| Coffee exporting enterprises proactively meet EU market regulations. Supply continues to be supplemented, coffee export prices drop sharply. |

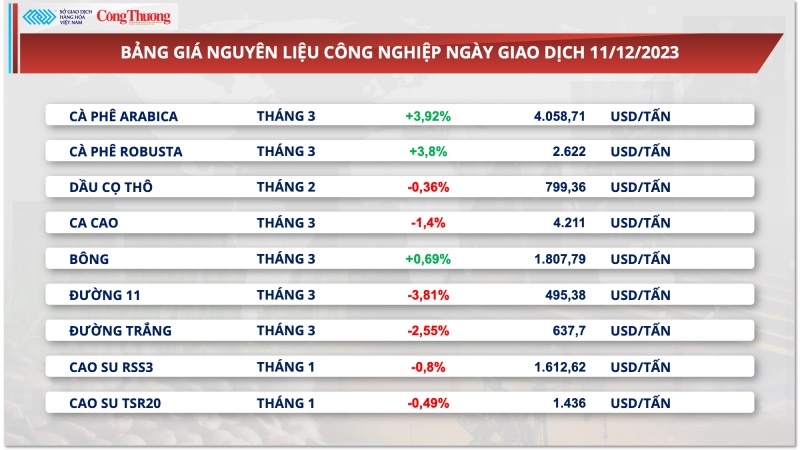

According to the Vietnam Commodity Exchange (MXV), after a sharp decline last week, coffee prices increased by 3.92% for Arabica and 3.8% for Robusta at the end of the trading session on December 11. Vietnam's coffee exports increased after 7 consecutive months of decline, but this was not enough to overshadow the heat wave risk in Brazil.

|

| Coffee prices skyrocket |

According to the General Department of Customs, in November, Vietnam exported 119,297 tons of coffee, up 172.8% over the previous month. This was also the first month of increase after 7 consecutive months of export decline. However, the amount of coffee exported last month was still lower than the level of more than 120,000 tons in the same period in 2022. Cumulative exports in the first 11 months of 2023 decreased by 10% compared to the previous year.

Furthermore, the heat wave is expected to spread to Brazil’s main coffee growing region in the next 10 days, potentially posing a risk to the development of the 2024/25 coffee crop. This raises doubts about the positive coffee supply outlook for the next crop year in Brazil, which was previously forecast by consulting firms.

In the domestic market, recorded this morning (December 12), the price of green coffee beans in the Central Highlands and the Southern provinces fluctuated between 60,700 - 61,600 VND/kg, a sharp increase compared to the previous day.

|

| Domestic coffee export prices increase due to unrecovered supply |

Regarding exports, according to Mr. Do Ha Nam - Vice President of the Vietnam Coffee - Cocoa Association (Vicofa), in the 2023/2024 crop year, domestic coffee consumption is expected to continue to increase, the total capacity of instant coffee processing factories is estimated at 100,000 tons of finished products/year, equivalent to 230,000 tons of green coffee and is expected to increase in the coming time due to many investment projects and factory capacity expansion.

In 2024, the domestic market for roasted and processed coffee is expected to stabilize, reaching about 150,000 tons. The total amount of green coffee consumed domestically could increase to 350,000-400,000 tons/year if instant coffee factories reach full capacity.

Commenting on the coffee export situation in the 2023/2024 crop year, Mr. Do Ha Nam said that due to the decrease in output combined with increased domestic consumption demand, it is expected that Vietnam's coffee export volume in the 2023/2024 crop year will continue to decrease, down to about 1.4 million tons.

However, as coffee prices continue to rise, export turnover is likely to set a new record, reaching 4.5 - 5 billion USD. Last crop, the Vietnamese coffee industry also achieved a record export of more than 4 billion USD despite a decrease in output.

To move towards sustainable coffee exports, many coffee growing regions in Vietnam are proactively replanting and introducing high-quality, high-yield coffee varieties into processing. According to the Ministry of Agriculture and Rural Development , the Ministry and localities with large coffee growing areas are currently conducting surveys and planning areas associated with identifying growing areas, ensuring export standards from the planting process.

The Ministry will also work with ministries, sectors and localities to propose to the Government support for production, especially the construction of coffee processing plants in growing areas. The goal is that from now until 2025, the whole country will replant 75,000 hectares, graft and renovate 32,000 hectares of coffee, of which Arabica coffee accounts for about 20% of the total area. In addition, most of the replanted coffee area will be planted with new varieties with high productivity and superior quality.

Source link

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

Comment (0)