You can still invest in real estate without much capital

At the regular press conference of the Ministry of Finance on the afternoon of June 18, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, said that he had worked with VPS Securities Company and requested that this unit immediately stop distributing securities certificates in the form of subdivided real estate.

According to the leader of the State Securities Commission, there are currently no regulations on this method of real estate investment. "The management agency assesses this as a type with many risks and requires VPS to stop distributing this product," said Mr. Hai.

This person also said that foreign markets have specific regulations to control and limit risks from this type of business, but in Vietnam there are still none.

Mr. Nguyen Duc Chi, Deputy Minister of Finance, also said that the Ministry has directed the Securities Commission on this issue.

According to Mr. Chi, current laws do not have any prohibitions, but from the perspective of a state management agency, the Securities Commission has the responsibility to closely monitor the activities of securities companies.

The services provided by these businesses must be within the licensed business fields and industries. If they are outside this scope, they will have to stop so that management can make a comprehensive assessment, Mr. Chi affirmed.

The real estate investment subdivision model is essentially selling real estate to many investors in the form of dividing shares. This model appeared in the Vietnamese market 4-5 years ago. Some models that have operated similarly before are Moonka, Houze Invest, Sunshine Homes…

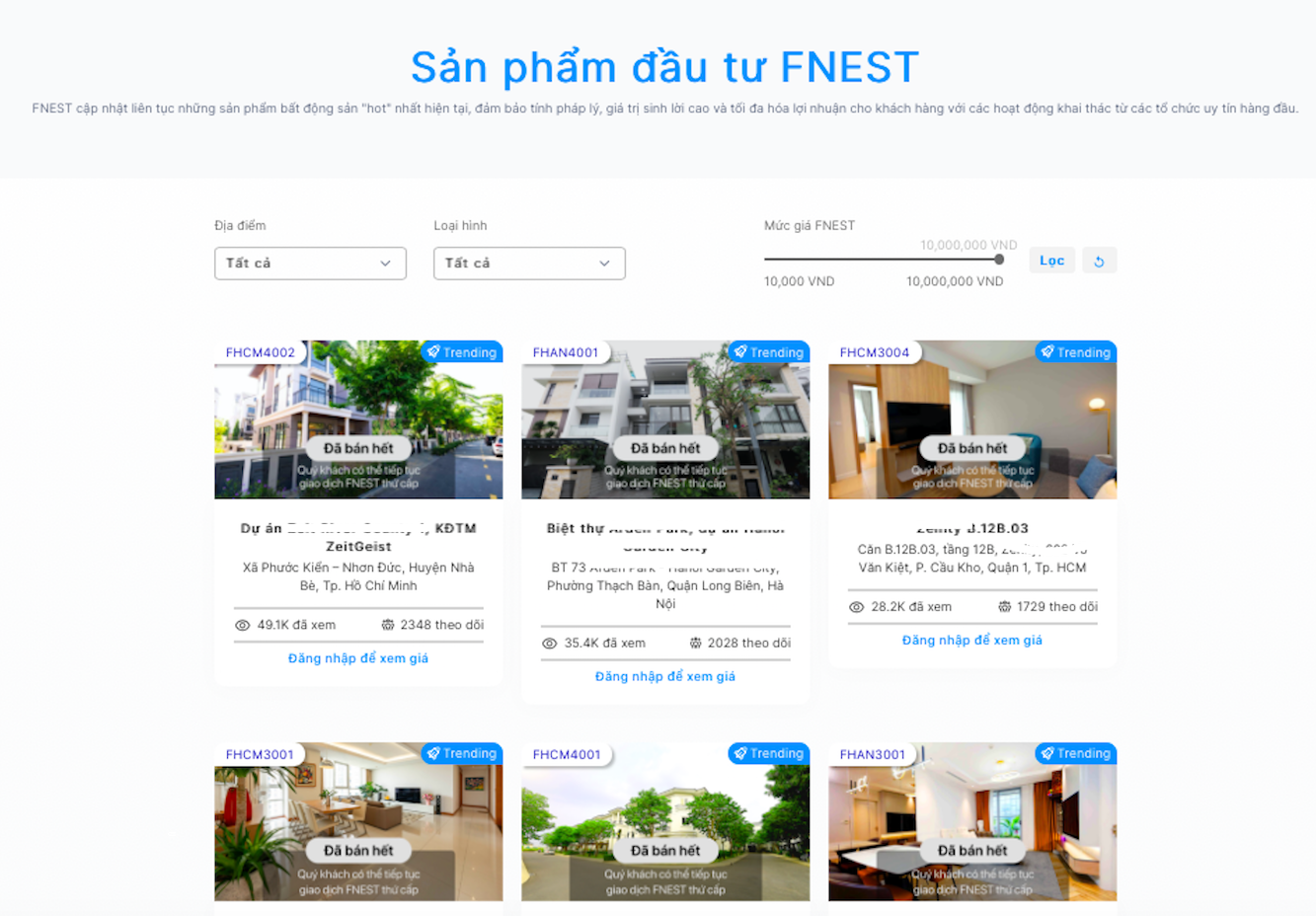

Recently, Fnest JSC provides real estate investment services through the SmartOne application of VPS Securities Company.

To participate, customers must be VPS investors. Accordingly, each real estate is valued by the business unit and converted into shares that can be sold to primary investors in the unit of Fnest. In which, 1 Fnest is equivalent to 10,000 VND. For example, a real estate valued at 25 billion VND will be equivalent to 2.5 million Fnest. The real estate portfolio that Fnest provides is quite diverse, from villas, shophouses, to apartments...

Talking to VietNamNet reporter , lawyer Mai Thao, TAT Law Firm assessed that the strength of this model is that it hits the right target, hitting the psychology of investors who do not have to invest much capital but can still invest in real estate as desired to own a part of real estate.

“In addition to adding a new look to the traditional real estate business model combined with 4.0 technology platforms with the promise of bringing more value to customers than the real estate business model, I think that creating such a “hybrid” form in the real estate market can easily cause instability in this business activity, and disputes can easily arise when there is no specific legal corridor to regulate it” - said lawyer Mai Thao, and believes that this is the disadvantage of this model that the parties involved in the transaction need to pay attention to, as well as state management agencies need to have necessary warnings for people when participating in the transaction.

Lawyers analyzed that, in essence, this type of business in the real estate market is a form of capital mobilization for enterprises. They consider real estate as a financial investment channel to attract money from the market in order to easily obtain working capital. Therefore, legally, in addition to the conditions that need to be ensured to bring real estate to the market, they have used the concept of "shares" which can easily mislead investors about their ownership of that real estate.

“In reality, investors only own a portion of the real estate value converted into money in the form of shares according to the agreement of the parties. Currently, the law does not have regulations on dividing real estate ownership into shares, so disputes over future ownership and management of real estate can easily arise,” said lawyer Mai Thao.

Regarding the value of profits and liquidity, the lawyer said that this only shows a one-way commitment from the unit selling the model without any guarantee measures for investors, so withdrawing capital when needed is difficult for small investors. In addition, service fees must be paid, and the management of the operating price of this model is also unclear and not transparent.

Who is responsible in case of dispute?

Regarding the issue of who is responsible in case of disputes related to investment real estate, lawyer Mai Thao said that the resolution is based on two mechanisms: Agreement and resolution at the court or arbitration.

Specifically, the basis for resolving disputes in this case will depend on the terms of the contract and other documents attached to the contract, if any. If the parties have clear regulations on the rights and responsibilities of the parties that do not violate the provisions of law, they will be applied. Relevant legal regulations will be considered to determine the responsibilities of the parties when participating in this model transaction when the two parties do not have specific regulations.

“Regarding the responsibilities, the two units, Fnest and the securities company, must take primary responsibility for resolving disputes to ensure the rights of investors, comply with regulations related to real estate and other relevant laws. If there is a violation, it will be resolved according to the contract dispute and compensation (if any) for investors when rights are violated,” said the lawyer.

Experts also pointed out that one of the problems of the model is real estate valuation. Accordingly, real estate valuation is an independent activity that helps parties have a basis for resolution when disputes arise or for investors to know their financial capacity to invest appropriately.

However, to limit disputes, experts recommend that investors should pay attention to checking the legal documents of the real estate by directly requesting the investor to provide them (Certificate of land use rights, house ownership, Construction permit, Minutes of project acceptance, etc.); the above information can be looked up at competent authorities such as the Department of Construction, Department of Natural Resources and Environment, and notary offices to check that the real estate is not in dispute, mortgaged, or guaranteed by the investor.

In addition, investors must also consider the terms of the investor's contract because the contract is an agreement between the parties according to the provisions of the Civil Code. If the specific branches of law do not have direct regulations, the Civil Code will apply.

In addition, it is necessary to consult with experts such as lawyers specializing in finance, investment, and real estate to have an objective view and evaluate the project. In case of disputes that require litigation or arbitration, it is necessary to consolidate the necessary evidence and apply emergency measures to avoid the dissipation of the investor's assets.

Source: https://vietnamnet.vn/hut-tien-dau-tu-nha-dat-chi-tu-10-000-dong-le-chua-quy-dinh-cam-bi-tuyt-coi-vi-sao-2293591.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

Comment (0)