Many opinions say that the preferential housing credit package for young people aged 35 and under, if implemented, will create great social security opportunities. However, should there be a separate fund or should it be combined with existing preferential credit packages?

People are excited, businesses are happy

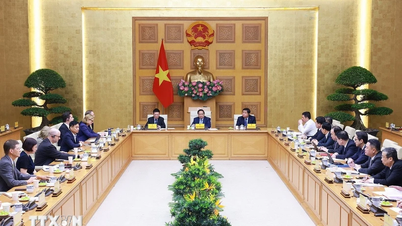

At a conference with commercial banks on February 11, Prime Minister Pham Minh Chinh requested the State Bank and commercial banks to study and continue to have preferential credit packages for both supply and demand to develop social housing, housing for young people aged 35 and under, and housing for disadvantaged groups.

This information immediately gave Ms. Minh Thu (30 years old) a "glimmer" of hope that she and her husband would have the opportunity to buy a house in Hanoi after nearly ten years of living and working in the capital.

According to Ms. Thu, house prices are increasing day by day, buying a house is too difficult with the couple's income of just over 30 million VND per month. If there is a preferential credit package for home loans with low interest rates for young people, it will be a great opportunity for many people like her and her husband to realize their "dream of settling down".

From a business perspective, sharing with VietNamNet reporter, Mr. Vu Kim Giang, Chairman of the Board of Directors of SGO Group Joint Stock Company (SGO Group), said that if there is a preferential credit package for both supply and demand for housing development for young people aged 35 and under at this time, it will have a very positive impact on the real estate market. When the supply is diverse, with many segments for buyers to choose from, the market will develop sustainably.

According to Mr. Giang, the previous preferential credit package of 30,000 billion VND not only provided loans for social housing but also for low-cost commercial housing, which helped many people access capital and buy houses. Now, if there is a loan package that ensures reasonable interest rates and a long-term loan of at least 10 years, it will be very good for buyers.

“For businesses, to develop commercial housing projects, if they can borrow capital with a stable interest rate for about 5-10 years, at 8%/year; it will certainly reduce production costs, thereby having a more suitable house selling price.

As for young people aged 35 and under, when borrowing to buy a house, there should be maximum incentives; the interest rate can be equivalent to the interest rate for buying social housing, about 5-6% is reasonable," said Mr. Giang.

Should there be a separate fund or should it be combined with existing preferential credit packages?

“The preferential credit package for young people aged 35 and under to buy houses, if implemented, will create great social security opportunities for many young people today. This is the main labor group, if given priority and stable housing, they will be assured to develop their capacity, contributing to socio-economic development,” Mr. Pham Duc Toan, General Director of EZ Property, shared with VietNamNet.

However, according to Mr. Toan, there should be a separate fund for lending, not using loan packages from commercial banks.

“The previous VND30,000 billion package was a real incentive package, many people could access capital. Therefore, there needs to be a separate package to create conditions for both businesses and home buyers to easily access. For units borrowing to develop social housing, they should base their loans on investment efficiency, not on strict regulations that make it difficult for businesses.

Similar to home buyers, loan procedures also need to be less complicated and troublesome; loan terms need to be longer, possibly up to 30 years to reduce the monthly payment. An average interest rate of 5%/year would be reasonable. How can young people buy a house, each month only having to pay principal and interest of about 6-8 million VND would be best. A couple with an income of about 30 million VND/month, raising two children, and paying a home loan of over ten million VND/month is difficult to do," Mr. Toan analyzed.

In addition, according to the General Director of EZ Property, it is necessary to remove legal and institutional bottlenecks to encourage each locality to have the motivation to develop social housing, housing for young people... thus creating a diverse supply source.

Considering that giving incentives to young people and people in difficulty to borrow at low interest rates to be able to own a house is a very humane issue and should be implemented, Associate Professor, Dr. Dinh Trong Thinh, an economic expert, suggested that implementing these loans could be combined with home loan packages such as the 145,000 billion VND credit package for social housing loans of commercial banks or the loan package of the Social Policy Bank that is lending to disadvantaged families.

“It would be difficult to establish a fund to lend specifically to young people under 35. It needs to be considered properly so that preferential capital is not dispersed. It is possible to add young people aged 35 and under as a priority group to buy social housing,” Mr. Thinh suggested.

Source: https://vietnamnet.vn/goi-tin-dung-uu-dai-nguoi-tre-mua-nha-lai-suat-nen-the-nao-vay-tu-dau-2370797.html

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

Comment (0)