Improved personal finance management tools

A recent survey from Techcombank shows that most modern users still face certain financial pressures every day. The reasons are the lack of useful management tools (26.5%), not having much time to learn (22.9%), lack of financial knowledge (16.9%) and lack of confidence in their income (44.6%).

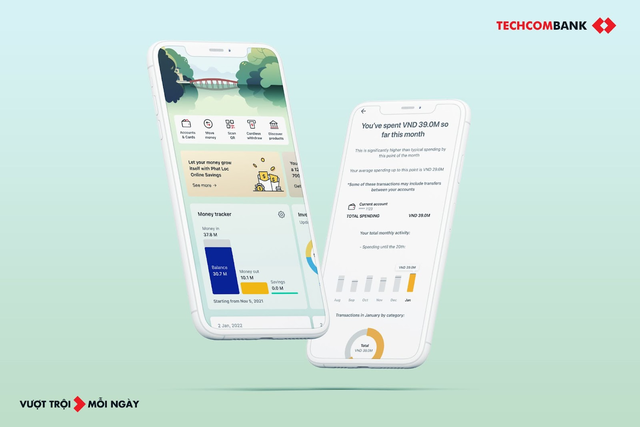

Understanding that, Techcombank has joined hands with Personetics to help customers manage their personal finances better, thanks to the support of AI technology. Techcombank representative said that through analyzing the financial transaction history and behavior of each customer, the system will provide useful advice such as saving "tips", recommending suitable financial products, or consulting on asset growth.

Not only that, this feature also promptly warns users of excessive spending or unexpected payments, helping customers increase their financial health as well as achieve their goals independently.

Initial results show that, with 10,000 customers participating in the experience journey, Techcombank received outstanding figures in just 3 weeks such as savings balance increased by 9%; the average rate of customers logging into the application increased from 14.2 times (compared to before the pilot period) to 77.3 times (during the implementation period); the number of installment transactions increased by 43.7% with the total installment value increasing by 32%.

Sharing about the personal financial management tools that Techcombank has been developing, Mr. Pranav Seth, Director of Digital Transformation Office at Techcombank, said: " At Techcombank, we aim to "revolutionize" the way customers manage their finances. We believe that personalized financial solutions based on in-depth analysis of customers' spending behavior are key factors to help them make smarter decisions and achieve financial strength ."

Techcombank and Personetics bring technology into the journey of financial personalization

Ms. Huyen, 30 years old, a freelancer, shared her experience with Techcombank's new tool: "With an unstable monthly income, the application has helped me track all monthly expenses and at the same time provided useful advice on payments or investments, helping me easily make informed decisions to optimize my finances."

Minh, 40, an executive, also uses Techcombank Mobile to optimize his investments. With advanced AI technology, Minh receives personalized advice on savings or investment products that suit his needs, financial goals, and risk appetite.

With the initial results achieved, Mr. Santhosh Mahendiran, Director of Data and Analysis at Techcombank, share more: " Combining the power of data and deep customer insights with Personetics has given us a great opportunity to design unique customer journeys. In a world where any product can be easily copied, what differentiates banks is how we use data and deliver unique experiences to each customer ."

Open up opportunities for long-term cooperation

Pioneering in pursuing a "customer-centric" strategy, Techcombank believes that cooperating with leading partners such as Personetics and Adobe will help the bank continue its efforts to bring breakthrough and comprehensive financial solutions to enhance the experience as well as enhance the living values for millions of Vietnamese customers in the future.

Commenting on the partnership, David Sosna, CEO and co-founder of Personetics, said: " We are also very excited to look forward to the next phase of this partnership, continuing to accompany Techcombank in improving the financial experience for customers and positively transforming the bank's business results with each key customer segment ."

“ From identifying new investment and savings opportunities to managing personal expenses, our ultimate goal is to empower customers with proactive control and unprecedented convenience. Partnering with Personetics marks a significant milestone in Techcombank’s long-term vision of ‘enhancing the value of life’ by providing a ‘personalized’ financial experience for each customer ,” said Mr. Pranav Seth.

Mr. Pranav shares about the cooperation between Techcombank and Personetics

Pioneering in digital technology to optimize financial experiences for customers, Techcombank Mobile application has recently received consecutive prestigious awards from international organizations:

- Celent Model Wealth Manager Award (Celent)

- Asia's Most Customer Engagement Bank Award (IDC)

- Best Digital Banking Model Award in Asia Pacific and Vietnam (The Asian Banker)

The above awards are a great recognition and encouragement for Techcombank to continue its efforts to bring outstanding personalized experiences on digital banking applications to all customers.

About Personetics: is a world-leading company providing personalized solutions and enhanced customer engagement based on collected and analyzed financial data. Serving nearly 130 million customers globally, Personetics currently works with more than 100 financial institutions and digital banks across 32 markets in North America, Europe and Asia such as US Bank, Metro Bank, UOB.

Visit https://bit.ly/TCBM_PR to experience Techcombank Mobile.

Source link

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)