Vietnam's financial market has made remarkable progress in recent times, playing an increasingly important role in the economy . In addition to the banking system, the financial system has also developed more comprehensively and diversified with the stock market, insurance and other non-bank financial institutions.

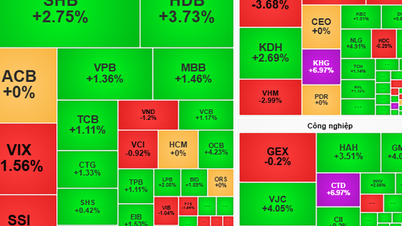

The colorful financial picture

According to the Banking University of Ho Chi Minh City, since Vietnam's Financial Development (FD) index was published in the data of the International Monetary Fund (IMF), it can be seen that in the period 1992-2021, Vietnam's FD index has tended to increase. In 2021, this index reached 0.38 points, ranked 59/183 countries and only behind the group of European countries (0.5 points) and the group of developed markets (0.62 points); higher than the world average (0.32 points) and much higher than the group of low-income and developing countries (0.15) in terms of the overall level of development of the financial system. In the ASEAN region, Vietnam's level of financial development according to the FD index is equivalent to the Philippines (0.38 points) and has a large gap compared to Thailand (0.73 points), Malaysia (0.73 points) and Singapore (0.7 points).

Private sector credit to GDP has grown strongly in the past 15 years, from 82.87% of GDP (2008) to 132.75% of GDP (2003). Vietnam's private sector credit to GDP ratio is among the highest in the world, while the insurance premium to GDP ratio, investment fund asset ratio to GDP, and pension fund asset ratio to GDP are very low, showing great pressure on the commercial banking system in particular and credit institutions in general.

Regarding the ability to access financial institutions and financial markets, the system of Vietnamese credit institutions in the past 15 years (2006-2021 period) has had a significant growth in the number of ATMs (8 times) and a certain growth in the number of bank branches towards maximum access for customers in providing financial products and services.

From an organizational perspective, Vietnamese financial institutions, specifically the banking sector, operate quite effectively and at a high level compared to other countries in the ASEAN region. However, from a market perspective and from non-bank financial institutions, Vietnam's operational efficiency needs to be improved in the future.

The scientific report of Dr. Nguyen Anh Vu - Dr. Trieu Kim Lanh (Banking University of Ho Chi Minh City) also stated that Vietnam's financial system has grown quite strongly in the past 15 years.

Credit increased 3.5 times (2013-2023 period); insurance premium revenue increased 10.7 times; market capitalization and stock trading value increased on average 25 times. However, the in-depth development of the three main pillars: banking, insurance and securities is still uneven. Capital flows in the economy circulate mainly in the banking sector.

Specifically, in 2023, credit accounted for 136.9% of GDP, while the insurance sector only accounted for an average of about 2% of GDP, the capitalization value and trading scale on the stock market were relatively large (58.08% and 43.02% of GDP), but the scale of capital mobilization from the stock market was still limited, the ratio of total assets of investment funds to GDP was only 0.65%, and voluntary supplementary pension funds were still in the formation stage with a small scale.

This shows that the level of capital concentration and dependence on capital supply for the economy is still undertaken by the banking system. The room for development of the insurance sector and the stock market in the future is still quite large and full of potential.

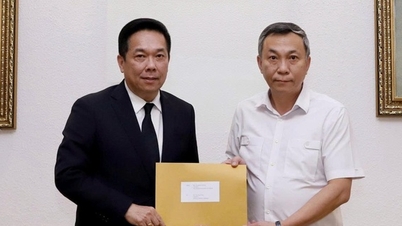

Vietnam's banking sector is assessed to operate quite effectively and at a high level compared to other countries in the region. Photo: LAM GIANG

Finding solutions to develop capital markets

Faced with these realities, Banking University of Ho Chi Minh City organized a scientific conference (FINHUB 2024) with the theme "Sustainable development of Vietnam's financial market", an event sponsored by Nguoi Lao Dong Newspaper.

The official seminar held on July 18 will gather experts from many universities, research institutes, financial institutions, associations and management agencies. Experts will share and discuss research results, as well as business practices and management practices of the overall Vietnamese financial market.

"With the gathering of a team of prestigious experts, FINHUB 2024 will contribute to assessing the current situation, potential, identifying risks, thereby proposing solutions for sustainable and comprehensive development of the Vietnamese financial system, ensuring capital needs for economic development, ensuring safety, system stability and social security" - Associate Professor, Dr. Nguyen Duc Trung, Principal of Banking University of Ho Chi Minh City, said.

According to Dr. Nguyen Anh Vu - Head of the Finance Department of Banking University of Ho Chi Minh City, Deputy Head of the FINHUB 2024 Organizing Committee - the reports at the conference will focus on discussing a number of main contents such as: Overall assessment of the scale, structure, and level of financial development in Vietnam; assessment of the current state of operations, identification of risks and development potential of the system of credit institutions, stock market, and insurance; market discipline and financial system supervision model; impact of external shocks and internal issues on the Vietnamese financial market.

Experts will also present solutions for developing the capital market and non-bank financial institutions; solutions for upgrading the Vietnamese stock market; financial innovation and the development of new financial products and services; green finance, sustainable finance and sustainable financing methods; financial integration and solutions for building an international financial center in Vietnam, digital transformation and technology application in the financial sector.

According to Associate Professor, Dr. Nguyen Duc Trung, FINHUB 2024 is organized according to a model that closely combines scientific content and practical value. Launched in early 2024, FINHUB 2024 has attracted the attention and participation of scientists from all over the country.

After going through the independent review round, 28 articles with the best quality were approved for publication in the full text of the proceedings. The articles will continue to be selected for publication in the Asian Journal of Banking Economics (AJEB).

Source: https://nld.com.vn/hien-ke-phat-trien-thi-truong-tai-chinh-viet-nam-196240717193450573.htm

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting to discuss solutions to overcome the consequences of floods in the central provinces.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/29/1761716305524_dsc-7735-jpg.webp)

![[Photo] Hue: Inside the kitchen that donates thousands of meals a day to people in flooded areas](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/29/1761738508516_bepcomhue-jpg.webp)

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Video] 24-hour news on October 29, 2025: Prime Minister Pham Minh Chinh: No one in the Central region will be left hungry or cold due to floods](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/29/1761743011202_z7168421557697-8aba01bb34381f15c3b1423843c0e51f-jpg.webp)

![[Infographic] Vietnam's socio-economic situation in 5 years 2021-2025: Impressive numbers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/29/1761730747150_anh-man-hinh-2025-10-29-luc-16-38-55.png)

![[Live] Concert Ha Long 2025: "Heritage Spirit - Brightening the Future"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/29/1761743605124_g-anh-sang-am-thanh-hoanh-trang-cua-chuong-trinh-mang-den-trai-nghiem-dang-nho-cho-du-khach-22450328-17617424836781829598445-93-0-733-1024-crop-1761742492749383512980.jpeg)

Comment (0)