| Robusta coffee export price hits 28-year high Coffee exports increase sharply by 158.3% |

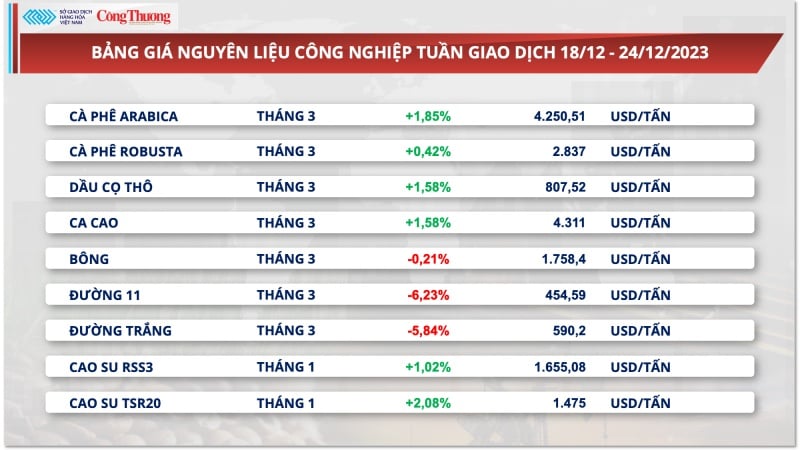

According to the Vietnam Commodity Exchange (MXV), at the end of the trading week of December 18-24, coffee prices increased by 1.85% for Arabica and 0.42% for Robusta, respectively.

|

| Prices of two types of coffee fluctuated sharply during the trading week of December 18-24. |

This was a volatile first week for this commodity as prices continuously recorded sharp increases and decreases. Robusta prices even hit a 28-year high and Arabica prices hit an 8-month high. Concerns about low inventories and limited coffee sales from farmers caused buying power to dominate.

In its coffee market report released on December 21, the US Department of Agriculture (USDA) estimated world coffee inventories for the current crop year at only 26.5 million 60kg bags, down 16.7% from the previous report and 4% from the estimate for the 2022/23 crop year. This is also the lowest inventory level recorded in the past 12 years. Along with that, the standard Arabica inventory on the Intercontinental Commodity Exchange of Americas (ICE-US) has recovered but is still at a 24-year low, and the amount of Robusta stored on the Intercontinental Commodity Exchange of Europe (ICE-EU) is also approaching the record low at the end of August.

Furthermore, the sharp decrease of 1.59% in the USD/BRL exchange rate last week has somewhat limited the demand for coffee sales of Brazilian farmers due to low foreign currency earnings. Meanwhile, rumors about Vietnam limiting the sale of new crop coffee in the expectation of higher prices still receive the attention of the market.

|

| Vietnam's coffee prices remain high |

In the domestic market, this morning (December 25), the price of green coffee beans in the Central Highlands and the Southern provinces remained stable compared to yesterday. Accordingly, domestic coffee is currently purchased at around 67,200 - 68,000 VND/kg.

Coffee prices in the coming time are expected to hover around a good level, around 60,000-70,000 VND/kg depending on the time. In April and May 2024, when Indonesia, and then Brazil, enter the harvest season, coffee prices will likely decrease significantly compared to now.

At the beginning of the new crop, green coffee was offered at 60,000 VND/kg, delivered from December 2023 to January 2024 - an unprecedented price at the beginning of the crop due to the high demand of businesses. For the first time in history, not only domestic businesses but also FDI businesses bought young coffee (purchased before harvest). In particular, what export businesses are very worried about is that if in 2023, by June Vietnam has no more coffee to buy, then in 2024, it may be out of stock by May, or even April.

According to the Vietnam Coffee and Cocoa Association (Vicofa), Europe currently consumes about 40-50% of Vietnam's coffee exports and this region still has good demand.

In addition, as the world's largest exporter of robusta coffee, Vietnam is currently the only country that harvests this type of coffee, so this is also an advantage that helps Vietnamese coffee prices stay high. Many businesses say that the price of robusta coffee traded on the London floor recently reached up to 3,000 USD/ton, a record high in the past decades.

Because the volume of goods in these countries is still insignificant, the European market is in great need of Vietnamese coffee, at least until April when Indonesia and Brazil enter their new harvest season. “Everyone is very worried about this. If everyone rushes to Vietnam to buy coffee, the supply will be very tight. Therefore, it is forecasted that coffee prices will continue to increase and Vietnamese coffee beans may become the most expensive in the world in 2024,” Mr. Nam predicted. Therefore, currently, Vietnamese businesses hardly sell far away for fear of not being able to buy goods, leading to great risks for businesses.

In the context of tight supply, the Vietnamese coffee industry is also focusing on many solutions for sustainable development, traceability, especially meeting the EU's EUDR anti-deforestation regulations. Currently, the world's major roasters such as JDE, Nestle, Tchibo... are coordinating with governments, international organizations, businesses... to build sustainable coffee programs as well as commit to sharply increasing certified coffee production in the coming years.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)