In 2024, 2 out of 4 zero-dong banks were compulsorily transferred. Controlling the difference between SJC gold bar price and world gold price within a suitable range has also been achieved.

At the Conference on Banking Tasks Implementation in 2025 held on December 14, the State Bank of Vietnam (SBV) said that the SBV has made important progress in handling weak banks. In 2024, two out of four zero-dong banks were compulsorily transferred. The remaining two banks are being submitted to competent authorities for early approval in 2024.

In managing gold trading activities, with the attention and direction of the Government, the synchronous solutions of the State Bank and the coordination of relevant ministries and branches, up to now, the initial basic goal of handling and controlling the price difference between SJC gold bars and world gold prices within a suitable range has been achieved.

According to the report, as of December 13, credit in the entire economy increased by about 12.5% compared to the end of 2023. Credit is focused on production, business, and priority sectors. Meanwhile, the lending interest rate has decreased by about 0.96%/year compared to the end of 2023.

To facilitate credit institutions to provide capital for the economy, on December 31, 2023, the State Bank assigned all credit growth targets for 2024 to credit institutions and publicly announced the determination principles so that credit institutions can proactively increase credit growth.

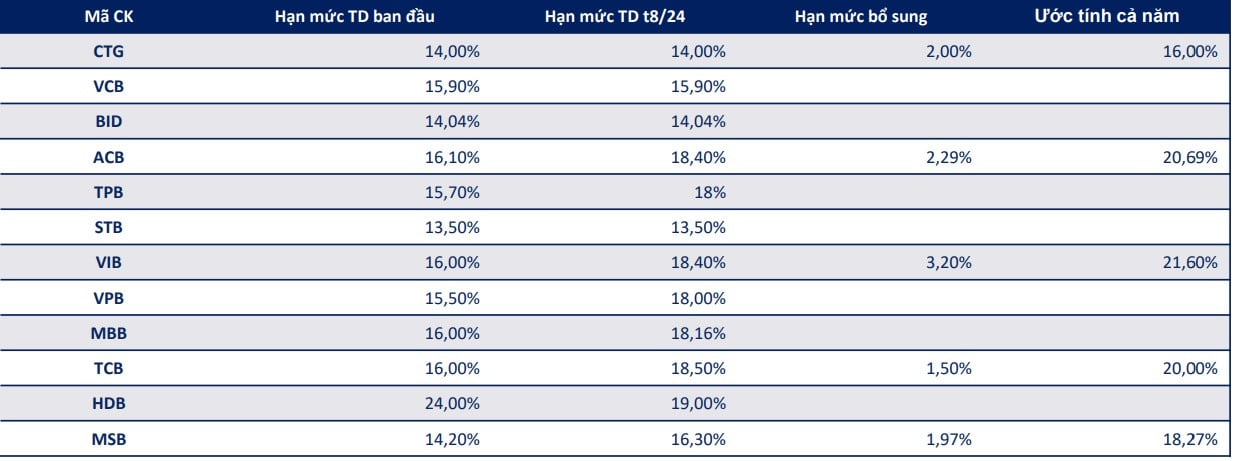

In 2024, the State Bank of Vietnam (SBV) has twice proactively adjusted the credit growth target for credit institutions, on August 28 and November 28, according to specific principles, ensuring publicity and transparency in the context of well-controlled inflation and to promptly provide capital for the economy, supporting production and business development.

Specifically, in the most recent adjustment on November 28, the State Bank continued to grant additional credit limits to banks that had used 80% of the granted limits with the determination to complete the credit growth target of 15%.

Based on the actual credit growth and asset quality of banks, according to a recent report issued by SHS Securities Company, it is estimated that 5 banks have just had their credit room expanded, including: VietinBank added 2%, estimated credit growth for the whole year to 16%; ACB added 2.29%, up to 20.69%; VIB added 3.2%, up to 21.6%; Techcombank added 1.5%, up to 20% and MSB added 1.97%, up to 18.27%.

Being granted additional credit room helps the above banks expand their business scale, when credit demand is often high at the end of the year.

In fact, the private banking group, especially the corporate lending group, has a higher credit growth rate than the state-owned banking group. Banks such as Techcombank, HDBank or LPBank have all exceeded the annual limit and have also had their credit room expanded before.

In the private retail banking group, VPBank's credit growth was 9% (55% of the limit), quite low compared to other commercial banks in the group. The reason partly comes from the fact that VPBank continues to proactively reduce corporate bond (TPDN) balance when the first 9 months of the year recorded a 47% decrease in TPDN balance, down to VND 18,442 billion after a 20% decrease in 2023. Meanwhile, VPBank's consolidated customer loans increased by 12.2% (same period in 2023 increased by 19%).

In addition, according to the report, outstanding corporate bonds (TPDN) at 27 listed banks at the end of the third quarter of 2024 were VND 173,546 billion, down 10% compared to the beginning of the year, accounting for 1.53% of total outstanding credit.

The group of state-owned banks has a fairly low proportion of corporate bonds held, less than 1% of total credit. In the group of private banks, ACB and VIB have an insignificant proportion of corporate bonds held, LPBank does not even hold corporate bonds.

Some banks have a very high ratio of corporate bonds/credit, led by Techcombank (about 5%), followed by TPBank, MB, HDBank, VPBank, Sacombank, OCB.

However, these banks are also reducing the proportion of corporate bonds held. At the end of the first 9 months of 2024, Techcombank decreased by 31.2% compared to the same period, down 21.9% compared to the beginning of the year; TPBank decreased by 23.7% compared to the same period, down 0.49% compared to the beginning of the year; MB decreased by 14.1% compared to the same period, down 9.78% compared to the beginning of the year; VPBank decreased sharply by 52.8% compared to the same period, down 47.21% compared to the beginning of the year. Only HDBank increased by 79.65% compared to the same period and up 31.82% compared to the beginning of the year.

Source: https://vietnamnet.vn/hai-ngan-hang-da-duoc-chuyen-giao-bat-buoc-kiem-soat-chenh-lech-gia-vang-sjc-2352341.html

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

Comment (0)