Enterprises still depend on internal financing for investment, need to improve access to finance for small and medium enterprises.

Associate Professor, Dr. Tran Hung Son - Director of the Institute for Banking Technology Development Research (University of Economics and Law) presented the paper Bank credit for sustainable growth at the conference - Photo: QUANG DINH

Associate Professor Dr. Tran Hung Son - Director of the Institute for Banking Technology Development Research (University of Economics and Law) made this statement at the workshop 'Using capital effectively to promote economic growth' organized by Tuoi Tre newspaper on the morning of February 28.

Vietnam's credit scale is at a critical point.

"Over the past two decades, Vietnam's economic growth has been accompanied by the growth of bank credit, including credit for the private sector," said Associate Professor Dr. Tran Hung Son, Director of the Institute for Banking Technology Development Research, University of Economics and Law.

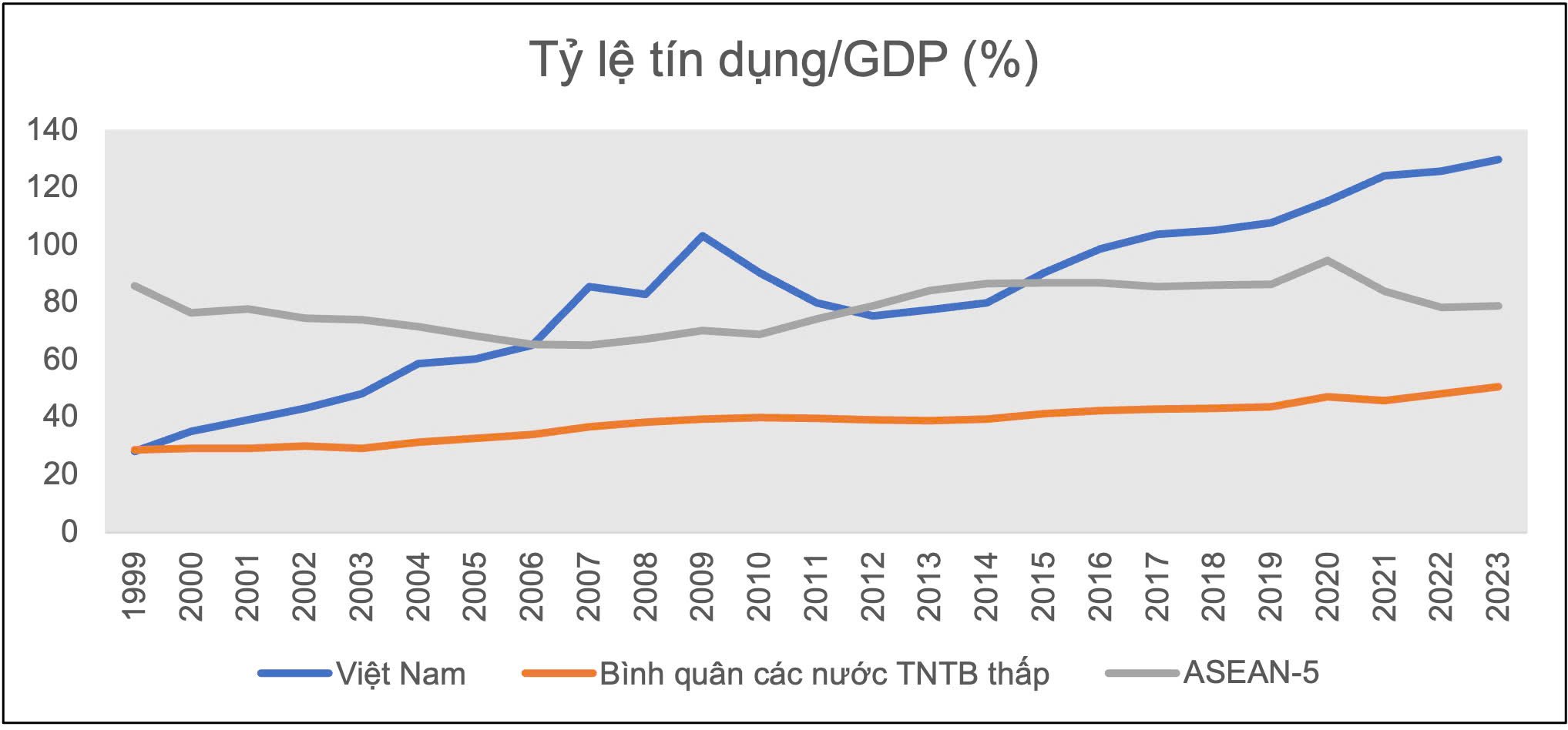

Specifically, the average credit growth rate in the past 10 years is more than 14%, 2.4 times higher than the GDP growth rate. Vietnam's credit/GDP ratio reached more than 136% last year, higher than ASEAN-5 countries and countries with the same level of development.

Vietnam's credit/GDP ratio is higher than that of ASEAN-5 countries and countries with the same level of development.

However, according to research by the Bank for International Settlements (BIS, 2024) in emerging economies in Asia, if the credit/GDP ratio exceeds the threshold of 130%, credit will restrain growth.

Meanwhile, Vietnam's average economic growth in the past two decades reached its highest level, the credit/GDP ratio reached nearly 100% and tended to decline when the credit/GDP ratio exceeded this threshold.

"Vietnam's credit scale is at a critical point," Associate Professor Dr. Tran Hung Son emphasized.

Financial constraints make business ineffective

In the context of financial constraints of enterprises being moved from lower level to higher level, Associate Professor Dr. Son said: On average, the ROA ratio (net profit on assets, measuring the ability to generate profit per dong of assets) decreased by about 2%, the revenue/investment ratio decreased by 33 dong.

It can be seen that the more financially constrained a business is, the higher its borrowing costs will be. Specifically, across each group, the average increase is 3%.

"If financial constraints for businesses can be reduced, we can expect a boom in long-term investment, increasing economic growth for Vietnam," Associate Professor Dr. Tran Hung Son said.

'If financial constraints for businesses can be reduced, we can expect a boom in long-term investment, increasing economic growth for Vietnam' - Photo: QUANG DINH

However, in reality, Mr. Son pointed out, the scale of bank credit is approaching a threshold point of continued increase, which could have a negative impact on economic growth.

Not to mention the underdeveloped capital market, which limits the long-term funding sources of enterprises. Enterprises still depend on internal funding for investment, and it is necessary to improve access to finance for small and medium enterprises.

"Access to finance is not currently a strong constraint on growth. But it is very likely to be a key constraint when the economy enters a high growth phase," said Mr. Son.

Credit trends 2025 and the coming period

Regarding credit trends in 2025, experts believe that the focus is on the following areas: processing industry, manufacturing, seafood, services, and high-tech applications. In contrast, credit is limited in the real estate and construction sectors.

Vietnam's growth model based on manufacturing and processing industry has achieved certain achievements. However, trade in manufactured goods has stagnated, cross-border trade in services - especially digital services - has increased in the period 2025-2045. Therefore, it is necessary to focus on services and manufactured goods that bring high added value.

Credit policy in the coming period needs to focus on service industries with global innovation such as information and communication technology, professional activities, science and technology inputs for the processing sector, increasing productivity of the industry and the economy.

Efforts to improve access to capital for businesses

Workers working in a seafood processing company - Photo: THE KIET

Regarding policy suggestions to increase the effectiveness of short-term credit, Associate Professor Dr. Son said it is necessary to improve access to capital for businesses, especially small and medium-sized enterprises.

Through the establishment and development of credit information centers with new digital technology applications. Development of digital lending platforms. Rapidly promulgating Sandbox for financial technology.

At the same time, combine growth momentum from bank credit with public spending, especially public spending on social security such as health, education, housing, etc. In which, public spending on housing has a large fiscal multiplier in promoting growth.

Implementing a good credit policy for social housing will be a driving force for economic growth. It will promote consumption and higher growth in economies with high savings rates like Vietnam.

In the long term, develop a market-based financial system (debt and equity markets) to create new financial incentives for growth. Note that improvements in institutional quality are often required during capital market development.

Source: https://tuoitre.vn/giam-tinh-trang-han-che-tai-chinh-cho-doanh-nghiep-co-the-bung-no-dau-tu-dai-han-20250227205122627.htm

Comment (0)