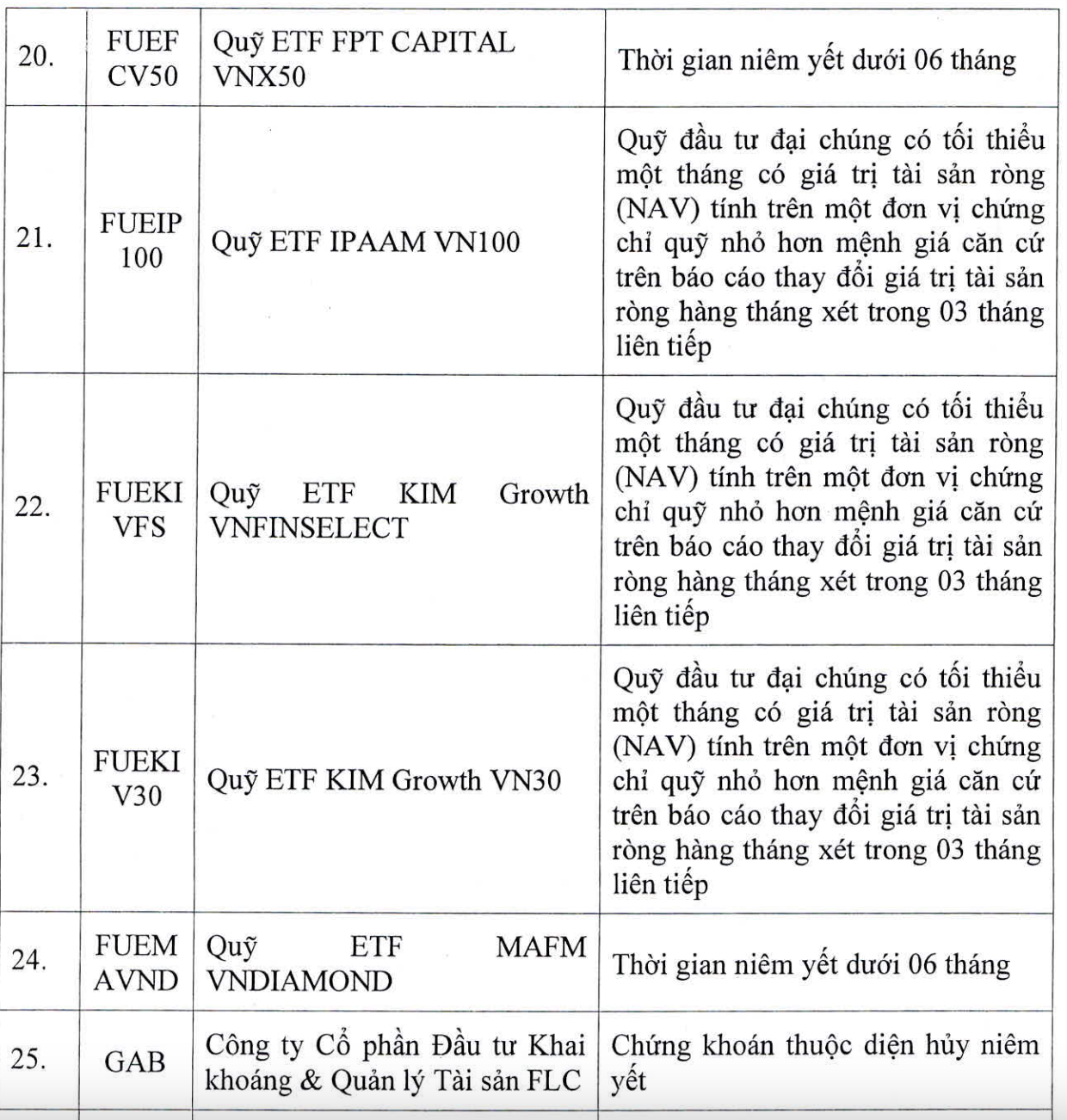

Recently, the Ho Chi Minh City Stock Exchange (HoSE) announced the list of securities ineligible for margin trading. Accordingly, there are 76 securities that are ineligible for margin trading in the third quarter of 2023, an increase of 2 compared to the number in the list announced at the beginning of the second quarter.

These are mainly familiar stocks that are under warning or control status, such as ABS, APC, AST, BCE, CIG, DXV, EVG, FDC, GMC, HVN, ITA, LDG, OGC, POM, PPC, PVP, SCD, SJF, TDH, TGG, TTF, VCA, VNL,...

VDS shares of Rong Viet Securities are the only securities company shares whose margin trading has been cut, due to the stock being under warning status and therefore ineligible for margin trading. HAG shares of Hoang Anh Gia Lai and HNG shares of HAGL Agrico also continued to have their margin trading cut in Q3 due to warning status from HoSE.

In addition, familiar names remain on this list, such as GAB and AMD from the FLC group, HBC from Hoa Binh Construction, HPX from Hai Phat, IBC from Apax Holdings, etc.

Some fund certificates have had their margin requirements cut on the HoSE.

In addition, the list of 76 stocks subject to margin cuts in Q3 also includes a number of fund certificates whose net asset value (NAV) per unit is less than the par value based on monthly net asset value change reports for three consecutive months (FUEKIV30, FUEKIVFS, FUEIP100, FUEDCMID, FUCVREIT, FUCTVGF3) or newly listed fund certificates such as FUEMAVND, FUEFCV50.

Some stocks, such as TTB and EMC, have had their margin trading suspended or delisted. These are all companies whose parent company's net profit attributable to shareholders/net profit after tax in their audited consolidated financial statements for 2022 was negative.

According to regulations, investors will not be allowed to use the credit limit (financial leverage - margin) granted by the brokerage firm to purchase 76 stocks that are on the list of securities ineligible for margin trading .

Source

![[Photo] Prime Minister Pham Minh Chinh receives the Governor of Tochigi Province (Japan)](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765892133176_dsc-8082-6425-jpg.webp&w=3840&q=75)

![[Image] Leaked images ahead of the 2025 Community Action Awards gala.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765882828720_ndo_br_thiet-ke-chua-co-ten-45-png.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh receives Lao Minister of Education and Sports Thongsalith Mangnormek](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765876834721_dsc-7519-jpg.webp&w=3840&q=75)

![[Live] 2025 Community Action Awards Gala](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F16%2F1765899631650_ndo_tr_z7334013144784-9f9fe10a6d63584c85aff40f2957c250-jpg.webp&w=3840&q=75)

![[Live] Closing Ceremony and Award Presentation for the "Impressive Vietnam Tourism" Video/Clip Creation Contest 2025](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/17/1765974650260_z7273498850699-00d2fd6b0972cb39494cfa2559bf85ac-1765959338756946072104-627-0-1338-1138-crop-1765959347256801551121.jpeg)

Comment (0)