Gold price today August 24, 2024 recorded the world market holding on to the threshold of 2,500 USD/ounce, domestic gold rings decreased. Experts commented that gold prices may have difficulty breaking out in the short term if there is no new catalyst.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 8/24 and EXCHANGE RATE TODAY 8/24

| 1. SJC - Updated: 08/23/2024 08:16 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 79,000 | 81,000 |

| SJC 5c | 79,000 | 81,020 |

| SJC 2c, 1c, 5c | 79,000 | 81,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,000 ▼100K | 78,300 ▼100K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,000 ▼100K | 78,400 ▼100K |

| Jewelry 99.99% | 76,850 ▼100K | 77,850 ▼100K |

| Jewelry 99% | 75,079 ▼99K | 77,079 ▼99K |

| Jewelry 68% | 50,593 ▼68K | 53,093 ▼68K |

| Jewelry 41.7% | 30,117 ▼41K | 32,617 ▼41K |

Update gold price today 8/24/2024

World gold price on the morning of August 23 dropped sharply as investors took profits ahead of an important meeting of central banks. By the afternoon of the same day, gold prices rebounded, holding on to the threshold of 2,500 USD/ounce.

According to the World and Vietnam Newspaper at 4:23 p.m. on August 23, the world gold price on the Kitco exchange was at 2,500.4 - 2,501.4 USD/ounce, an increase of 15.7 USD compared to the previous trading session.

The market fell as investors sold to take profits ahead of an important conference of world central bank leaders, held by the US Federal Reserve (Fed) in Jackson Hole, Wyoming on August 23 (US time).

Most investors are betting on the Fed easing at its meeting next month. The only debate now is whether the agency will cut by 25 basis points (0.25%) or 50 basis points.

Minutes from the Fed's July meeting released earlier this week also showed the agency was ready to act.

The dollar and U.S. Treasury yields rose yesterday, also weighing on gold. The stronger dollar makes gold more expensive for non-U.S. buyers. The yield on the 10-year U.S. Treasury note rose 0.1%, making non-interest-bearing assets like gold less attractive.

Commenting on the August 23 plunge, Phillip Streible, chief market strategist at Blue Line Futures, said: “The market saw two-year bond yields and the USD Index rise.

The precious metal has had an incredible rally over the past three sessions, hitting new all-time highs, so it's no surprise that some traders are taking profits on the recovery in the US dollar and bond yields."

Domestic gold price remains stable at 81 million VND/tael for SJC gold bars.

Specifically, as recorded on the afternoon of August 23, the gold price in the domestic market was listed as follows: SJC gold price in Hanoi and Da Nang is 79 million VND/tael for buying and 81 million VND/tael for selling.

DOJI gold price in Hanoi is 79 million VND/tael for buying and 81 million VND/tael for selling. Similarly, DOJI gold price in Ho Chi Minh City is also buying at 79 million VND/tael and selling at 81 million VND/tael.

Meanwhile, the price of 24K gold rings and jewelry gold of all kinds was traded around 76.9 million VND/tael for buying and 78.2 million VND/tael for selling, down 200,000 VND per tael compared to a day ago.

The price of SJC 9999 gold ring is bought at 76.9 million VND/tael - sold at 78.2 million VND/tael, down 200,000 VND compared to the previous session.

|

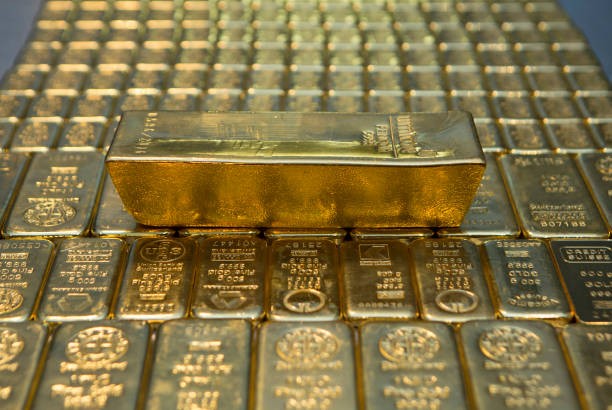

| Gold price today August 24, 2024: Gold price tries to hold on to an important level, many ounces are 'swept away' and cannot go far without this. (Source: Getty Images) |

Still need more catalysts

World gold prices have increased by about 20% this year, supported by the net buying trend of central banks, the demand for "safe haven" by global investors and the vibrant demand for physical gold in the free market in many countries.

Central banks and investors still see gold as a reliable long-term investment during times of economic uncertainty. When interest rates fall, gold prices often rise because they offer a higher return than bonds.

Additionally, precious metals are also used as a hedge against inflation, with the expectation that they will maintain their value as prices rise.

Recent signs of weakness in the US labor market strengthen the case for the Fed to start cutting interest rates in September, said Ole Hansen, chief strategist at Saxo Bank.

"However, gold prices may find it difficult to break out in the short term without new catalysts. Perhaps gold prices need the Fed's interest rate cut cycle to really start before they can enter a new rally.

The precious metal is currently receiving strong technical support in the $2,475-2,480/ounce range," he said.

In the long term, most experts are optimistic about the prospect of gold price increases.

For example, UBS Global Wealth Management predicts that gold prices could reach $2,700 an ounce by mid-2025.

"The fundamentals for gold to rise remain strong, and we recommend investors add to their portfolios on any dips," said Michael Armbruster, a fund manager at Altavest.

Central bank gold purchases and the BRICS idea of a common currency backed by gold are very favorable factors for gold prices."

Source: https://baoquocte.vn/gia-vang-hom-nay-2482024-gia-vang-co-bam-tru-moc-quan-trong-nhieu-ounce-bi-cuon-troi-chua-the-di-xa-neu-thieu-dieu-nay-283637.html

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)