World gold prices fell sharply after Donald Trump was elected the 47th president of the United States. Domestic gold prices fell by 5-6 million VND/tael. What will happen to gold prices in the near future? Will they continue to fall sharply?

Gold prices plummet

The world gold market has just witnessed a rare price drop, with a decrease of about 100 USD/ounce, from 2,740 USD/ounce to nearly 2,640 USD/ounce, after news that the Republican candidate won the new US presidential election.

Before the election, there was a price drop when many signals showed the advantage was leaning towards Mr. Donald Trump. From the historical peak of 2,789 USD/ounce (86.4 million VND/tael) recorded on September 30, gold fell to 2,740 USD.

At the beginning of 2024, the price of gold was only $2,063/ounce. By the end of October, the increase was more than 35%.

Gold fell sharply amid the rapid rise of the USD. Investors believe that the US economy will break out and the US position will be stronger under Donald Trump. Any country that does not use the USD in international transactions will have to be wary of the 47th president's statement of "100% tax on countries that abandon the USD".

The US dollar has been weakening for many years and is expected to continue this trend as many countries, including Russia and China, cut back on dollar transactions and reduce their US currency reserves.

The expansion of the BRICS group of emerging countries, with the admission of five new members including Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates (UAE) in early 2024, in addition to existing members including Russia, India, China and South Africa... has made many people doubt the position of the USD.

At the most recent forum (October 22-24), Russian President Vladimir Putin appeared at the BRICS conference with a strange bill in his hand, which could not convince investors about the early birth of a new common currency. But it also affected the outlook for the USD.

Gold’s prospects are also less bright after the US elected a new president. In his victory speech, Donald Trump declared that he would stop wars and did not want to use the military. During his 2017-2021 term, the US under Trump hardly participated in any new major armed conflicts, except for defeating the self-proclaimed Islamic State (IS) in record time.

Previously, Mr. Trump had repeatedly declared that he would end the conflict between Russia and Ukraine "within 24 hours" if elected, even before officially taking office as president.

This is negative news for gold. Gold tends to rise when geopolitical tensions escalate.

Gold's plunge may also be due to money looking for more investment channels. As soon as news of Mr. Trump's election broke, the cryptocurrency market took off, with Bitcoin rising from $69,000/BTC to nearly $77,000 at one point and now $76,000.

The US stock market has skyrocketed, setting new highs one after another. Investors expect money to flow into the US, into manufacturing industries, and the US economy to accelerate.

Will gold fall further or turn around and increase sharply?

Mr. Trump is expected to take office as president on January 20, 2025, more than 2 months from now.

The question is what the outlook for the gold market will be, will the gold price continue to fall deeply or slightly, or will it turn around and increase strongly again?

At $2,692/ounce as of 8:45 p.m. on November 8 (Vietnam time), gold has fallen nearly 3.5% from its peak of $2,789/ounce recorded on October 30. Compared to the beginning of the year, gold prices have still increased by 30.5%.

Thus, it can be seen that the adjustment is not much. There have been predictions that gold may adjust down to 2,500 USD/ounce, equivalent to a decrease of about 10%, before turning up again at the end of the year and next year. However, the number of predictions of gold reaching 2,500 USD is not much.

Most forecasts from the world's leading prestigious organizations such as Goldman Sachs, WB, WGC,... all believe that gold is still in an uptrend in price in the context of the US Federal Reserve (Fed) just starting its interest rate cut cycle.

In fact, in an uptrend, corrections of 5-7%, even 15%, are not uncommon for many commodities. But for gold, a 10-15% drop is not much, because the general trend of gold is to increase in price according to world inflation.

The increase since the beginning of the year has been huge, reaching 35% at times; and compared to mid-November 2023, the increase has reached 43%. An 8-10% correction is also possible, especially in the context of the US having a new president, Mr. Trump. In 2022, the price of gold decreased by 8-9%.

Some experts say that the 100-point drop in gold prices on November 6 was an overreaction to the US election results. But looking at the big picture, with a relative drop of less than 3.5% (after a 35% increase since the beginning of the year), this is not a big number.

However, with the declining trend of the USD, inflation may increase following the trend of lowering interest rates and increasing money pumping of many countries, gold will be supported not to fall too deeply.

On the morning of November 8 (Vietnam time), the world gold price increased by about 55 USD, from a low of below 2,650 USD to above 2,700 USD after the Fed cut interest rates for the second time, with a reduction of 0.25 percentage points. But then, gold fell back to 2,680-2,690 USD/ounce.

In the long term, gold is forecast to continue to increase, possibly reaching $3,000/ounce in 2025. But in the short term, the gold market may fluctuate strongly, with downward pressure due to Mr. Trump's statements and/or policies still present.

Source: https://vietnamnet.vn/gia-vang-lao-doc-nhan-tron-mat-6-trieu-dong-lieu-con-tut-sau-2340241.html

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

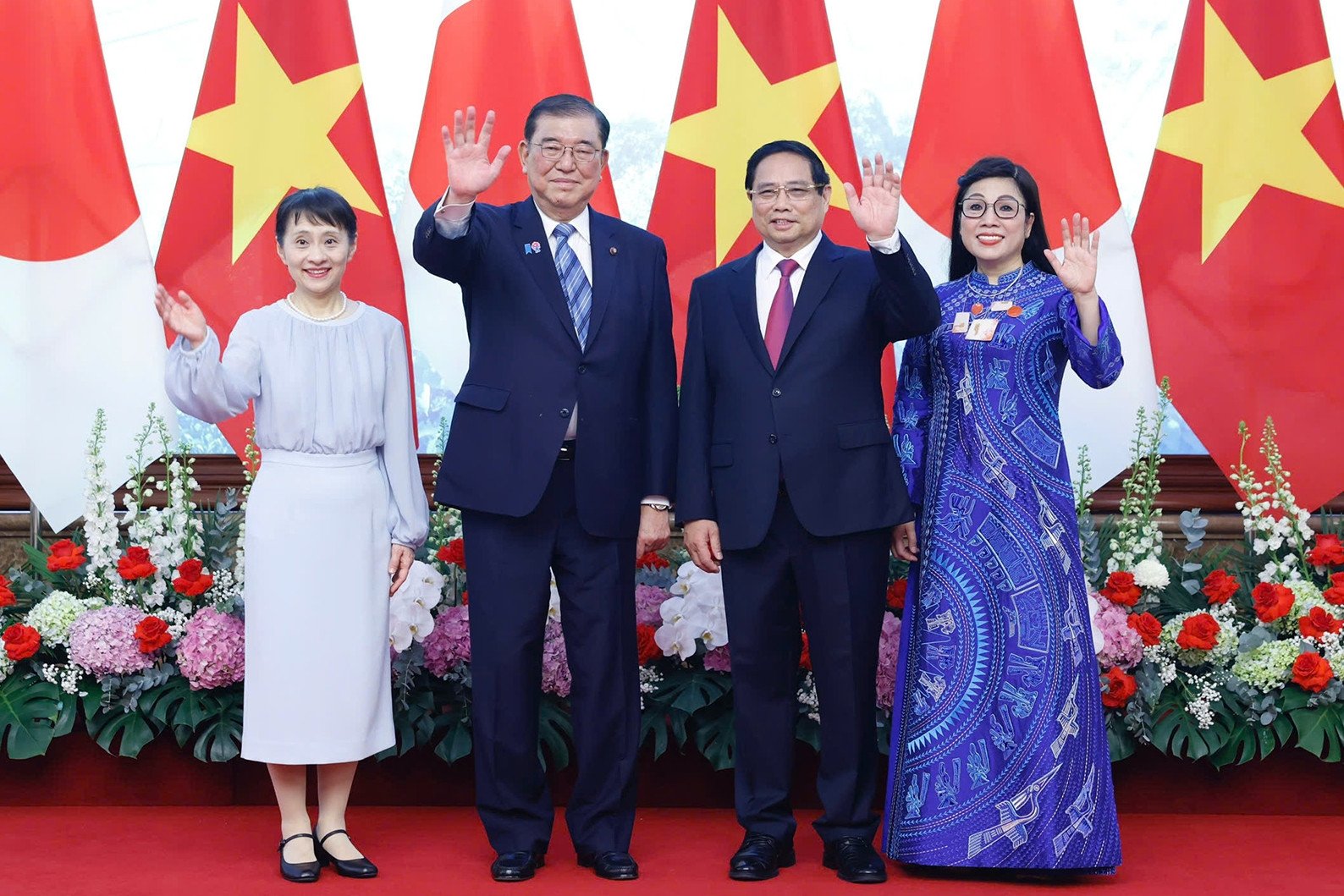

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] Signing ceremony of cooperation and document exchange between Vietnam and Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/e069929395524fa081768b99bac43467)

![[Photo] A long line of young people in front of Nhan Dan Newspaper, recalling memories of the day the country was reunified](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/4709cea2becb4f13aaa0b2abb476bcea)

![[Photo] Special supplement of Nhan Dan Newspaper spreads to readers nationwide](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/0d87e85f00bc48c1b2172e568c679017)

Comment (0)