The Red Sea is not over yet.

The importance of the Red Sea shipping route to global trade is immense. But for more than six months now, Houthi forces from Yemen have been attacking ships passing through the area if they believe the owner or operator has ties to Israel.

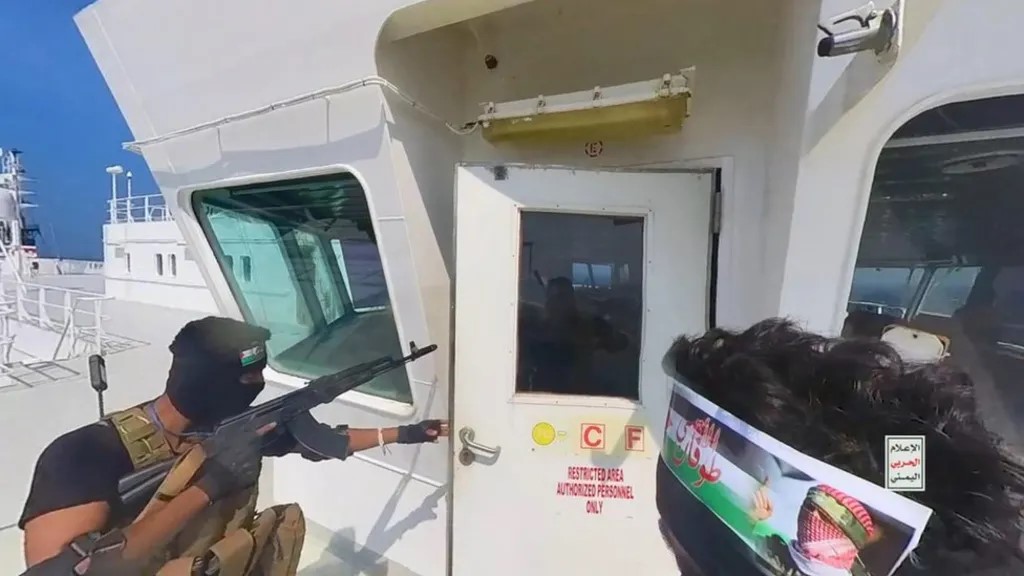

Houthi fighters boarded a British-owned and Japanese-operated ship in the Red Sea late last year. Photo: BBC

The attacks come as Israel waged war against the militant group Hamas in Gaza. The Houthis have attacked Israeli-linked ships in the Red Sea in a show of solidarity with the Palestinians. For example, on June 20, the Houthis, who claim to be fighting for Palestinian rights and justice, sank a coal ship in a drone strike.

In response to Houthi attacks in the Red Sea, US and UK military vessels have repeatedly targeted these positions in Yemen over the past several months. In addition, warships from two international coalitions are operating in the area to secure maritime traffic along the Yemeni coast.

Houthi forces in Yemen seized the Galaxy Leader while it was passing through the Red Sea, claiming it belonged to an Israeli businessman. Photo: DW

At the end of February, the European Council (EC) also decided to launch “Operation Aspides” to ensure maritime security in the Red Sea region, with 19 EU countries participating and 4 of them sending warships to protect merchant ships.

However, these efforts are not enough to prevent Houthi attacks. Because US and EU warships need to consider between opening fire and compromising to limit the escalation of the conflict as well as ensure the highest safety of the crew.

In addition, airstrikes by the US and its allies against Houthi weapons facilities have not been effective, as the group still has many missiles and UAVs to continue attacking ships passing through the Red Sea.

Shipping costs are up again

Global trade has been under intense pressure since the Israel-Hamas war broke out last October. The secondary conflict in the Red Sea has led to higher shipping costs and increased costs for insuring commercial cargo.

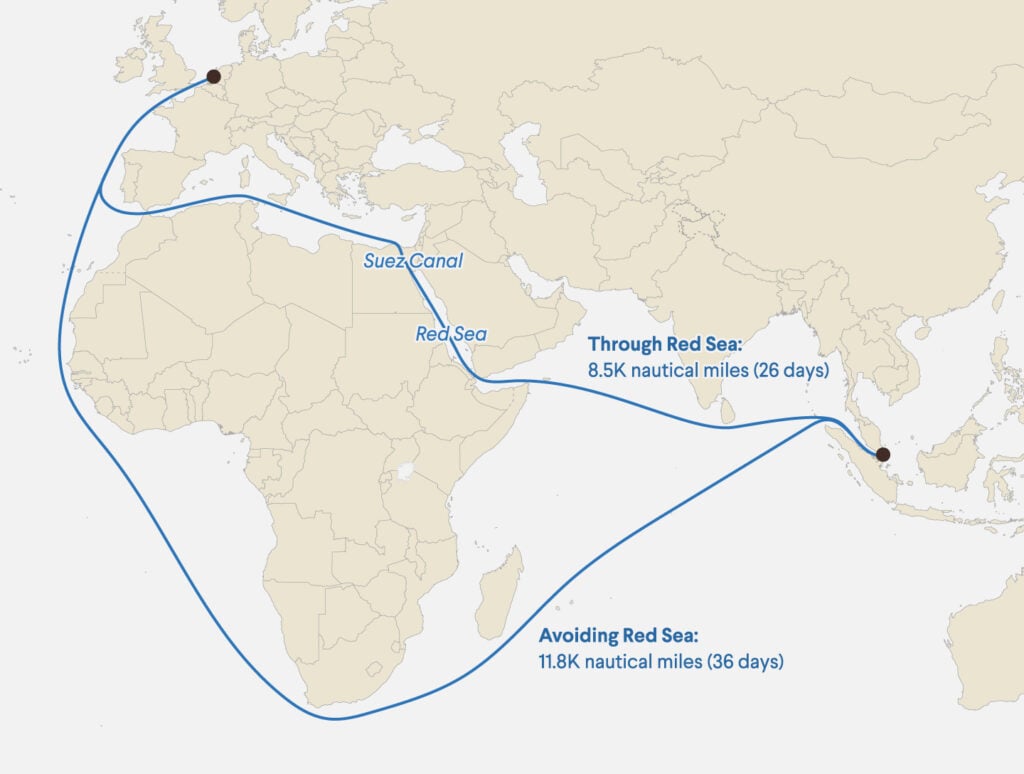

The need for ships to go around the Cape of Good Hope has significantly increased travel times and led to higher fuel consumption. Photo: ICIS

Ship owners face higher insurance premiums as the risk of losing their vessels has increased significantly, especially in the Red Sea. Furthermore, moves to avoid the Suez Canal for safety reasons and instead sail around the Cape of Good Hope have significantly increased travel times and led to higher fuel consumption.

Drewry World Container Index, which tracks global freight markets, reports that in the third week of June alone, the cost of shipping a standard 40-foot container increased by 7%, resulting in a staggering 233% increase compared to the same period last year.

Find safer routes

Shipping companies are being forced to become more flexible, said Simon MacAdam, an analyst at London-based financial consultancy Capital Economics.

“Shipowners seem to have adapted quite well to the situation, given the restrictions on using the Suez Canal,” acAdam told DW, adding that costs had fallen this spring “after spiking in January.”

But now “freight rates are starting to rise again”, suggesting there is no reason to expect any reduction in costs.

“Another driver seems to be that importers are now increasing orders to ensure they have enough stock to last through the year. But with ships having to reroute around the Cape of Good Hope, prices are likely to rise further,” said Capital Economics.

More ships needed

Jan Hoffmann, a trade expert at the United Nations Conference on Trade and Development (UNCTAD), also blamed longer travel times in Africa for the increased costs.

The Panama Canal Authority has cut the number of ships allowed to pass through each day to 22, about 60% of normal. Photo: ET

“Going around South Africa requires more ships to maintain supply. The average distance a container travels in 2024 will be 9% further than in 2022,” he told DW.

As ships spend more time at sea, they need more space, Hoffmann said. That means shipping companies have to charter or buy more ships and hire more staff. “And because these ships don’t exist yet, freight rates are naturally going up,” he said.

Hoffmann also pointed to another unintended side effect of longer shipping routes: increased greenhouse gas emissions. “Ships have increased their speeds, leading to increased emissions, with an increase of up to 70% on the Singapore-Rotterdam route, for example.”

From the Suez Canal to the Panama Canal

In addition to safety concerns in the Middle East, global trade is also being hampered by low water levels in the Panama Canal due to climate change, Hoffmann said.

When drought gripped the Central American country last year, the Panama Canal Authority cut the number of ships allowed to pass through each day to 22, about 60% of normal, meaning the vital waterway was not being used to its full capacity.

As a result, US carriers have had to integrate what he calls “land bridges” into their sea routes with East Asia, meaning they have had to move goods across the US by rail or road from West Coast ports to ports on the US East Coast.

Mr Hoffmann added that shipping bulk commodities such as wheat or liquefied natural gas (LNG) via the US is not economically viable, leaving shippers with no choice but to take a very long and dangerous detour around Cape Horn at the southern tip of South America.

But Simon MacAdam still sees some light at the end of the tunnel when it comes to a return to normal Panama Canal shipping operations.

Water levels in the canal have "recovered somewhat" in recent months, he told DW, and the La Nina weather phenomenon will "ease things even further soon." MacAdam added that a slight rise in water levels in the Panama Canal has increased cargo traffic there.

The crisis is not over yet

According to Bloomberg news agency, about 70% of commercial activities on the Red Sea are still being diverted through Africa.

The diversions around Africa have slowed ship schedules, forcing shipping lines to cancel some sailings and divert vessels from other parts of the world to fill the gap in service. The disruptions have also left containers stranded at ports around the world and led to shortages in export hubs like China.

The Port of Singapore, a global container shipping hub, has been overwhelmed, leading to long waiting times for berths and high shipping costs. The average time at the Port of Singapore increased 15% from mid-April to mid-June, to nearly 40 days, according to Port Performance data from S&P Global Market Intelligence.

The port of Singapore, a global hub for container routes, has been overloaded, leading to long wait times for a berth, driving up shipping costs. Photo: Bloomberg

The bottlenecks are complicating logistics for retail and manufacturing goods, but importers and exporters say they are most concerned that the congestion could widen as demand increases in the coming months, entering the busy peak season for the transport industry.

A prolonged crisis could put pressure on shipping companies and continue to significantly increase freight rates, said Simon MacAdam, an analyst at Capital Economics.

“Shipbuilding takes years and 90 percent of new containers are built in China. Higher capacity cannot be achieved overnight,” MacAdam told DW, warning that the industry’s crisis could get “even worse.”

Quang Anh

Source: https://www.congluan.vn/tu-suez-den-panama-hang-hai-toan-cau-van-lao-dao-vi-xung-dot-va-bien-doi-khi-hau-post302957.html

![[Photo] General Secretary To Lam receives leaders of typical Azerbaijani businesses](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/998af6f177a044b4be0bfbc4858c7fd9)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)