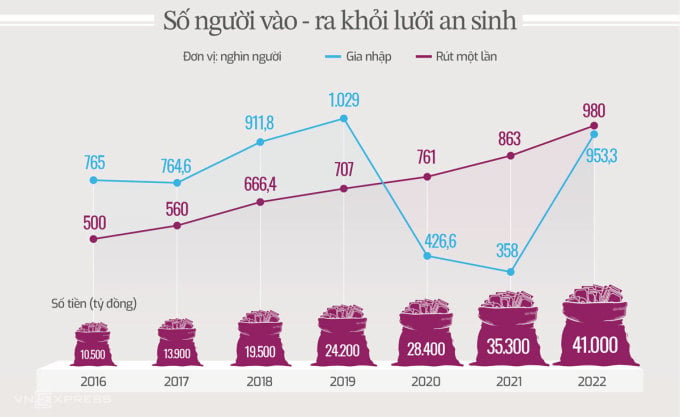

Workers join and withdraw from the social security net at once with payment amount for the period 2016 - 2022 (See details) Graphics: Gia Linh

To solve the problem of one-time withdrawal of social insurance, in addition to including family and child allowance policies in the revised Law on Social Insurance, ILO recommends expanding unemployment benefits. When there is no or low level of benefits, workers are forced to find alternative sources and immediately think of one-time withdrawal of social insurance.

Currently, the unemployment benefit rate is 60%, but the salary used as the basis for social insurance contributions is low, so the benefits received by workers are quite low compared to the cost of living and actual income. Statistics show that the salary used for social insurance contributions is only 5.56 million VND, and the benefits received by workers are only 3.4 million VND per month.

The ILO also recommends gradually increasing the waiting period beyond 12 months after leaving work to reduce the incentive for workers to withdraw their social insurance benefits at once, such as increasing the waiting period by one month for each year of insurance payment. In addition, it is necessary to improve vocational training policies, job placement services and credit to help workers quickly find new jobs.

According to the ILO, increasing subsidies and gradually limiting the one-time withdrawal of social insurance will not create a shock and make workers more receptive to policy changes. "This requires consulting with workers and employers to ensure that the policy receives their consensus and is accepted by society," the report stated.

By the end of 2022, the Unemployment Insurance Fund balance is estimated to reach 59,300 billion VND, expected to increase to more than 62,400 billion VND this year. In the same year, the number of workers applying for unemployment benefits increased by nearly 23% compared to the same period, about 983,000 people. Most workers chose to receive subsidies, while the number of workers receiving vocational training support was only 21,800.

At the Labor Forum at the end of July, workers petitioned the National Assembly to amend the law to increase the subsidy and reduce the contribution rate to less than 1% for workers, because the surplus fund is large while the subsidy level is limited. Workers believe that the subsidy equal to 60% of the average monthly salary for unemployment insurance contributions for the six consecutive months before quitting the job is low.

Hong Chieu

Source link

Comment (0)