| The United States initiated an administrative review of the anti-dumping duty order on honey from Vietnam. The United States concluded the final review of the anti-dumping duty order on wind towers from Vietnam. |

Specifically, according to the Department of Trade Remedies, Ministry of Industry and Trade , on August 14, 2024, the US Department of Commerce (DOC) posted a notice initiating an administrative review of a number of Vietnamese export products subject to anti-dumping/anti-subsidy taxes, including:

Steel Nails: Case code: A-552-818 (anti-dumping), review period: July 1, 2023 - June 30, 2024, case code: C-552-819 (countervailing duty), review period: January 1, 2023 - December 31, 2023.

Welded Stainless Pressure Pipe; Case Code: A-552-816 (anti-dumping); Review Period: July 1, 2023 - June 30, 2024.

Passenger Vehicles & Light Trucks Tires; Case number: C-552-829 (countervailing duty); review period: January 1, 2023 - December 31, 2023.

|

| The Trade Defense Department recommends that product manufacturing/exporting enterprises properly and fully comply with the requirements of the US investigation agency. Illustrative photo |

According to US law, within 35 days from the date of publication of the notice of initiation of the review (expected September 18, 2024), the US Department of Commerce will select enterprises as mandatory defendants in the cases based on the export volume of the enterprises from high to low according to data from the US Customs and Border Protection (CBP) or the Q&V questionnaire.

According to the regulations, in case the manufacturing/exporting enterprise is listed in the review list in the initiation notice but has no export activities during the review period, the enterprise must notify the US Department of Commerce within 30 days from the date of publication of the initiation notice (expected to be September 13, 2024). In addition, within 90 days from the date of publication of the initiation notice, the parties can withdraw their review request (expected to be November 12, 2024).

In addition, for countries that the United States considers to be non-market economies such as Vietnam, in order to enjoy separate tax rates, enterprises must apply for separate tax rates within 30 days from the date of publication of the notice of initiation of review (expected September 13, 2024). In case the enterprise does not apply for separate tax rates and is not selected as a mandatory respondent, the enterprise may be subject to the nationwide tax rate.

The US Department of Commerce plans to issue its review conclusions no later than July 31, 2025, according to the Trade Remedies Authority. In the coming time, DOC will request information from the parties to select a replacement country and value for Vietnam, issue a Quantity and Value questionnaire and a questionnaire for mandatory respondents.

To ensure the legitimate rights of enterprises, the Trade Defense Department recommends that enterprises producing/exporting related products continue to update the developments of the case; properly and fully implement the requirements of the US investigation agency, and closely coordinate with the Department throughout the process of the case.

Notice see here

Source: https://congthuong.vn/hoa-ky-khoi-xuong-ra-soat-hanh-chinh-thue-chong-ban-pha-gia-san-pham-xuat-khau-cua-viet-nam-340305.html

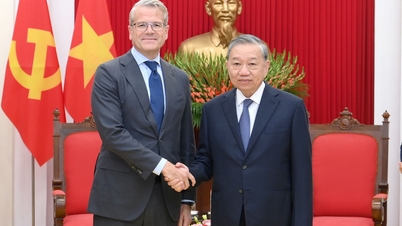

![[Photo] General Secretary To Lam receives Slovakian Deputy Prime Minister and Minister of Defense Robert Kalinak](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/18/1763467091441_a1-bnd-8261-6981-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and his wife meet the Vietnamese community in Algeria](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/19/1763510299099_1763510015166-jpg.webp)

Comment (0)