LIVE UPDATE TABLE OF GOLD PRICE TODAY 6/2 and EXCHANGE RATE TODAY 6/2

| 1. PNJ - Updated: February 5, 2024 9:30 PM - Website supply time - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 63,200 | 64,400 |

| HCMC - SJC | 76,200 ▲300K | 78,400 ▲100K |

| Hanoi - PNJ | 63,200 | 64,400 |

| Hanoi - SJC | 76,200 ▲250K | 78,400 ▲100K |

| Da Nang - PNJ | 63,200 | 64,400 |

| Da Nang - SJC | 76,200 ▲300K | 78,400 ▲100K |

| Western Region - PNJ | 63,200 | 64,400 |

| Western Region - SJC | 76,100 ▲600K | 78,400 ▲300K |

| Jewelry gold price - PNJ | 63,200 | 64,400 |

| Jewelry gold price - SJC | 76,200 ▲300K | 78,400 ▲100K |

| Jewelry gold price - Southeast | PNJ | 63,200 |

| Jewelry gold price - SJC | 76,200 ▲300K | 78,400 ▲100K |

| Jewelry gold price - Jewelry gold price | PNJ Ring (24K) | 63,200 |

| Jewelry Gold Price - 24K Jewelry | 63,100 | 63,900 |

| Jewelry Gold Price - 18K Jewelry | 46,680 | 48,080 |

| Jewelry Gold Price - 14K Jewelry | 36,130 | 37,530 |

| Jewelry Gold Price - 10K Jewelry | 25,330 | 26,730 |

Domestic gold price decreased on the morning of February 5.

Specifically, in the Hanoi market, DOJI Gold and Gemstone Group listed the price of SJC gold at 75.85 - 78.15 million VND/tael (buy - sell), down 100,000 VND/tael in both buying and selling compared to yesterday's closing price.

Phu Quy Gold and Gemstone Group listed the price of SJC gold at 75.7 - 78.1 million VND/tael (buy - sell), keeping the same price for both buying and selling compared to yesterday's closing price.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 75.7 - 77.92 million VND/tael (buy - sell), an increase of 100 thousand VND/tael for buying and a decrease of 200 thousand VND/tael for selling compared to the closing price yesterday.

Summary of SJC gold prices at major domestic trading brands at the closing time of February 5:

Saigon Jewelry Company listed the price of SJC gold at 76.2 - 78.4 million VND/tael.

Doji Group currently lists the price of SJC gold at: 76.05 - 78.35 million VND/tael.

PNJ system listed at: 76.2 - 78.4 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 76.23 - 78.35 million VND/tael; Rong Thang Long gold brand is traded at 64.48 - 65.58 million VND/tael; jewelry gold price is traded at 64.00 - 65.30 million VND/tael.

Thus, compared to the morning session of February 5, at the close of trading session on the same afternoon, the price of SJC gold in Hanoi market listed by Saigon Jewelry Company increased by VND500,000/tael for buying and increased by VND480,000/tael for selling.

|

| Gold price today February 6, 2024: SJC gold price increases, the gap with the world is widening, the international market is plummeting. (Source: Watcher Guru) |

World gold prices fell in the morning session of February 5 in Asia, when the USD and US government bond yields increased after the country's employment report reduced hopes that the US Federal Reserve (Fed) would soon lower interest rates.

Spot gold prices fell 0.1% to $2,036.96 an ounce at 9:15 a.m. (Vietnam time).

US gold futures were steady at $2,053.5 an ounce.

According to the World & Vietnam Newspaper , information on Gold Price , as of 7:03 p.m. Vietnam time on February 5, the world gold price was listed at 2,027.84 USD/ounce, down 11.89 USD/ounce compared to the previous trading session.

Converted according to the USD price at Vietcombank on February 5, 1 USD = 24,540 VND, the world gold price is equivalent to 59.96 million VND/tael, 18.44 million VND/tael lower than the selling price of SJC gold.

Gold prices plummet

Gold prices fell to a one-week low as hopes of a US Federal Reserve interest rate cut faded.

Gold prices fell to a one-week low on Feb. 5 after positive U.S. jobs data last week and comments from Fed Chairman Jerome Powell dampened hopes of an early rate cut, sending the dollar and bond yields higher.

Spot gold fell 0.7% to $2,024.55 an ounce at 10:34 GMT, hitting its lowest since Jan. 29. U.S. gold futures fell 0.6% to $2,040.70 an ounce.

“Markets are in for another test with the combination of the FOMC meeting, the strong jobs report, followed by Powell’s comments casting doubts on the timing of the Fed’s next rate cut,” said Ole Hansen , commodity strategist at Saxo Bank.

“If we see any weakness in the upcoming data because the Fed is certainly very data-driven right now, that will dictate where gold goes,” he added.

The dollar index (.DXY), which hit an eight-week high, made bullion more expensive for holders of other currencies, while the yield on the benchmark 10-year Treasury note rose above 4%.

Data from the US Department of Labor on February 2 showed that the country's non-farm payrolls increased by 353,000 jobs in January, nearly double the 180,000 forecast by economists polled by Reuters .

Mr Powell said in an interview that the Fed could be “cautious” in deciding when to cut its benchmark interest rate, with a strong economy giving central banks time to build confidence that inflation will fall further.

Traders now expect about a 60% chance of a US rate cut in May, according to the CME Fed Watch tool. Lower interest rates boost the appeal of non-yielding bullion.

Investors' focus now turns to remarks from a series of Fed speakers this week for further clues on rate cuts.

Kitco News ' latest weekly gold survey shows that two-thirds of experts have lost confidence in the precious metal, while most retail investors still expect prices to rise next week.

Twelve analysts participating in the Kitco News Gold Survey and Wall Street turned sharply bearish on the precious metal’s near-term outlook. Only two analysts, or 17%, see gold prices higher this week. Eight analysts, or 66%, see prices falling. Another two, or 17%, see prices moving sideways this week.

Meanwhile, 123 votes were cast in Kitco’s online poll, with the majority remaining bullish. Sixty-six retail investors, or 54 percent, expect gold to rise this week. Another 27, or 22 percent, predict lower prices. Meanwhile, 30 respondents, or 24 percent, are neutral on the precious metal’s near-term outlook.

Source

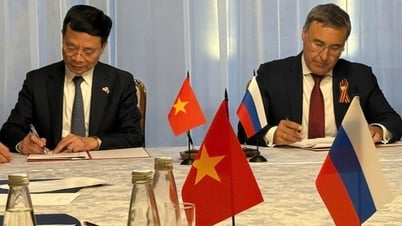

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)