At the end of the trading session on October 15, the domestic price of SJC 9999 gold bars was listed by SJC and Doji Gold and Gemstone Group in Hanoi and Ho Chi Minh City at VND83-85 million/tael (buy - sell), unchanged in both directions compared to the previous session.

Domestic gold ring prices are still at a historical peak, around VND82.3 million/tael (buy) and VND83.85 million/tael (sell).

Saigon Jewelry Company Limited (SJC) listed the price of gold rings of type 1-5 at only 81.9-83.3 million VND/tael (buy - sell). Doji listed the price of 9999 smooth round gold rings at 82.95-83.85 million VND/tael (buy - sell).

As of 8:00 p.m. on October 15 (Vietnam time), the spot gold price today on the world market was at $2,648/ounce. Gold for December 2024 delivery on the Comex New York floor was at $2,670/ounce.

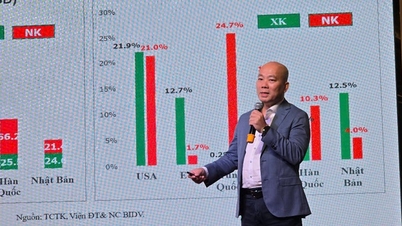

The world gold price on the night of October 15 was about 28.4% higher (585 USD/ounce) than at the beginning of 2024. The world gold price converted to the bank USD price was VND 80.6 million/tael, including taxes and fees, about VND 4.3 million/tael lower than the domestic gold price as of the end of the afternoon session on October 15.

Gold is under pressure to fall as the US dollar remains at a fairly high level. Selling pressure remains high after a period of hot precious metal prices and the situation in the Middle East seems to have saturated investors.

The Middle East is still hot and there are signs of direct US involvement in the region, the conflict could spread. However, the war in this region has been going on for a long time and investors are no longer paying much attention to new developments.

The US dollar remains high. The DXY index (which measures the greenback’s performance against six major currencies) is still above 103, compared to 100.7 in mid-September. The strong US dollar is holding back the rise in gold prices.

Gold is also less attractive as money flows into US stocks and many cryptocurrencies, including Bitcoin.

Gold Price Forecast

Investors are betting on the possibility that the US economy will improve after the presidential election early next month. The owner of the White House will increase the injection of money to stimulate the economy in the new term.

Gold prices also slowed down due to reduced demand from central banks in many countries when gold prices rose.

However, many forecasts say that gold will still inch up and could reach $2,700/ounce by the end of this year and possibly even higher in early 2025 as the Fed continues to lower interest rates and demand increases as Asia enters its peak gold consumption season.

Still, the gain may not be huge after gold has gained 28% since the start of the year.

Source: https://vietnamnet.vn/gia-vang-hom-nay-16-10-2024-vang-the-gioi-giam-tiep-vang-nhan-tren-dinh-2332264.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)