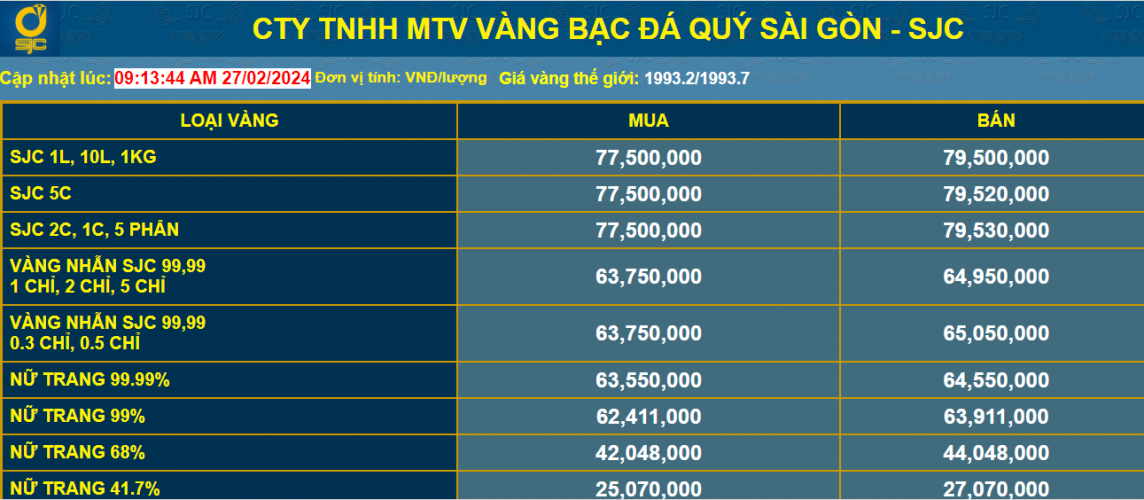

At 11:00 a.m. on February 27, 2024, the domestic SJC gold price increased sharply compared to the early morning of the same day. Specifically, Saigon Jewelry Company Limited - SJC listed the afternoon SJC gold price at 77.5 million VND/tael for buying and 79.5 million VND/tael for selling. The difference in buying and selling prices here was reduced to 2 million VND.

Compared to the early morning of the same day, the price of SJC gold at this unit was adjusted up by 700,000 VND for buying and up by 480,000 VND for selling.

The difference between domestic gold price and world gold price is still high, 17 million VND/tael.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Screenshot at 11:00 on February 27, 2024 |

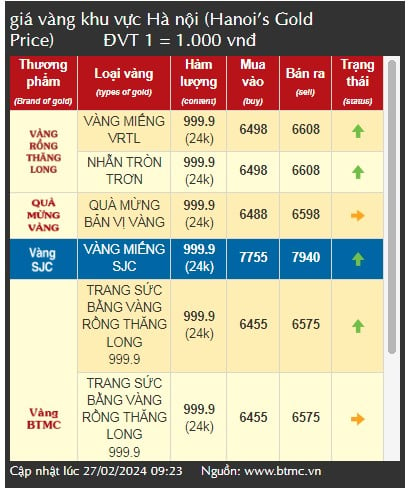

Similarly, at the same time, Bao Tin Minh Chau listed the afternoon buying price of SJC gold at 77.55 million VND/tael and the selling price at 79.4 million VND/tael.

Compared to the early morning of the same day, the gold price here was adjusted to increase by 550,000 VND for buying and 500,000 VND for selling.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Screenshot at 11:00 on February 27, 2024 |

Domestic gold prices today increased strongly. However, according to Bao Tin Minh Chau, the number of customers coming to trade is relatively stable, the number of customers coming to buy accounts for 55% and the number of customers coming to sell accounts for 45%.

At a time when gold prices are rising, experts advise investors and people to be cautious in investing and trading.

Bao Tin Minh Chau representative advised that gold price increased dramatically this morning, so investors and people should consider before trading and regularly monitor gold price on official channels to make the most correct decision.

Ms. Uyen Huong (Hoang Mai, Hanoi ) shared that gold is an investment asset, but also a defensive asset. Because in 2023, among investment channels such as: Securities, real estate... gold is the safest investment channel even though this investment channel is less profitable. In 2024, domestic gold prices tend to increase due to the influence of world gold prices. Therefore, investors can choose the time to invest to make a profit.

|

| Gold prices are increasing, should we invest in gold at this time? |

According to experts' analysis, world gold prices tend to increase because the US Federal Reserve (FED) has sent a message that they may stop raising interest rates, or even reduce interest rates. In the second quarter of 2024, and at the latest in the third quarter of this year, the FED will reduce interest rates. In the case of a rate cut, the value of the USD will decrease, and usually when the USD decreases, the price of gold will increase. The price of gold at this time can reach 2,100 USD/ounce. Therefore, domestic gold prices can also increase accordingly.

Gold prices are difficult to predict, but are likely to increase only in the short term and will be difficult to maintain this upward momentum in the medium and long term. Therefore, experts recommend that investors should only choose times when gold prices are less hot to invest and use idle money to buy gold, and invest in gold for the long term.

Notably, according to analysis from experts, domestic gold prices in the coming time will be strongly affected by the State Bank's proposals to the Government regarding the adjustment of Decree 24. Therefore, if investors and people want to invest in gold, they should wait a little longer.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)